On Chain We Trust 🤨, Hyper Liquid 💦 for DeFi Lead 👑

This week’s TGI is covering Harmony 2024 report, Japan’s Black Forex, and Bitcoin Futures. AND, we are hiring 🎖️ “DeFi Lead” – send your resumes to t.me/stephentse or s@harmony.one!

You will initially manage product development, curate trader community, and run monthly campaigns. Later, you may as well engage business development, build partnership integrations, and grow marketing reach.

You are expected for startup-like long hours and relentless dedication. Harmony’s mission is “to scale trust and create radically fair economy”.

Our current team practice are: daily progress updates, weekly team sync, monthly metric reports, quarterly performance reviews, annual conference trips, and some in-person work sessions.

https://socap.notion.site/A-ton-of-TON-669f52e82d624262ab8993428e51480e

https://x.com/timelesswallet/status/1821592249194725553

3️⃣ Monetizing Engagement: Our SocialFi mini-apps reward users for tasks, capturing on-chain and off-chain data. This improves social capital scores, creating a virtuous cycle. The dashboard reflects user engagement across networks and blockchains, reducing waste and mitigating risks for SocialFi builders. 📊💡

🍄 Many teams will likely leverage TON's mindshare to funnel users into their games or protocols. The second half of 2024 will be crucial for TON gaming, as the focus shifts towards retention and LTV, requiring teams to execute meaningful liveops to achieve sustainability.

“LiveOps are changes and updates you bring into the game after the release date to engage your players, create long-term relationships with them, and improve the Life-Time-Value (LTV) of your game. In an ideal scenario, these updates are handled by the product team and do not require the involvement of developers.”

https://messari.io/report/what-s-the-hype-with-hyperliquid

Hyperliquid’s trading experience is gasless; gas is only induced for transactions that increase state bloat i.e. spot listings or transferring to new wallets. According to Hyperliquid’s docs, the mainnet currently offers sub-second latency even in the 99th percentile. It also supports 100 thousand orders/sec,

The chain must allow for specific order prioritization - such as for cancels and post-only limit orders which insure market makers aren’t subjected to as much toxic flow. Liquidating positions atomically based on the latest oracle price feed. Strictly distributing funding payments in a single atomic operation consistently each hour. Verifying solvency on the platform at the end of each block.

Hyperliquid has built out user vaults, with its principal HLP vault carrying out an active market making strategy, collecting fees, and earning off perp DEX liquidations for passive USDC depositors. HLP’s 25%+ APR has attracted over $150 million in TVL as of July 24th, 2024. Also of note, new spot deployments on Hyperliquid originate from a permissionless Dutch auction that takes place every 31 hours.

https://messari.io/report/state-of-synfutures-q2-2024

As of Q2, SynFutures commanded a 66% market share on Blast. While competitors like Vertex’s Edge and Blast Futures also facilitated billions in trading volume during the quarter, SynFutures continued to lead the ecosystem. Outside Blast, SynFutures’ quarter catapulted it to become a leading perp DEX in a competitive sector. Perp DEXs are among the few crypto products with a well-established product-market fit. That said, there are currently over 90 live Perp DEXs

SynFutures V3 utilizes the Oyster AMM, which integrates features of an onchain order book, moving away from the traditional matching process from AMMs. With single-token liquidity provision, this permissionless model allows listing pairs with any asset as collateral and enables users to trade any quote asset against any collateral asset. Theoretically, users could pair any combination of assets against each other. In addition, order management, matching, and executions occur fully onchain, unlike alternative models that depend more heavily on offchain controls.

https://messari.io/report/state-of-defi-q2-2024

🔢 Harmony 2024 Ecosystem: 🐠 Sustainable Scaling & 🔰 Onchain Security

Here is our 2024 report on Harmony ecosystem. Builders and traders – join us at All-In Summit, Token 2049, Solana Breakpoint, and Network State Conference!

https://members.delphidigital.io/feed/ostium-on-chain-perps-for-rwas

In the case that the Liquidity Buffer is depleted, the Market Making Vault provides liquidity to traders and in return for taking on this risk, LPs receive a share of Ostium’s protocol fees. In particular, LPs receive 50% of the opening fees collected for each trade and 100% of liquidation rewards. Generated fees are accrued directly to OLP token holders.

To complete the incentive mechanisms for the protocol’s trading engine, Ostium has a dynamic fee structure. Different fees are in place to help Ostium move OI skew towards equilibrium, reward counterparties for the risks they assume, generate protocol revenue, and ensure perps track the price of the underlying asset.

https://members.delphidigital.io/feed/oev-how-auctions-influence-value-capture-in-lending-protocols

Block builders aggregate and bid on these blocks in PBS auctions, further driving up costs. This intense competition results in searchers often paying up to 99% of their profits to validators, highlighting a unidirectional flow of value toward validators and block builders, who ultimately capture the majority of the value in the transaction supply chain.

With Block builder centralization increasing and builders playing the role of an auctioneer and accumulating private order flow has led to costly bribes and inefficiencies in MEV/OEV capturing. Effective decentralization and incentive structures are crucial for mitigating these risks in oracle-based auction mechanisms like API3’s OEV Network, UMA’s Oval, and Pyth’s Express Relay.

https://members.delphidigital.io/reports/ethcc-one-year-later-have-we-made-progress

Hyperliquid, who recently announced they will be offering spot trading, also announced that they will be offering the ability for users to provide liquidity on their order-book. Elixir is another project that aims to bring passive LPing to order-books. Currently, Elixir offers perps liquidity provisioning with plans to support spot in the near-future. The emergence of more performant L1s and L2s and their support for on-chain order-books should accelerate this trend in the near-future.

While the LVR [Loss Versus Rebalancing] problem may sound trivial, it is estimated that LVR is responsible for well over $500M in LP losses every year — more MEV than sandwiching and front-running combined. Moreover, less profitable LPs means less AMM liquidity. Downstream of less liquidity is worse execution for traders and thus less volume which makes LPs even less profitable. Put simply, LVR is a huge issue for AMMs.

https://messari.io/report/state-of-solana-q2-2024

Bitcoin-related: Zeus Network’s $8 million raise and token launch, Wormhole’s WBTC launch, 21BTC’s launch, and Zeus Network’s alpha testnet launch of APOLLO.

Ellipsis Labs’ $20 million raise, DFlow’s beta launch, C3’s launch, Adrena’s perps introduction, Ranger Finance’s perps aggregator introduction, Photon limit orders launch and stimmies, Lifinity Sandglass launch, Bullpen’s Telegram bot release, RugCheck Token Verification launch, Prism V4’s launch, and Coinhall’s Solana integration.

https://members.delphidigital.io/reports/milady-nfts-as-onchain-cults

Remilia adopted a Viral Public License (VPL). This copyleft license applies to every collection they created, but instead of simply waiving rights, it also requires every project using it to waive rights, too, with no further restrictions.

Those who take the white pill believe in love and optimism, distancing oneself from bitterness, sarcasm, and envy and acknowledging that hate’s always a projection; this goes in hand with adopting an abundance mentality and farming good karma.

Network Spirituality embraces the hyperreal experiences found online, seeing them as gateways to a new form of consciousness. This concept encourages users to engage meaningfully with virtual spaces, adopting and internalizing the unique cultural norms and modes of expression in these digital environments. Through our collective online interactions, we’re not just sharing information, but creating and nurturing new forms of spiritual entities – digital egregores that exist in our shared virtual consciousness.

“Elon pump”: Musk to tweet the most iconic Milady meme, which says, “There is no meme I love you”, spiking Milady’s floor to above 5 ETH for the first time.

Bonklers was that you could burn a Bonkler to get back 70% of its value in ETH (30% going to Remilia’s treasury), so essentially, they were backed 1:0.7 to ETH. Sort of like if Nouns, without a DAO and ragequit. Bonkler’s was a massive success; the first one sold for 60 ETH, and the highest sales went as high as 75 ETH.

MiladyChan of Master Plan – Realtime posting: Hyperrealtime Communication (HRTC) allows users to see every letter as it’s being typed, enabling a more intimate type of communication – more akin to real-life chat.

https://messari.io/report/state-of-pyth-network-q2-2024

Protocols like Aave and Compound have spent at times over $100 million on liquidation incentives, with much of this value being lost to MEV. The cost of MEV can discourage searchers from participating in DeFi, weakening the security of particular protocols. Express Relay removes the need to bid for blockspace to validators, removing this form of harmful MEV.

In addition to aiding searcher profitability and helping DeFi protocols retain searchers (and bootstrap searcher networks), integrating with Express Relay can allow protocols to set more economical liquidation incentives and pass down savings to stakeholders. Express Relay is already implemented in various protocols, like Synthetix, ZeroLend, and Ionic. It also already has a robust searcher set with notable entities such as Wintermute, Caladan, and Flowdesk.

https://members.delphidigital.io/reports/api3-the-state-of-oev

MakerDAO and several other lending protocols, like Euler, Yield, and even Oracle-less protocols like Ajna, use Dutch Auctions. With Ajna, an auction could last for over 72 hours, with the collateral price starting 256 times higher and gradually decreasing until the price reaches 0. While beneficial to borrowers, Dutch auctions are not the most efficient at timely liquidations or preventing OEV extraction. Most liquidations happen across short periods of high market volatility. The collateral price may crash even as the auction price gradually decreases.

Some protocols, like Maker, have a reset function in their auctions to mitigate this. Even Dutch auctions can be reset when too much time has passed since the start of the auction. This measure could also be set in place when the price of the collateral has changed drastically.

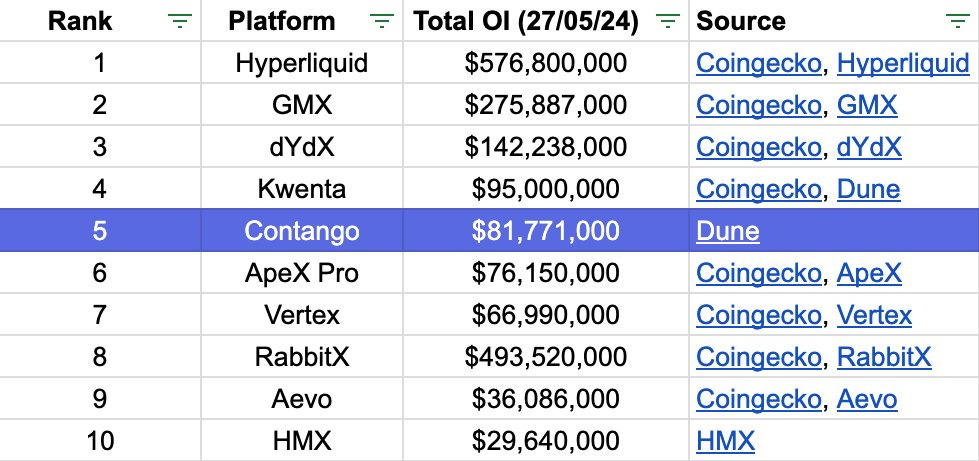

https://messari.io/report/contango-q2-2024-brief

the largest money market on Contango was Morpho, which experienced a significant increase in volume, growing more than 25 times from $10 million to $268.6 million in the second quarter. Aave, which was the leader at the end of the first quarter, also saw gains with a 169% QoQ increase, ending Q2 with $224.3 million in volume. Silo rounded out the top three.

https://messari.io/report/state-of-smart-contract-platforms-q2-2024

https://members.delphidigital.io/feed/redacted-cartel

pxUSD will act as the native currency of the Dinero protocol. While the Curve Wars are not in their prime anymore, Redacted Cartel still owns enough CVX (1.4M, 2.58% of supply) to generate substantial incentives to foster pxUSD adoption.

Hidden has processed $35M+ of bribes and is still steadily maintaining $400k-$500k worth of bi-weekly bribes. The vast majority of the bribe volume is from Aura + Balancer incentives. Hidden charges a 4% fee on all bribes, split between treasury and rlBTRFLY stakers.

https://members.delphidigital.io/feed/liquity-v2-whitepaper-explained

Sustainable Yield: Interest payments from borrowers provide yield to Stability Pool depositors. Protocol-incentivized liquidity (PIL) to ensure DEX availability.

Adaptive Redemption Mechanism targets loans with lowest interest rates rather than lowest collateral ratios.

https://members.delphidigital.io/feed/one-year-gho-anniversary

The program allocates $20 million annually, which is distributed among wETH borrowers and GHO stakers. This initiative has resulted in a 15.82% APR from the Merit Program, which, when combined with $stkAAVE rewards, is 21.91% APR for GHO stakers.

Liquidity is mainly concentrated in the GHO/USDT/USDC pool on Balancer, GHO/USDe pool and GHO/fxUSD pool on Curve.

https://www.notboring.co/p/blackbird

https://members.delphidigital.io/feed/blackbird-flypaper

The Flypaper introduces a new token, $F2, which will serve as the gas and governance token for the network. The network itself will be a Layer 3, Flynet, built on top of Coinbase’s Base L2 (which itself is built on top of Ethereum).

Tomo recently launched Tomoji Launchpad, a meme issuance platform based on the ERC404 protocol. This platform allows users to create and trade personalized emojis.

Pop, a leading SocialFi AI project within the BSC ecosystem, boasts over 500,000 global online users, with more than 50,000 daily active users and over 100,000 monthly active users... enhancing DeFi features and integrating advanced AI technologies.. having generated over 20 million pieces of content globally.

The Chinese Q* allows an LLM to solve problems that have multiple steps, like complex logic puzzles. Rather than having to follow each potential multi-step answer to its conclusion before deciding whether it’s right or wrong (aka a Monte Carlo tree search), the Chinese Q* helps an LLM “search” for the best possible next step it should try during each step of the answer. It does so through a special equation called a Q-value model, which helps the LLM to estimate future rewards—or the likelihood of a correct final answer—for each possible next step.

“Quiet-STaR'' paper, published in March, from Stanford University and Notbad AI. Similar to how people pause to think through their thoughts before speaking or writing, this paper explains how LLMs can be taught to generate internal “thoughts”' about the steps they take in a complex reasoning problem to help them make better decisions.

Arvin Sun, a Chinese American entrepreneur and Jason Hong, a former OpenAI mathematical alignment and ChatGPT development engineer, co-founded Traini and have nicknamed it PetGPT.

https://www.nytimes.com/2024/08/04/technology/china-ai-microchips.html

China tested a weapon that shook U.S. officials: a hypersonic missile that circled the earth. The weapon, which surpassed American technology, could theoretically dodge missile defense systems to deliver a nuclear warhead to the United States.

Leslie Zhou, the market vendor who shared a detailed message arranging the $103 million shipment to a local warehouse, said the the banned Nvidia chips — including A100s and H100s – weren’t hard to obtain.