Harmony's Hod1 🏋️♀️ on Telegram, Solana 🤣 Memes on Pump.Fun 🎢

Introducing Hod1, a Telegram DeFi app for Harmony. Hold ONE tokens with friends until 10% price gain – to win daily jackpots!

New users get 1000 free ONE tokens, new friends get 500, and new tasks get 200. Regular airdrops from our community meme coins, ecosystem game tokens, or partner campaign quests.

It’s hype(r) staking – more money than loseless lottery and easier than perpetual options! Anyone can start a “Hod1 Train” at the market price, ask friends to jump on, and keep going until ONE hits the price target. Someone must add tokens to the train within 30 minutes – or all are lost to the jackpot. (Forever) holders are (always) winners. 50% of the jackpot is rewarded to a random user of your winning train. The other 50% is for bringing in people together to the “Hod1 World”!

https://www.fvmglobal.com/token2049-telegram-supercharge-dubai-web3/

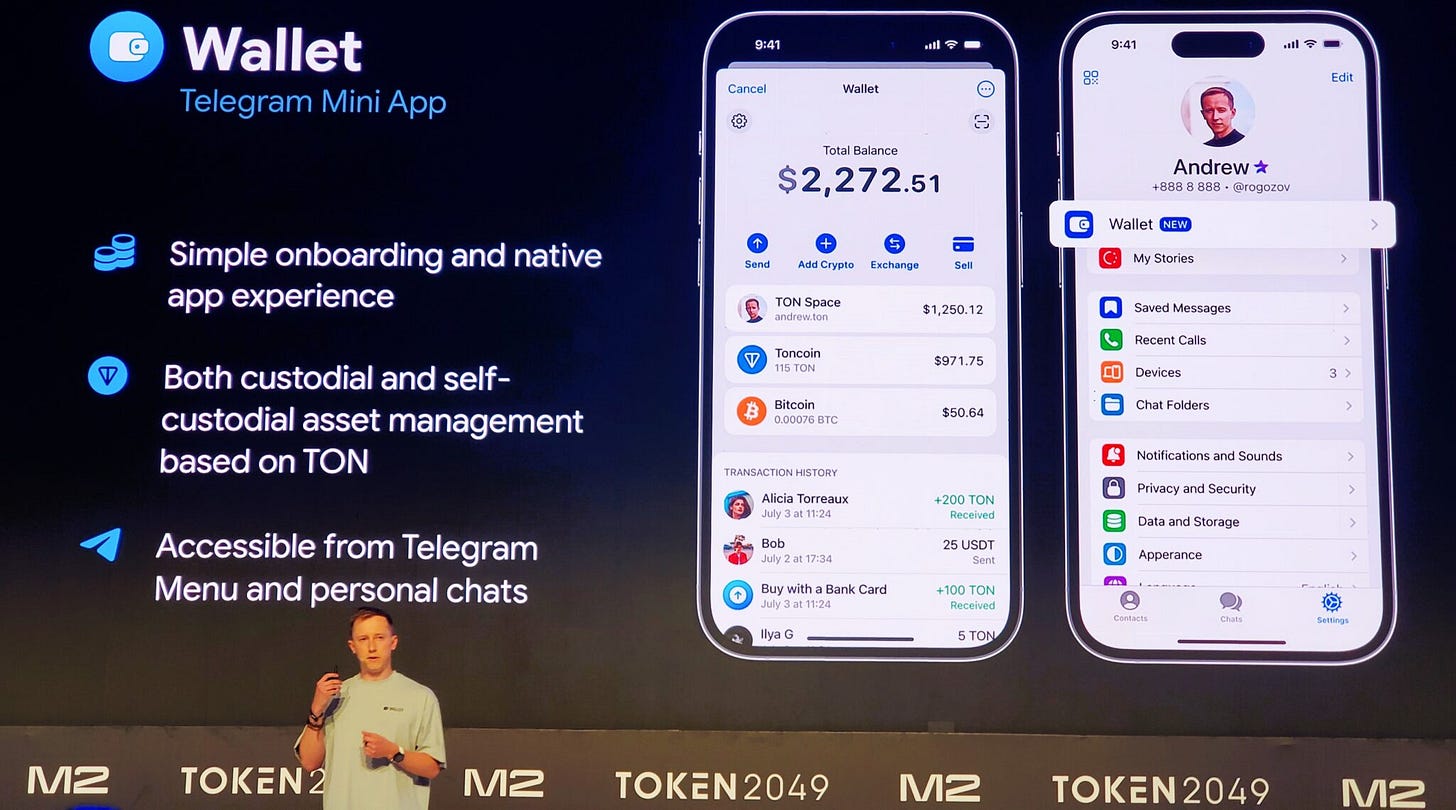

In June 2024, the permitted supply of USDT on the TON blockchain rose to over $580 million. This places TON as the sixth-largest blockchain for USDT issuance, after Tron, Ethereum, Solana, Avalanche, and Omni.

TON Wallet has joined with the TON Foundation to give $30 million in TON tokens to USDT holders. Participants can also earn 50% annually on their holdings. Tether also announced on April 19, 24 that it will launch the gold-pegged Tether Gold (XAUT) stablecoin on TON.

📩 Telegram's 👆Tap-to-Earn Social Games, 👶 Mini DeFi Bots + Wallets + Apps

100M users for Hamster Kombat! “First Social Capital, then Utility. Wei highlights Foursquare, Wikipedia, Quora, and Reddit as products that used the promise of social capital to get people to do free work that then becomes a utility for the masses.”

https://members.delphidigital.io/reports/attention-is-all-you-need (2024-05-13)

But crypto is different. Crypto democratizes attention by letting us own it. If you find yourself spending a lot of time on [insert ur favorite project: FriendTech, DRiP, pump.fun] you can actually own and profit from your attention. This may seem dumb and obvious, but it represents a seismic shift in the Internet’s economics.

Armed with weapons-grade financial technology… all it takes is a simple meme to coordinate the Internet in the age of attention.

https://members.delphidigital.io/feed/uwu (2024-08-12)

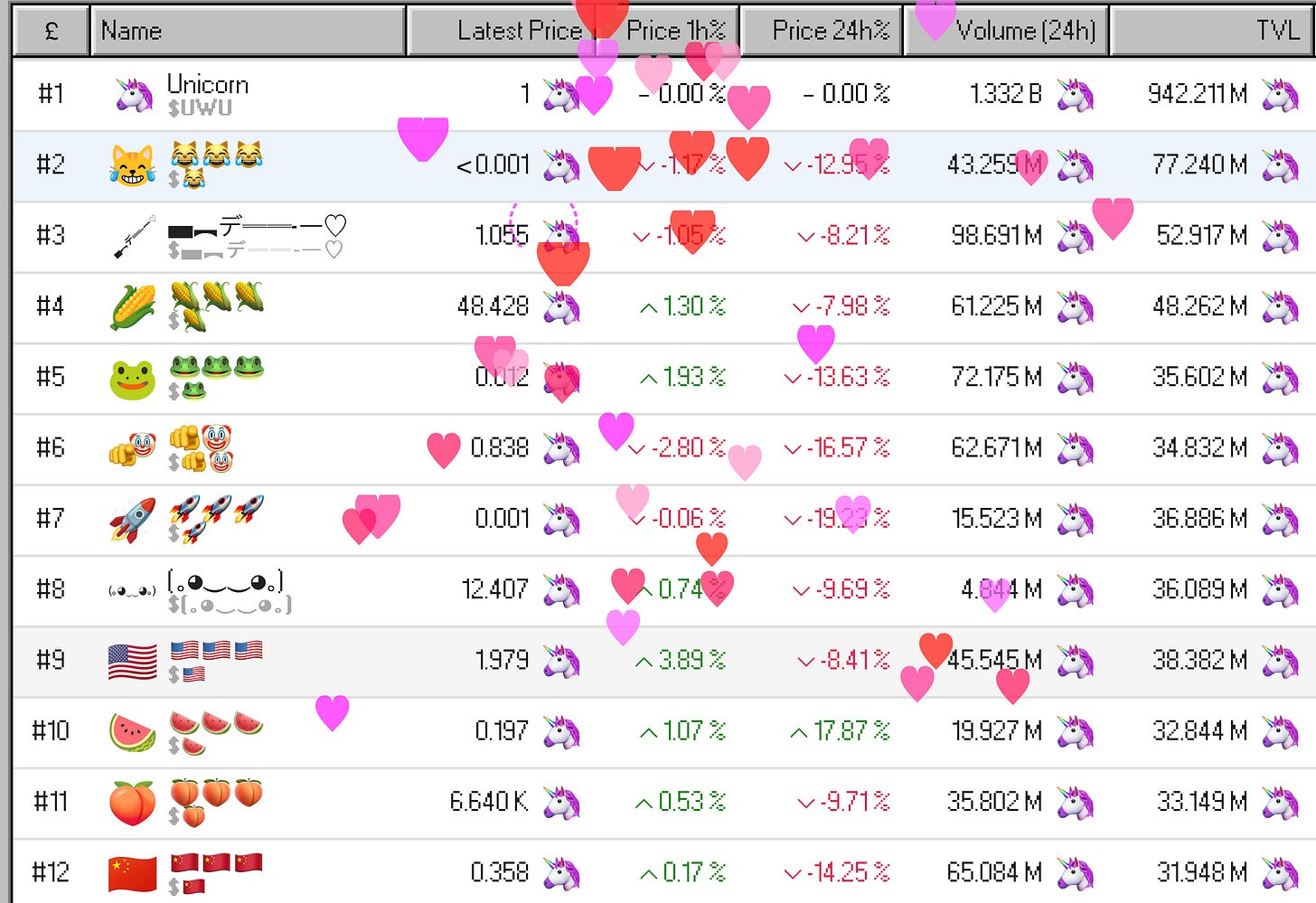

A new PoS “memechain” on cosmos – yes, memechain. Traders can trade “memecoins” on their Meme Market, but these aren’t ordinary tokens since the tickers are based on combinations of emojis. For example, while the testnet was live, the top traded token was “🌽🌽🌽.”

https://messari.io/report/analyst-discussion-pump-fun (2024-04-12)

On Solana, when enough users buy the token to reach a market capitalization of $69,000, $12,000 of liquidity is then added into the DEX, Raydium. Similarly, on Blast, achieving a market cap of $420,000 triggers the addition of $30,000 in liquidity to the Thruster DEX.

Mason Nystrom describes well the strategies that many SocialFi applications implement. Pump.fun seems to have adopted the former approach, with its primary service overtly being a tool for deploying and trading memecoins.

Financial-first: Focus on the financial component (e.g., an exchange) and then develop social features around it.

Social-first: Create a social experience and then embed financial features.

https://time.com/6312307/gamestop-meme-stocks-dumb-money/

Paul Dano stars as Keith Gill, a trader and livestreamer whose full-throated support of the stock on the subreddit community Wall Street Bets catalyzed a movement around “meme stocks”: assets that surged in price fueled by social media enthusiasm.

While Plotkin took heavy losses during the meme stock craze, he still scrounged up enough money to lead a group that bought the NBA basketball team Charlotte Hornets recently at a $3 billion valuation. Last December, the Securities and Exchange Commission (SEC) proposed reforms to securities markets after its Chair Gary Gensler pledged to “drive greater efficiencies…particularly for retail investors” in the wake of the meme stock craze.

https://members.delphidigital.io/reports/dog-days-of-summer#solana-summer-0485 (2024-07-24)

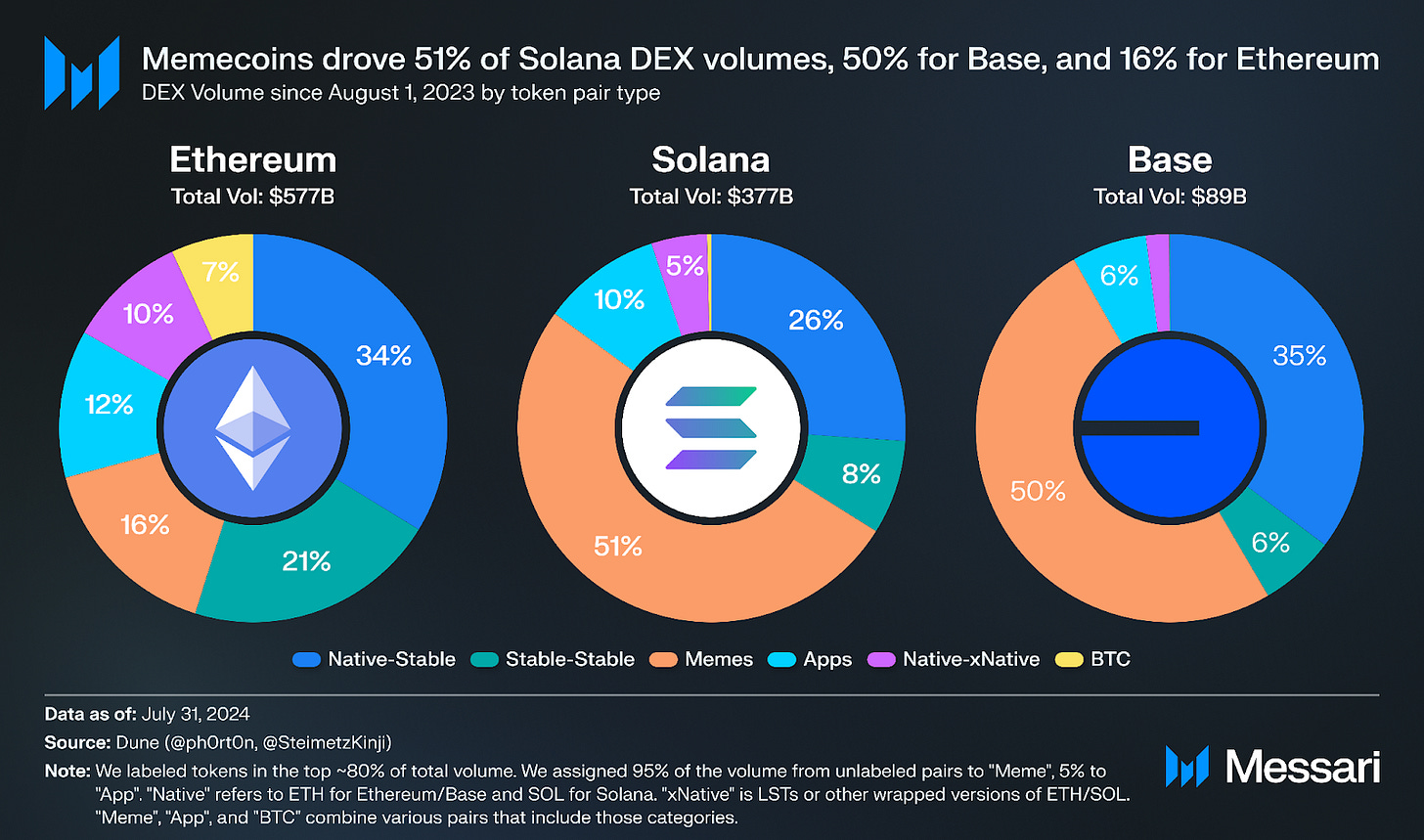

Why have Solana volumes stayed so consistent? Well, because it’s the world’s greatest casino. It’s fun. And almost all of the hot new coins are on Solana. You have the dog and cat coins, the politifi coins, and the celeb coins — all on Solana. Obviously, derivatives exist elsewhere — some even more popular than the SPL editions — but in aggregate, most of the exciting coins of this cycle sit on Solana.

One way to gut-check this vibes-based take is to look at where people launch tokens. The average token deployer is an utterly self-interested actor. They could care less about crypto politics or power struggles.

https://messari.io/report/state-of-solana-q2-2024 (2024-07-12)

In Q2, the memecoin meta shifted to pump.fun, a gamified token launch platform that became one of the most widely discussed applications across crypto. In Q2, it collected an average of $525,000 in daily fees. Near the end of May, several celebrities began launching their own tokens on pump.fun, sparking a celebrity memecoin craze, which drew some controversy. Pump.fun’s popularity spawned forks such as Dexscreener’s Moonshot, Whales Market’s whales.meme, and Meme Royale.

Raydium has been a major beneficiary of pump.fun, as all the liquidity from pump.fun bonding curves is transferred to Raydium once the token hits a market cap threshold. Raydium’s average daily volume increased by 77% QoQ to $867 million, raising its market share from 40% in Q1 to 54%. Its DeFi TVL also grew by 46% QoQ to $991 million, becoming Solana’s top DeFi protocol by TVL. During Q2, Raydium also released its V3 UI and launched a new constant product AMM program.

https://messari.io/report/are-the-dog-days-over

The global gambling industry is a behemoth, and a large chunk of it could realistically be captured onchain through memecoin capital formation. While the presence of more utility-driven onchain protocols are needed, it should be noted that memecoins’ highest point of share capture occurred in a time period where sentiment around “real” sectors like DeFi was ebullient. I believe memecoins are a real product in and of itself, and its growth will remain secular even as other sectors increase their relative value proposition. The memecoin category is great at drawing attention, encouraging irrational behavior, and soliciting repeat engagement. Memecoins are crypto’s iteration of slot machines and poker tables.

Some studies suggest that as high as 80% of American adults gamble on a yearly basis, and the AGA estimates that more than $500B a year is spent on illicit and untaxed gambling markets in the US. Furthermore, over $100B was spent on lottery tickets in 2022, where the improbable payout odds are table stakes for every participant. In crypto’s case, the “house always wins” refers to the snipers, KOLs, and sophisticated traders who frontrun slower capital.

https://en.wikipedia.org/wiki/GameStop_short_squeeze

Keith Gill, known by the Reddit username "DeepFuckingValue" ("DFV") and by the YouTube and Twitter alias "Roaring Kitty", purchased around $53,000 in call options on GameStop's stock in 2019 and saw his position rise to a value of $48 million by January 27, 2021. Gill, a 34-year-old marketing professional and Chartered Financial Analyst (CFA).

On January 27, 2021, the r/wallstreetbets subreddit had received 73 million page views in 24 hours – breaking all-time traffic records. On January 29, the community surged by 1.5 million users overnight – to a total of 6 million users – making it the fastest-growing subreddit at the time.

Elon Musk tweeted "Gamestonk!!"—a reference to the "stonks" meme rising in popularity at the time. As of January 28, 2021, the all-time highest intraday stock price for GameStop was $483.00 (nearly 190 times the low of $2.57 reached 9 months earlier in April 2020). In pre-market trading hours the same day, it briefly hit over $500, up from $17.25 at the start of the month.

A "gamma squeeze" also took place in addition to the short squeeze: as traders bet on the rise of stocks by purchasing call options, options sellers hedge their positions by purchasing the underlying stocks, thereby driving their prices even higher. At his testimony, Gill made references to memes. Palihapitiya, who passed on early investment opportunities in Robinhood, opined that the founding co-CEOs, Baiju Bhatt and Vladimir Tenev, lacked integrity and urged his followers to delete the app.

https://messari.io/report/state-of-solana-q1-2024

The increase in DEX volumes was largely driven by memecoin trading. Following SOL-stable and stable-stable pairs, SLERF-SOL and WIF-SOL accounted for the fourth and fifth-highest token pair trading volume in Q1. SLERF and BOME, whose trading pair was the seventh-highest by volume, drove the memecoin “pre-sale meta”. Other memecoins in the top 15 by trading volume included BONK and WEN.

In Q1, DRiP announced partnerships with Worldcoin, Bryan Johnson, DMC, Pyth, Parcl, and SharkyFi, among others. During the memecoin-driven periods of high activity, DRiP mints took longer to reach users. In response, DRiP released an update allowing users to see their collectibles that had yet to be distributed onchain. DRiP is planning several further updates to address the issue.

https://www.theguardian.com/technology/2015/apr/13/what-is-the-button-reddit

https://messari.io/report/systematic-memecoin-investing (2024-06-24)

Entirely memecoin-driven strategy outperforms a buy-and-hold strategy of a market-cap-weighted basket of smart contract networks and memecoins from January 1, 2021, to March 24, 2024.

https://a16zcrypto.com/posts/article/blockchain-culture-computer-vs-casino/

I call this culture the casino because, at its core, it’s really just about gambling. Tales of fortunes won and lost are dramatic, easy to explain, and attention-grabbing… reckless ones encourage bad behavior and play fast and loose with people’s money. At worst, they’re outright Ponzi schemes.

Blockchain networks, through mechanisms such as airdrops, grants, and contributor rewards, expand the circle once more. Future networks could have billions of owners. The world needs new, digitally native ways for people to coordinate, cooperate, collaborate, compete.

On Chain We Trust 🤨, Hyper Liquid 💦 for DeFi Lead 👑

This week’s TGI is covering Harmony 2024 report, Japan’s Black Forex, and Bitcoin Futures. AND, we are hiring 🎖️ “DeFi Lead” – send your resumes to t.me/stephentse or s@harmony.one!

https://messari.io/report/degen-chain-packing-layers (2024-04-05)

Layer-3s, while sounding like a meme to those in Solana and having obvious security and decentralization tradeoffs, are a welcomed experimentation for the business model experimentation they bring.

Over time, as zk aggregation and other improvements on integrated chains like Solana develop, then we can graduate users to low-cost architectures with higher security. Effectively, being welcoming of business model experimentation within low-risk verticals like social and gaming is strategically optimal for crypto broadly.

https://x.com/MustStopMurad/status/1823378013544669475

https://members.delphidigital.io/reports/solana-nfts-in-2024-a-hotbed-of-opportunities (2024-02-01)

SPL20 inscriptions represent unique addresses on Solana, which contain images and metadata stored directly on the blockchain, diverging from the common practice where NFT metadata links to external services like IPFS or Arweave. This concept draws inspiration from Bitcoin’s Ordinals and the BRC-20 standards.

The applications of inscriptions and SPL20s appear limited to speculation and memecoin-like collections today, with no standout use cases to solidify their role in the ecosystem as yet.

https://a16zcrypto.com/posts/article/memecoins-tokens-regulation-policy/ (2024-04-20)

SEC’s role is to (1) protect investors; (2) maintain fair, orderly, and efficient markets; and (3) facilitate capital formation. The SEC is failing across all three of these objectives when it comes to digital asset markets and tokens.

Memecoin projects, meanwhile, don’t have developers, so there’s no pretense of memecoin investors relying on the “managerial efforts” of anyone. Memecoins thus propagate, while innovative projects struggle. Investors end up facing more risk, not less.

https://knowyourmeme.com/memes/doge

On November 20, 2013, YouTube implemented an Easter egg when a user searches the phrase "doge meme". The use of the misspelled word "doge" to refer to a dog dates back to June 24th, 2005, when it was mentioned in an episode of Homestar Runner's puppet show.

Dogecoin can be mined and exchanged for goods and services among the participants, though it is programmed to level out at a higher threshold of up to 100 billion coins and prevent any use of special bitcoin-mining equipment like ASICs.

https://messari.io/report/navigating-memecoin-mania (2024-03-14)

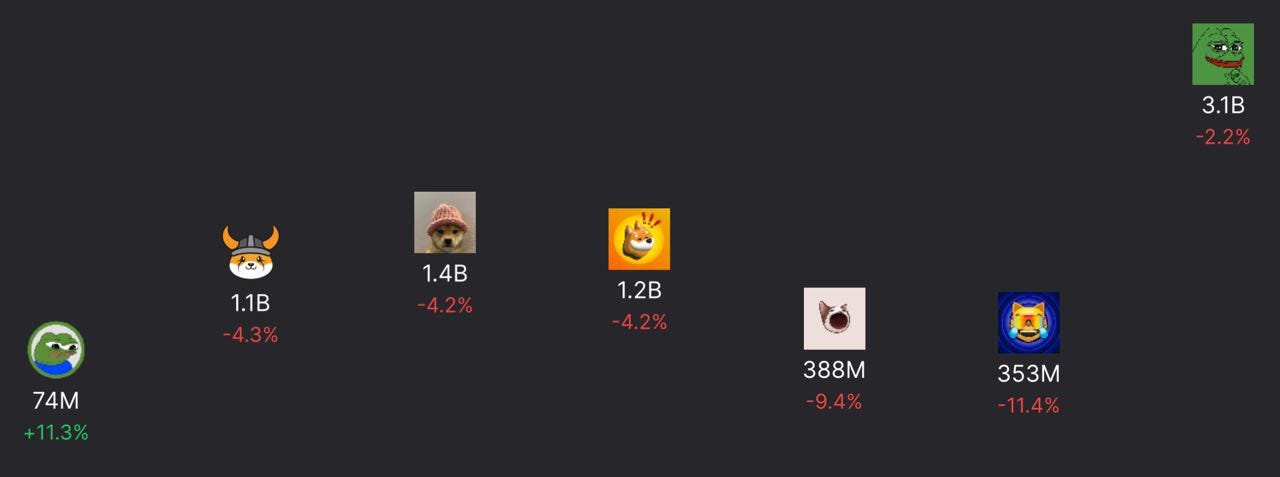

The approval of Bitcoin ETFs has catapulted BTC to new heights, subsequently sparking a resurgence in memecoins that have outshined the performance of many other sectors. This revival has cast a spotlight on legacy meme tokens such as DOGE and SHIB, both of which have recorded notable gains over 100% in the past few weeks. Yet, it's newer memes like PEPE on Ethereum and WIF on Solana that are at the forefront of this trend, up over 600% in the past month.

There are three critical metrics to monitor: the rate of change in the number of holders, the ratio of new to returning daily buyers, and the types of buyers. Notably, one of the tokens closely mirroring WIF's data footprint in two distinct phases is POPCAT.

Thanks to its scale, Solana enables fundamentally new stuff. Enter the “Only Possible On Solana” meme. OPOS challenges developers to build from first principles. It asks: what’s possible on Solana that’s impossible everywhere else?

Phoenix — Solana’s top central limit order book (CLOB) DEX. Phoenix’s design helps market markers remain profitable while offering tight spreads to takers (retail tradoors).

https://members.delphidigital.io/reports/return-of-the-coins#breakpoint--back-from-the-dead-cd20

Outside of the price ripping, perhaps the surprise of Breakpoint was the community’s embrace of the ‘Only Possible On Solana’ meme. Despite the official Solana Foundation-endorsed theme being ‘Liquid Metal,’ op/os was ubiquitous.

The meme is salient because, to date, most Solana applications have been EVM copycats. We’ve yet to see many apps push the bounds of Solana’s larger design space.

https://members.delphidigital.io/feed/memecoin-nfts (2024-07-27)

Remilio is (technically) Remilia’s third pfpNFT, basically Milady’s younger, more chaotic brother – adopting a more reactionary semi-ironic aesthetic, rightfully braggadocious but at the same time purposely rough around the edges, making them the perfect contrast to Milady.

Trading Axe. They would often sign his tweets with “Remilio” at the end, and after some interactions with Andrew Tate, the latter sent them a direct message calling him “Retardio” instead of Remilio. Anyways, as Retardio started gaining traction on CT, Paradilf.

https://members.delphidigital.io/reports/solana-the-modular (2024-08-14)

Now, 21.6 million users sounds like a lot, and it is. But it’s important to remember that this is a simplified calculation based on several assumptions. Not everyone uses the network evenly throughout the day. We’re bound to see periods of peak demand, like during a major NFT drop or a sudden market swing.

To understand the potential of SVM rollups, let’s examine Ethereum’s history. As the first programmable blockchain, Ethereum had a first-mover advantage. The 2017 ICO boom further solidified its position, with most ICOs using ERC20 tokens. This was followed by the DeFi boom, which led to another spike in Ethereum’s developer market share. The NFT boom also contributed to Ethereum’s growth.

SpiceNet is a high-performance DEX rollup for perpetual futures trading. It addresses the need for ultra-fast transaction confirmations, providing soft confirmations in just 2-5 milliseconds compared to 250ms for Arbitrum. This speed is crucial for market makers and high-frequency traders who require near-instant feedback on their transactions. For its architecture, Spicenet is using Sovereign SDK and its zk-fraud proofs.

https://members.delphidigital.io/feed/the-meme-signal (2024-05-04)

Situations like low float launches, locked tokens, accelerated vesting schedules for early-stage investors, airdrop sybiling, and huge unlocks are all too common. Understandably, retail participants often feel overlooked and undervalued.

Memecoin popularity is a signal that retail wants better access to low-valuation opportunities and is skeptical of how token allocations are currently constructed.

https://a16zcrypto.com/posts/article/go-to-market-in-web3/ (2022-02-04)

Viral images with text overlays are another GTM tactic for web3 organizations. Given the complexity and breadth of the cryptocurrency ecosystem and the short attention spans of social media users, memes allow information to be rapidly conveyed. Memes can also signal belonging, community, goodwill, and more in a highly information-dense way.

These moves can in turn also beget other memes, as in the case of Crypto Covens and the “web2 me vs. web3 me” meme where users came to display their witches alongside their actual faces, signaling identity, belonging, and more.

https://messari.io/report/memecoin-escape-velocity (2024-01-11)

The JTO launch catalyzed a significant transformation in Solana's trading landscape, shifting focus from stablecoin trades to a heightened interest in memecoins and small-cap assets. This event, a first in Solana's history, brought a substantial influx of liquidity, leading to a chain reaction of increased user engagement. Consequently, the trading volume market share for memecoins and small-cap assets rose dramatically, now accounting for 25% of the total DEX trading volume.

Within the Solana ecosystem, one of the most notable new memecoins is WIF, dogwifhat, distinguished by its meme of a dog wearing a knit hat. In early December, WIF achieved what can be described as its "escape velocity," experiencing rapid growth from a market cap of under $1 million to over $350 million in a mere two weeks.

https://www.notboring.co/p/make-the-internet-fun-again (2024-07-16)

oncyber v2 will literally start out looking like a toy. They’re launching with games, starting with Flappy Bome, a collaboration with art producer Darkfarms. Instead of the bird, the game will feature the popular frog-looking meme, Bome. And your score will influence the rarity of the NFT you’re able to mint at the end, showcasing the native crypto integration.

Hundreds of thousands of people created oncyber experiences, imported over 5 million digital assets, and spent more than 2 million aggregate days in oncyber. At its peak, 10% of all NFT-holding wallets were connected to oncyber, and $2 billion worth of NFTs were displayed in oncyber.

https://messari.io/report/intern-narratives-part-2 (2024-08-20)

Memecoins amplify the social layer, providing utility through entertainment and a sense of community. Cult coins have emerged as a new subsector of memecoins, focusing on niche internet subcultures and memes. They foster "cult-like" devotion and are powerful tools for social coordination and community building.

https://www.esquire.com/lifestyle/a39636815/what-is-r-place-explained/

https://culturalhistoryoftheinternet.com/student-projects/fall-2020/rplace/

https://members.delphidigital.io/feed/jito-goes-crazy-with-meme-mania (2024-03-07)

Jito validators are now receiving more tips from MEV than transaction fees combined. Sandwiching has gotten so bad on Solana recently that Eugene from Ellipsis (Solana’s top CLOB) has even proposed socially “banning” third party mempools like Jito to buy more time.

https://www.alexirpan.com/2022/05/02/r-place.html

https://kolelee.substack.com/p/jupiter-aggregator-solanas-defi-hub

Jupiter-like memecoin BONK-is a levered bet on the SOL… their Perps has the ability to become the top perpetuals platforms in DeFi. There’s a great flywheel: as Jupiter gains more liquidity, more people will come to trade, causing more even more people to deposit liquidity to get JLP fee rewards.

Their LFG Launchpad is also a major catalyst. 75% of fees generated by the launchpad, which currently has over twenty high-quality Solana applications applying, will go to those who partake in the JUP voting process.

https://a16zcrypto.com/posts/article/social-media-for-startups-guide/

Where in the world is the audience located? This can be tricky for web3 because so many people are anonymous. Tools like Twitter Analytics can help with this. But a really simple, growth-hacky way to get this information is to just go into your Discord and ask people to drop their flags in the chat.

Enticing shares and replies: Take the community management idea one step further and create the kinds of posts that people want to discuss. Pose questions (“What’s your favorite crypto meme?”), create curated lists (“10 essential resources for ZK proofs”), solicit opinions (“How would you explain web3 to someone new to crypto?”).

https://members.delphidigital.io/feed/sols-bonkers-liquidity-boost (2024-03-04)

The last time BONK’s price surged like this – back in December – it took a lot of attention away from SOL, which traded sideways during BONK’s parabolic run up.

The subsequent peak in BONK’s rally, however, marked the local low for SOL’s price. SOL proceeded to gain >50% over the following two weeks, aided by the rotation of money out of the high-flying meme coin.

https://messari.io/report/emerging-casino-business-models (2023-08-23)

Several coins, notably Unibot, Espresso, and Bullet Game, have potentially begun to carve out niches for themselves using this model. By far the leader in this movement, Unibot allows onchain crypto users easy access to new token sniping, wallet mirroring, and more. The project generates revenue from in-app usage, but the majority of the revenue comes from buy/sell taxes on UNIBOT trades.

https://www.theinformation.com/articles/the-rise-of-cryptos-shadow-bankers

The interest rates FalconX, B2C2 and others charge fluctuate daily based on borrower demand and crypto market volatility. They typically range between 9% and 15% on an annualized basis, though they can rise as high as 25% when bitcoin prices soar, because borrowers expect to cover the interest costs through their trading strategies.

https://avc.com/2017/05/rare-pepe/

It’s a meme popularized by the alt-right and attached to a lot of ideas that I personally find difficult to take. I find it encouraging that people are building things that are comprehensible to the average person on public blockchains. Rare Pepe may not be the killer app that public blockchains are waiting for, but something like it may well be.

https://a16zcrypto.com/posts/article/virtual-society-the-metaverse-blockchains/

Some of the most interesting experiments in Ethereum today have been in fields that mix artistic, social, economic, political, and gameplay-like elements. A good example here is NounsDAO, which launched in the summer of last year. In brief, NounsDAO is an NFT project in which a daily auction is held for the sale of a Noun NFT, and proceeds of the sale go to a treasury shared by holders of the Nouns, who can vote on proposals for how the treasury is spent.

Crucially, the auction protocol, the art, and the governance is all conducted entirely on-chain. Proposals funded by the DAO have proliferated the Nouns meme and ethos across the internet and the physical world — thanks primarily to the way the project has captivated the imagination of artists and developers.

Oxytocin requires two things: eye contact and touch. Those are exactly the two things that you don’t get when your relationships are mediated by technology. So the best way that you can get oxytocin, and thus the satisfaction that you need from your relationships, has to be with somebody who’s a real person with you.

Touch their hand, look ‘em in the eye. Your brain needs it. Your brain craves it. That’s how your brain is evolved. Real life is awesome, but you gotta experience it, and you can’t be distracted from it systematically by these technological methods.

https://a16zcrypto.com/posts/article/beyond-tokenomics-tokenology/ (2023-04-21)

For alignment. Creator coins, social tokens, and NFTs allow fans to directly interact with the artists they love the most, and to prove their fandom — whether as an early adopter, to show intensity of support, or for community and meaning. Dogecoin’s strength, for instance, is the meme, community, and “religion” it represents.

Tokens can also be extended to not only represent membership in this community, but to establish a digital cultural identity; in this context, holders of such tokens can also vote on creative decisions in decentralized collaboration between creator and community.

Memecoin: A token with no intrinsic value that is used primarily for financial speculation, the most famous of which is Dogecoin.

https://messari.io/report/the-infrastructure-vs-application-debate (2024-07-19)

while the application layer may see marginal funding improvements, infrastructure will likely remain dominant in absolute funding size for the foreseeable future.

Returning to the three key questions for investing in infrastructure (Can this technology problem be solved? Does solving this problem lead to meaningful improvement? How large of a market is unlocked?)

https://a16zcrypto.com/posts/article/decentralized-identity-on-chain-reputation/

Furthermore, if every piece of content on the internet were truly composable or remixable, it could be possible to gauge which content inspires further creation, or is the most meme-able. This would offer a new way to surface content, similar to TikTok’s system. Finally, and perhaps the most disruptive of all, people could become the new platforms for discovery — especially is incentivized through token models.

Derived on-chain reputations will bring about massive opportunities for business and society. But as we traverse this new territory, we will be forced to consider the implications of permanence. Inevitably, we’ll need to find a balance between what is ephemeral and what should be forever.

Curation Markets is a model that allows groups to more effectively coordinate & earn from value they co-create around shared goals.

Each topic/meme/idea/goal has an associated token of value that is used to curate information inside it.

We also had a Discord meme channel set up, in the same way that we had a highlights channel. Lots of people would hang out there. We made the meme channel accessible to everyone, not just testers. They built some of our best marketing campaigns ever. These memes would get shared out through their own channels, on their own Discord servers, on their own Twitter.

I kind of thought it was silly when we first added it. I was like, “Why did we do this?” Then I saw the impact of these things getting posted all the time and I was like, “We really need to double down.”

That’s something that we’re starting to see more and more in the way people are sharing and communicating. “What game is this? What are you guys talking about?” You’re able to attract free engagements, free new players because you’ve built this community around sharing these memes.

https://www.notboring.co/p/blackbird (2024-07-30)

Blackbird Pay offers restaurants a flat 2% fee on payments, versus an industry average of 3-4%. Payments is how Blackbird will make the majority of its revenue. Ben explained that, in the short-term, they’ll lose money on some transactions (when users choose to pay with credit card and Blackbird eats those fees), and make money on others (when they pay with $FLY and Blackbird pays basically zero fees), but that “On a blended basis, we love how it looks at 2%.” Win-win-win.

Guest Value Score: Blackbird uses the data it has to provide a measure of each guest’s expected lifetime value to each restaurant. This is important, because even with all of the data, restaurants can’t be expected to be experts in calculating LTV.