📩 Telegram's 👆Tap-to-Earn Social Games, 👶 Mini DeFi Bots + Wallets + Apps

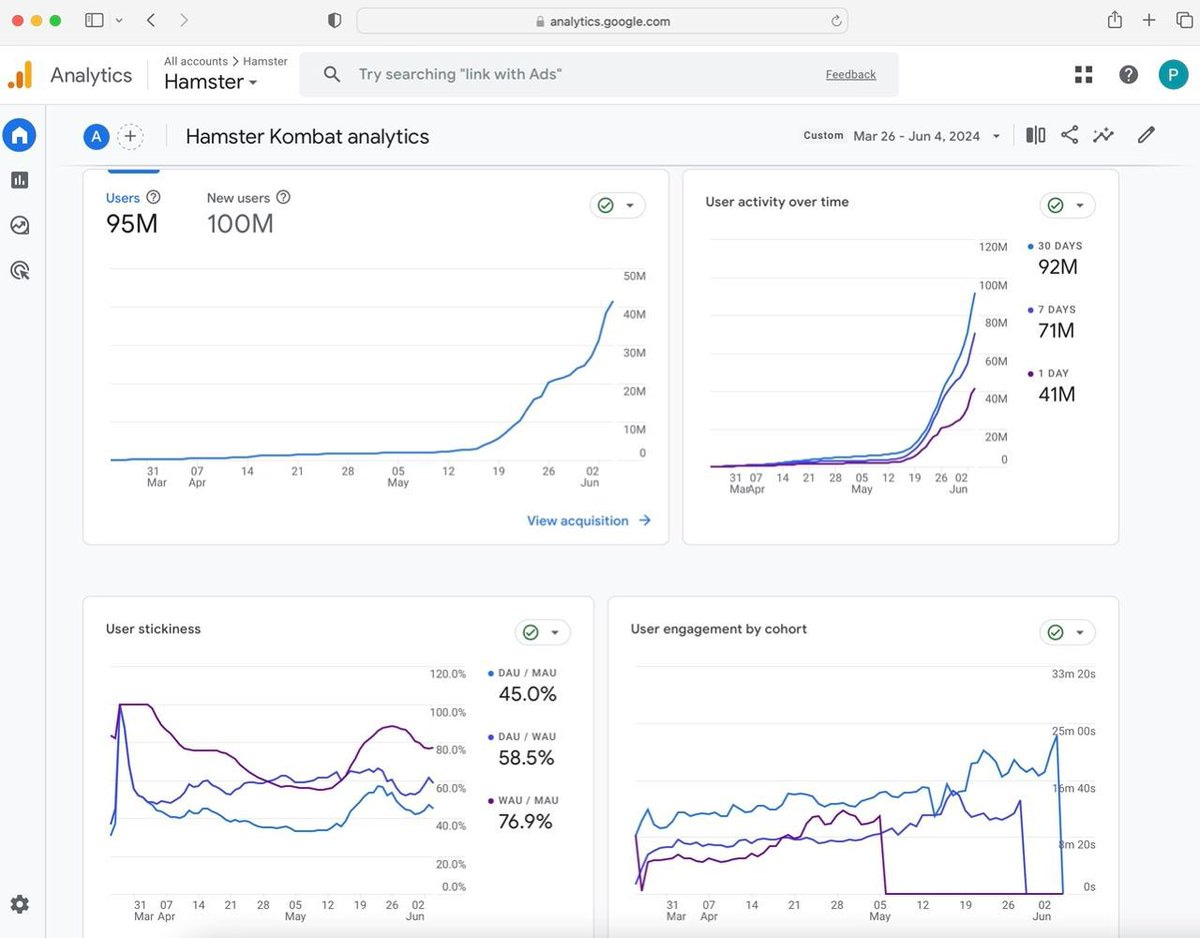

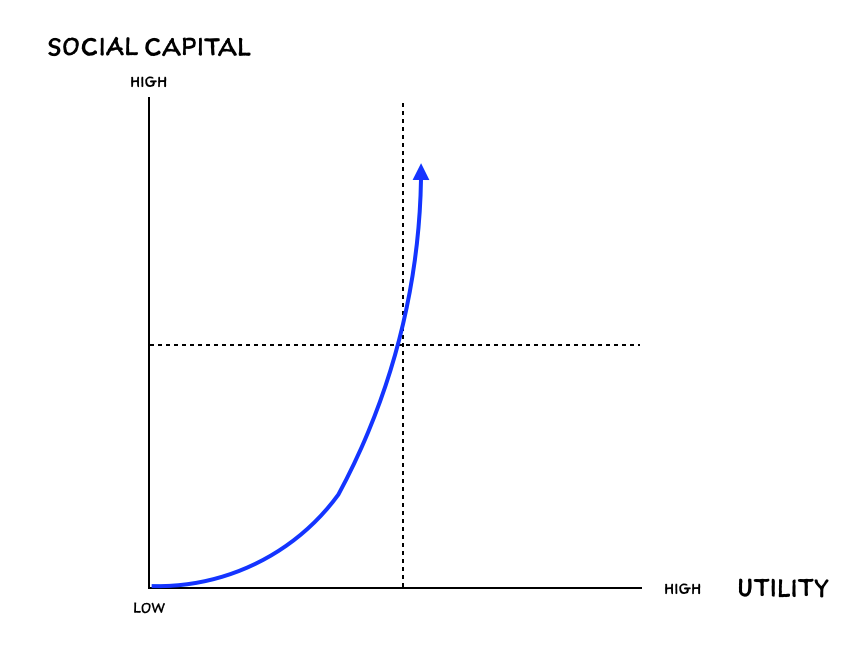

100M users for Hamster Kombat! “First Social Capital, then Utility. Wei highlights Foursquare, Wikipedia, Quora, and Reddit as products that used the promise of social capital to get people to do free work that then becomes a utility for the masses.”

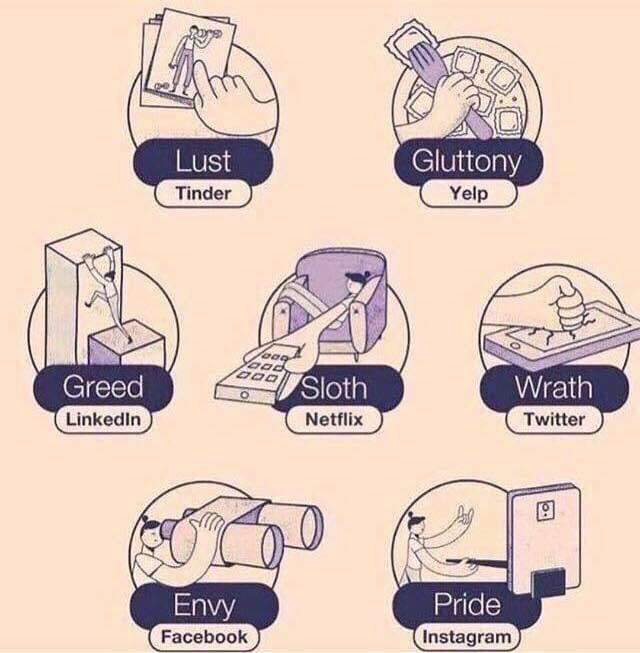

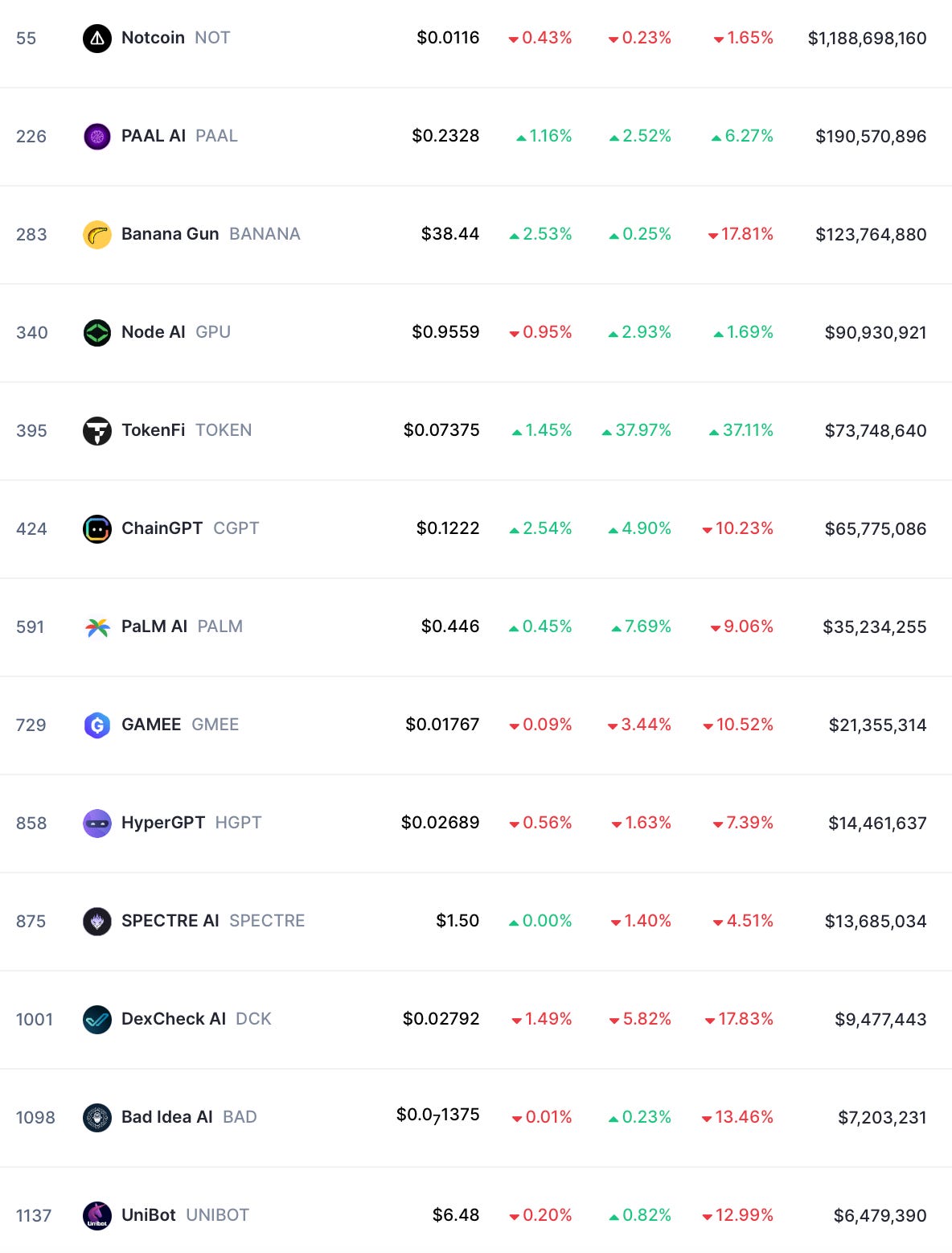

What’s the best social games after Catizen or Notcoin? The best mini DeFi apps like Unibot, Telefrens, BookieBet, Boxbet, Banabot, Banana Gun, Maestro, BonkBot? "It's not as easy as it looks." Because we are modern [crypto users], and we are not mortals, we are now gods. "Will you maintain and preserve inviolably…?" See Euegen Wei’s 3 essays on TikTok: the Sorting Hat, an Algorithm, and American Idle.

https://messari.io/report/evaluating-the-open-network-s-onboarding-thesis

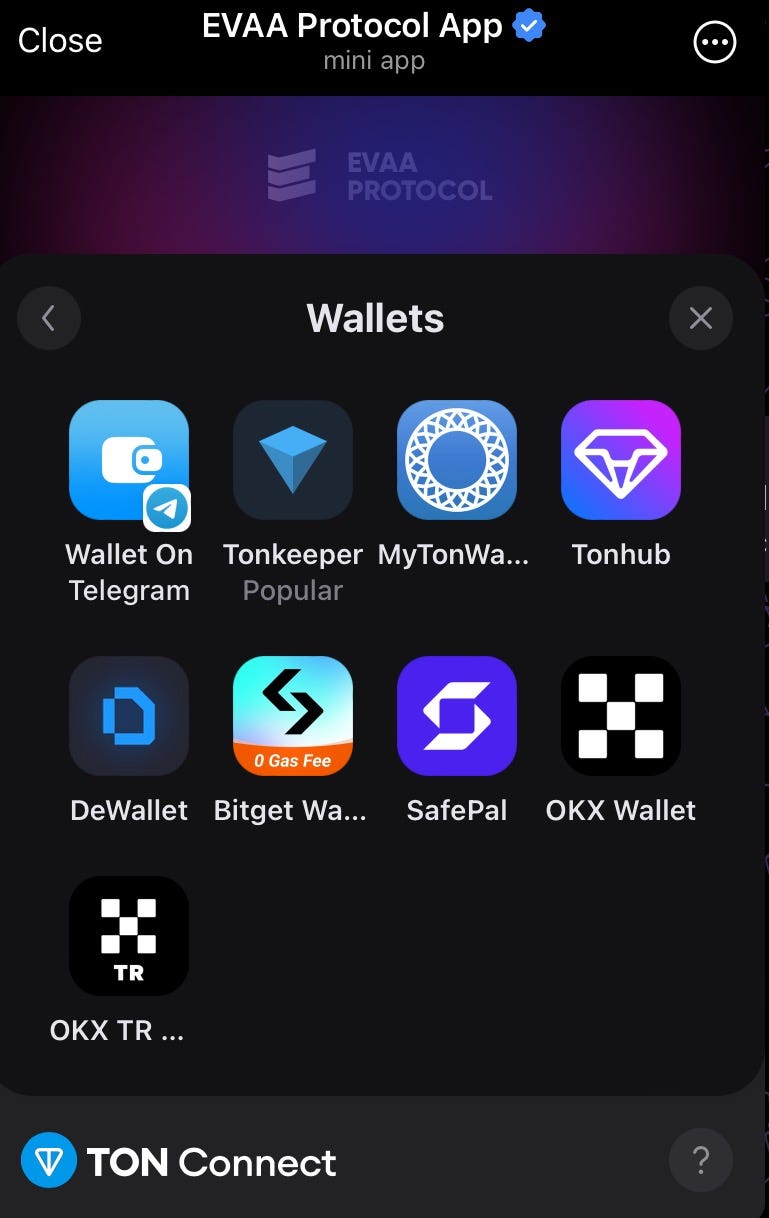

TON Space, the self-custodied wallet, does provide private keys but is planning to build out an optional recovery mechanism for users who prefer more accessible recovery methods similar to Coinbase’s smart wallet. Telegram mini-apps of the chain’s largest DEXs, lending protocols, and perp trading platforms. Perp DEX Storm Trade for example, has built its application solely for the Telegram mini-app format.

The founder of Toncoin has said that 94% of Notcoiners had come from referrals. SquidTG, a game leveraging inscriptions, has boasted a strong Telegram to onchain conversion rate at ~60%. As The Open League continues, more and more developers will be targeting onchain metrics in order to win rewards, also acting as TON’s best sources of onboarding activity.

So far the blockchain has managed to process over 8 million transactions a day (~92 TPS) at its peak without any issues, but problems arose during TON’s own inscription craze, when the basechain split into 11 shardchains within a rapid window. Due to intense load on certain validators, select shardchains’ processing speeds dropped to 1 TPS - highlighting that test results are unreliable when stresstesting the blockchain in real conditions.

https://www.eugenewei.com/blog/2019/2/19/status-as-a-service

Why do some large social networks suddenly fade away, or lose out to new tiny networks? Why do some new social networks with great single-player tools fail to transform into networks, while others with seemingly frivolous purposes make the leap? Why do some networks sometimes lose value when they add more users? What determines why different networks stall out at different user base sizes? Why do some networks cross international borders easily while others stay locked within specific countries? Why, if Metcalfe's Law holds, do many of Facebook's clones of other social network features fail, while some succeed, like Instagram Stories?

What changed Twitter, for me, was the launch of Favstar and Favrd (both now defunct, ruthlessly murdered by Twitter), these global leaderboards that suddenly turned the service into a competition to compose the most globally popular tweets. Recall, the Twitter graph was not as dense then as it was now, nor did distribution accelerants like one-click retweeting and Moments exist yet.

What Favstar and Favrd did was surface really great tweets and rank them on a scoreboard, and that, to me, launched the performative revolution in Twitter. It added needed feedback to the feedback loop, birthing a new type of comedian, the master of the 140 character or less punchline

In a clever move to unbound social capital accumulation and to turn a zero-sum game into a positive sum game, broadening the number of users working hard or engaging, Snapchat deprecated the very popular Best Friends list and replaced it with streaks.

The same way many social networks track keystone metrics like time to X followers, they should track the ROI on posts for new users. It's likely a leading metric that governs retention or churn. It’s useful as an investor, or even as a curious onlooker to test a social networks by posting varied content from test accounts to gauge the efficiency and fairness of the distribution algorithm.

Whatever the mechanisms, social networks must devote a lot of resources to market making between content and the right audience for that content so that users feel sufficient return on their work. Distribution is king, even when, or especially when it allocates social capital.

https://members.delphidigital.io/feed/mapping-out-ton-defi-landscape

Storm Trade is a perp DEX on TON that allows users to leverage trade crypto, stocks, forex, and commodities through a web app or within Telegram. Storm has generated $250M in trade volume over the past 30 days, and collected over $500K in fees. is generating most of TON derivatives volume.

https://www.eugenewei.com/blog/2020/8/3/tiktok-and-the-sorting-hat

How did an app designed by two guys in Shanghai managed to run circles around U.S. video apps from YouTube to Facebook to Instagram to Snapchat, becoming the most fertile source for meme origination, mutation, and dissemination in a culture so different from the one in which it was built?

A machine learning algorithm significantly responsive and accurate can pierce the veil of cultural ignorance. Today, sometimes culture can be abstracted… the most important piece of technology Bytedance introduced to TikTok: the updated For You Page feed algorithm.

https://www.eugenewei.com/blog/2020/9/18/seeing-like-an-algorithm

To help a network break out from its early adopter group, you need both to bring lots of new people/subcultures into the app—that’s where the massive marketing spend helps—but also ways to help these disparate groups to 1) find each other quickly and 2) branch off into their own spaces.

It is a rapid, hyper-efficient matchmaker. Merely by watching some videos, and without having to follow or friend anyone, you can quickly train TikTok on what you like. In the two sided entertainment network that is TikTok, the algorithm acts as a rapid, efficient market maker, connecting videos with the audiences they’re destined to delight. The algorithm allows this to happen without an explicit follower graph.

https://www.eugenewei.com/blog/2021/2/15/american-idle

One of my favorite paragraphs of recent years was one describing the miracle that are Cheetos: To get a better feel for their work, I called on Steven Witherly, a food scientist who wrote a fascinating guide for industry insiders titled, “Why Humans Like Junk Food.” I brought him two shopping bags filled with a variety of chips to taste. He zeroed right in on the Cheetos. “This,” Witherly said, “is one of the most marvelously constructed foods on the planet, in terms of pure pleasure.” He ticked off a dozen attributes of the Cheetos that make the brain say more. But the one he focused on most was the puff’s uncanny ability to melt in the mouth. “It’s called vanishing caloric density,” Witherly said. “If something melts down quickly, your brain thinks that there’s no calories in it . . . you can just keep eating it forever.”

TikTok is entertainment Cheetos. Each video requires so little cognitive exertion and reaches its climax so quickly that it feels like we could keep watching forever, each punch line scored to the most satisfying bass drop or stanza from every pop song. TikTok delivers dopamine hits with a metronomic rhythm, and as soon as we swipe up the previous one melts in our memory.

https://www.veradiverdict.com/p/investing-in-ton-network

Memecoin trading tools like BonkBot generated tens of millions of dollars in revenue through Telegram’s user interface. TON-based applications, such as StormTrade, now enable users to trade perpetuals, cryptocurrencies, stocks, and equities using the same interface.

StormTrade facilitates over $10 million in trading volume daily, and we believe that similar TON-native Telegram bots will become the preferred user experience for many traders. With TON’s self-custody wallet, users don’t need to remember their seed phrase; instead, they can simply use Telegram and their email as backup.

https://www.tapps.center/web3 and https://t.me/tapps_bot/center

Simplicity and token-supportive mechanism of BONKbot, the advanced trading features of Trojan (formely UniBot), the speed and meme coin focus of Photon, the versatility and multi-chain support of Maestrobot or Shuriken, liquidity sniping with Banana Gun Bot, or degening on Base chain with Sigma bot.

https://members.delphidigital.io/feed/tons-of-distribution

Notcoin started as a Telegram-based game that allows users to “mine” the token by tapping. It has since become mostly a memecoin and inspired copycat projects as well as the so-called “tap-to-earn” meta.

The game itself isn’t all that novel, but the price action and the attention it has attracted are certainly worth paying attention to. As we’ve seen on other chains like Ethereum and Solana, sometimes all it takes is a single meme to ignite the wealth effect and onchain animal spirits.

https://members.delphidigital.io/reports/a-ton-of-gaming-hype

What’s more, unlike central exchanges like Coinbase and Binance, Telegram is fundamentally a social app, meaning that in-app user behaviors differ drastically. In other words, because users login to Coinbase with the intention of trading crypto (a highly solitary and serious behavior), they will undoubtedly have a higher propensity to resist or churn when presented with any casual enjoyment-focused or social features.

Telegram, on the other hand, falls further on the other side of the spectrum, and thus, social-adjacent applications like games are more easily integrated and have a better product-market fit.

Where Catizen and Notcoin stand out through excellent monetization strategies and clever play on Web3 culture respectively, Hamster Kombat shines with its social presence. No game comes close to its community engagement, which saw an average of 2.2M impressions, 20k likes, and 2k+ retweets per post over the last seven days.

In terms of gameplay, Hamster Kombat is very similar to Notcoin at its core. Users access the game, tap on the screen, and accrue points over time. You play as the fictional Hamster CEO of a crypto exchange, and the goal is to mine as many HMSTR coins as possible. Players can boost their earnings by investing in marketing, licenses, talent, and new products in-game or referring new players.

This simple loop has attracted over 200M registered users to date. The prospect of potential returns paired with minimal effort requirements on the user side has led to exponential growth. The team didn’t focus solely on Telegram and Twitter but has put significant efforts into gamifying their YouTube channel. The team releases two 2-minute videos a day—one covering daily crypto news while the other is usually an educational video—and hides clues within the videos to incentivize users to stay continuously engaged.

Their account has grown to 28M+ subscribers, making it one of the fastest-growing YouTube channels ever. Their 137 videos have generated 461M+ views. To put this into perspective from a Web3 gaming standpoint, this comes down to about 100x more than the Illuvium YouTube channel.

https://www.binance.com/en/square/post/9307462880442 (2024-06-10)

https://hamsterkombat.vip/whitepaper

99% of players are invited by their friends. We build the viral product with viral internal content. Thousands of videos about our features, in-game cards, Daily Combos, and ciphers are launched by bloggers on YouTube daily

Within the game, players are required to increase their coin balance, complete daily combos and ciphers, and get their daily rewards—all of that to maximize their passive income and ensure their exchange is working for them. Hamster Kombat is a crypto exchange CEO simulator in which players create profiles and boost them through various activities.

https://blog.ton.org/these-are-the-best-projects-of-the-open-league-season-5

https://telegram.org/blog/w3-browser-mini-app-store

Mini App Store. More than 500 million out of Telegram's 950 million users interact with mini apps every month. We've added a new 'Apps' tab in Search which shows a list of apps you use and a list of popular mini apps. Now you can quickly access all your games and services — or find something new.

To enable payments for digital goods and services across the Telegram ecosystem, we're launching Telegram Stars. Stars can be acquired through in-app purchases via Apple and Google or PremiumBot, then spent on digital products offered by bots – from e-books and online courses to items in Telegram games.

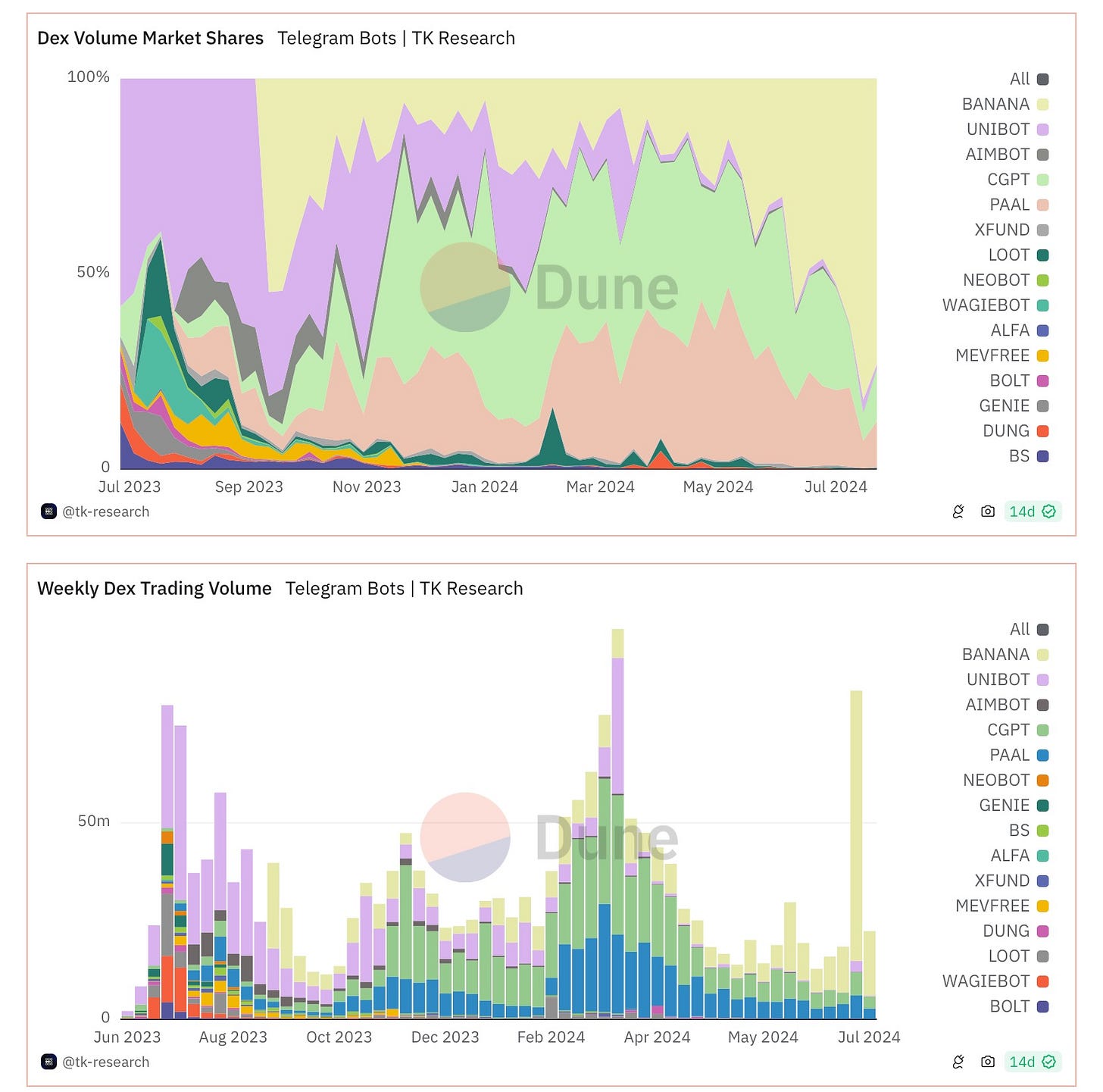

Taxation has been a pivotal source of revenue for Unibot. It has effectively facilitated the bootstrapping of Unibot’s liquidity and operational aspects, especially since they did not seek external funding. Through these mechanisms, Unibot has successfully amassed a revenue of 9.18K ETH, of which a significant 7.3K ETH can be traced back to taxes.

Thanks to the taxes, Unibot has amassed ~$5M in liquidity within their Uniswap v2 pool. Achieving such a liquidity benchmark typically demands a heftier protocol outlay, especially when attempting to bootstrap via incentivized liquidity renting or presales. Notably, through the utilization of taxes, the protocol now holds 42% of this liquidity.

The Orbs Protocol expanded into the TON ecosystem in a big way, developing multiple Layer-3 applications for TON, such as TON-Access, TON Minter, and TON Verifier. With this partnership, TON became the first non-EVM blockchain to explore Orbs’ innovative technologies. They further cemented their relationship this year when Orbs was announced as the main sponsor of two upcoming TON hackathon events.

https://members.delphidigital.io/reports/telegram-bots-evaluating-cryptos-new-cash-cows (2024-02-13)

Trading terminals are very popular among CEX users and will pair nicely with Telegram bots simple app experience. Unibot’s trading terminal, Unibot X, is live, and BananaGun is launching one soon. Telegram bots could become a full-stack professional trading front end across desktop and mobile, with an embedded social layer.

Their perpetual proximity to the hot new thing via Telegram makes trading bots well positioned to capitalize on new narratives first and acquire users. The recent craze around Pandora and ERC404 helped drive Banana Gun to all-time high weekly volume and fees. From Feb.7 – Feb.10, Banana Gun’s top 10 pairs were all ERC404 related.

https://dune.com/tk-research/telegram-bots

https://evaa.finance/#benefits

https://members.delphidigital.io/reports/the-year-ahead-for-gaming-2024#telegram-crypto-gaming-3870 (2023-12-14)

TON’s ~1M active wallets and ~200k daily transactions are focused on token trading, TON has a rapidly evolving blockchain gaming ecosystem – gaming is one of TON’s core focuses for 2024. Currently, the main way apps monetize is via IAPs, which is a little clunky and unideal for a predominantly hypercasual platform.

Two notable developer publishers early to TON are Nakamoto Games and GAMEE. The former recently created its own multi-coin TON wallet and ported 50 of its casual games to the platform. The latter, creators of hypercasual blockchain gaming portal Arc8, are also one of the largest distributors of games on Telegram. Additionally, Animoca Brands (parent company of GAMEE) recently became the largest validator for TON and will undoubtedly support future gaming initiatives in the ecosystem.

https://decrypt.co/resources/what-is-musk-empire-telegram-elon-game-airdrop (2024-08-05)

https://messari.io/project/the-open-network?recap=7D (2024-08-09)

Telegram's potential to onboard the first billion cryptocurrency users is highlighted by X10 CEO Ruslan Fakhrutdinov, with X10 launching a hybrid crypto exchange and a Telegram-based mini app to simplify digital asset trading for new retail investors.

Pixelverse's partnership with Azur Games aims to enhance Telegram mini-games by bridging Web3 and traditional mobile gaming, incorporating new gameplay mechanics and token distribution methods.

X Empire, a popular Elon Musk-themed Telegram tap-to-earn crypto game, is gearing up for a token launch on The Open Network (TON) with an airdrop for players, featuring gameplay mechanics that include tapping a cartoonish Elon Musk to earn in-game cash and engaging in stock market bets.

https://app.intotheblock.com/coin/TON

Hamster Kombat, a Telegram-based game with 300 million players, is preparing to launch its crypto token on The Open Network (TON) and has delayed its token launch to finalize plans for a large-scale airdrop.

Notcoin has launched a story-driven game in collaboration with The Open Network (TON) NFT project Lost Dogs, where players influence the narrative and earn tokens.

MEET48 is set to launch Coin Idols, the first no-click idol training and management game on The Open Network (TON), deeply integrated with idol culture and leveraging TON's capabilities to innovate the gaming and idol management landscape.

IntoTheBlock (ITB) has integrated The Open Network (TON) into its analytics platform, offering advanced analytics to the TON community for free, aiming to boost user engagement and network transparency with over 60 indicators for in-depth analysis.

https://defillama.com/chain/TON

https://members.delphidigital.io/reports/delphis-office-hours-6th-of-august-2024 (2024-08-06)

Like we’ve had ordinals, we’ve had rooms, we’ve had telegram. We’ve had, I mean, last year we had telegram bots. Now banana is obviously good, but banana was like, not the first mover there at all. Um, we’ve had, I don’t know, so many different narratives that come and go.

https://members.delphidigital.io/reports/enter-the-dream-machine#sanko-tv-775a (2024-06-28)

They didn’t stop here; over the year, they delivered multiple new additions to the Dream Machine: ¡SANKO! (their crypto-version of UNO, which includes betting), Sakura Park Pinball, McAfee’s Main Event (poker tournament), and Miya (telegram dice game).

Sanko, now with their L3, has been memecoin trading – SMOKE being the main memecoin so far, with a market cap above $2.5m. Apart from this, someone launched a Pump fork on Sanko called Fanko, with additional memecoin infra being deployed by the community, such as a telegram bot called Dream Bot, which acts just as most telegram bots, allowing users to deploy their wallets, check tickers, and trade tokens – see iLoveSanko.

https://members.delphidigital.io/media/the-great-l0-sybil-hunt-robinhoods-meme-season-and-is-ton-the-next-hot-l1 (2024-06-15)

https://coinmarketcap.com/view/telegram-bot/

https://members.delphidigital.io/reports/market-musings-april-showers-bring-may-flowers (2024-05-28)

Specifically, we noted, “$NOT, a Telegram-based clicker game, performed quite well over the last week amid increasing interest due to the token launch and airdrop earlier this month. Telegram and the TON ecosystem have an incredible distribution network of over 1Bn users (with $NOT reporting over 35M players), making it easy to see how a project within this ecosystem can potentially do very well.” Since then, both coins have had outstanding weeks, with $NOT up over 150% and $PEOPLE up nearly 50%.

https://members.delphidigital.io/reports/market-musings-april-showers-bring-may-flowers (2024-06-03)

We have also seen $NOT, a telegram based clicker game perform quite well over the last week amid increasing interest due to the token launch & airdrop earlier this month. Telegram and the TON ecosystem have an incredible distribution network to nearly 1Bn users (with $NOT reporting over 35M players). Given this, it is not hard to see how a project within this ecosystem can potentially do very well. As Kevin Kelly likes to say, distribution is king.

https://messari.io/report/ecosystem-brief-the-continued-growth-of-ton-and-liquid-staking (2023-09-25)

💍 ONE Bot on Telegram for ALL Your AI (Wishes) 🧚

Can you access ALL possible AI models, agents, characters, services… as ONE bot in a harmonious interface that already has 1 billion users? How about Pay-per-Use rather than $20 monthly subscriptions for each of the hundreds of automation, intelligence, personalization… yet to come?

https://stse.substack.com/p/social-agi-in-harmony-but-bitcoin (2024-02-25)

We launched Telegram harmony1bot with 100 AI models in 2023 Q3, and $HUMAN on h.country with #hash^powers and /slash~links in 2024 Q1.

Our GOAL is to enable financial transactions and autonomous economy among “small social groups”. Our products are Telegram Bot or Farcaster Frame with an embedded, non-custodial wallet per each Telegram group.

Are there new Bot APIs or enhanced features for supporting client-side states per Telegram groups? Let’s study technical architecture and product design of Unibot, Telefrens, BookieBet, Boxbet, Banabot. Which of these bots are open source, which non-custodial, and which with most tractions?

Seamless interactions with Telegram’s native TON Wallet (with fiat gateways to Bitcoin) – and Apple Pay on its iOS clients as well as our own forked deploy.

https://members.delphidigital.io/reports/the-year-ahead-for-defi-2024 (2023-12-21)

Telegram bots, such as Unibot, BookieBet, and Boxbet, have provided a makeshift mobile experience that was previously lacking. Telegram bots peaked at 35% of Azuro daily volume, settling around 15%. Their arrival marks a turning point in Azuro’s growth trend, suggesting a truly complete mobile experience would be a powerful catalyst.

Account abstraction, TG bots, PWAs, infrastructure improvements, alternative blockchains like Solana, etc should allow DEX UX to approach that of CEXs over the next few years.

https://www.coingecko.com/en/categories/telegram_apps

Telegram Bots Take On-Chain Trading by Storm. In last month’s report – Catalysts Stacking Up – Will Narratives Drive Fundamentals? – we discussed some of the “lightweight” narratives that were gaining popularity. This month, we wanted to highlight one of the more exciting trends we’ve been tracking –one that exemplifies what’s possible when early product-market fit, organic usage, and favorable token incentives come together – the rise of chat trading bots.

In recent months, Telegram bots have been all the rage. For the uninitiated, these bots are often run via applications like Telegram or Discord and allow users to quickly transact on DEXs, spin up wallets, snipe contracts, farm airdrops, and much more. Unibot is one of the most popular Telegram bots and is ”focused on bringing the fastest and easiest to use trading tools and snipers to investors.” Over the last few months, these bots have quickly become a more favored and interesting way for people to interact with the on-chain Ethereum casino, and for a pretty good reason.

Ghosts of Cycle Past — The Early Innings of a New Cycle? … the similarity of crypto cycles, Solana’s growing mindshare in markets, the Telegram bot meta (implying higher risk-taking appetite), and macro factors playing in the industry’s favor.

https://members.delphidigital.io/reports/the-delegated-authorization-network-trust-minimization-in-the-age-of-ai (2024-07-02)

From account abstraction to the recent buzz around chain abstraction, builders en masse have recognized the need to present alternate UX options. The most recent and notable example of the desire for revamped UX is the Telegram bot meta.

It’s clear that even the most seasoned on-chain veteran is looking for ways to simplify this convoluted experience. In the case of Telegram bots, they are even willing to compromise on security to achieve this. This trend cannot be ignored, and justifies the search for newer UX models that make good on existing compromises.

Telegram sniping bots and copy trading bots are examples of more primitive agents that offer no significant edge other than simplifying UX and perhaps reducing the amount of time taken to construct, submit, and finalize a transaction. But there are only certain things you can do with these retail bots that exist today – mainly token swaps.

https://www.lesswrong.com/posts/sLpX8C2rrxquksGxE/status-as-a-service-done-quick

"Being famous is just like being in high school. But, I'm not interested in being the cheerleader. I'm not interested in being Gwen Stefani. She's the cheerleader, and I'm out in the smoker shed."

https://okxventures.medium.com/a-deep-dive-into-the-ton-the-open-network-ecosystem-34376fdd6082 (2023-11-27)

Tact incorporates a strong type system, gas control, and zero-overhead type composition, enabling developers to build complex smart contract systems with verified execution costs. Notable features of Tact include its actor-oriented design, which aligns with the TON actor model, and its gas control mechanisms that ensure safe cross-contract messaging and precise gas commitments.

TON Space. Self-hosted wallet in Telegram: the user keeps their private key, and all smart contracts can be invoked; Release time: September 2023. Usability: Currently in beta, it can be activated in the wallet in the personal account, and only has basic payment and collection functions. In the future, TON Space will act as a blockchain account, fully supporting the TON ecosystem including Toncoin, Jettons, and Collectibles.

Lending Platforms: Presently, there are only two usable pledge platforms (TonStake and Whales Pool) in the TON ecosystem.

Social relations: TON can leverage a social graph protocol based on TNS (TON Naming System) to enhance social interactions. Combining social and trading elements within gaming environments can create engaging social/trade markets. Additionally, providing a sharing and invitation platform can encourage user participation and network expansion.

🤖 Telegram bots & clients: 🛡️ Self-custody wallets & 👨👩👧👦 Multi-signature transactions

How to use Telegram as your ❤️🔥 hot wallet for signing Harmony transactions? Keep your private keys strictly 🛡️ on device – rather than on any bot server or even Telegram itself. How to extend the custody and the approval of Web3 & AI assets and governance to a 👨👩👧👦 social group as simply a multi-people chats?

https://stse.substack.com/p/minimal-on-chain-moc-solvers-quest (2024-01-17)

Social Lottery on Telegram. Rewards are based on levels of “Online Users” in Telegram chat. Like treasury hunts on anotherworld.gg (9.country). Add @harmony1bot. Snapshot “online users” per hour.

Lotteries, raffles, sweepstakes.. are token games with blockchain randomness. Social rewards from Telegram bots, Twitter promotions, .country domains!

https://members.delphidigital.io/feed/cryptos-killer-use-case (2024-05-24)

And of course we’ve seen early instantiations of this thesis through Telegram Bots such as Banana Gun, Maestro and BonkBot which have cumulatively processed nearly $15B in volume to date.

2. NFT Trading Bot (New Product). The recent success of Unibot for on-chain trading of low-cap altcoins highlights the power of simplifying the trading process. It bypasses common obstacles of using MetaMask: slippage, gas fees, sandwich attacks, and more. A Telegram or Discord NFT trading bot could direct users to Blur’s marketplace aggregator.

Incorporating Blur’s existing analytics infrastructure could make its trading bot top of its class. By charging a transaction fee similar to Unibot, this bot could generate substantial revenue — Unibot generated $10M in fees over 3 months. The simplification of the trading process reduces barriers to entry and facilitates more frequent trading, and hence volume.

https://members.delphidigital.io/reports/the-real-merge#random-walks-down-determined-paths-3929 (2024-02-20)

Dialect is also an agent. Dialect is a Solana-based Telegram bot that lets users interact with crypto using natural language. Users can buy, sell, swap, or ask for price data, and the Dialect bot will execute those requests.

The Dialect bot is still primitive. If prompted to “buy $10 of $WIF” it will respond with a transaction to swap $10 worth of SOL → WIF, which is not what we wanted. Generic user commands — buy, sell, swap — are still hardcodes on the backend to save on inference costs. If a message doesn’t match a hardcode, it’s sent to chatGPT to figure out what to do.

The recent success of Unibot for on-chain trading of low-cap altcoins highlights the power of simplifying the trading process. It bypasses common obstacles of using MetaMask: slippage, gas fees, sandwich attacks, and more.

A Telegram or Discord NFT trading bot could direct users to Blur’s marketplace aggregator. Incorporating Blur’s existing analytics infrastructure could make its trading bot top of its class. By charging a transaction fee similar to Unibot, this bot could generate substantial revenue — Unibot generated $10M in fees over 3 months. The simplification of the trading process reduces barriers to entry and facilitates more frequent trading, and hence volume.

https://members.delphidigital.io/feed/more-than-just-governance-unpacking-value-accrual-mechanisms-executive-summary (2023-10-26)

Tax-tokens impose a tax on any trades/swaps on the project’s token. It’s at the project’s discretion to determine how the tax earned is distributed and utilized. Unibot has amassed 9.18K ETH worth of revenue, of which a significant 7.3K ETH can be traced back to taxes.

Tax tokens haven’t proved ideal for value accrual towards token holders. An investor would need to realize a gain of +8.7% just to offset these taxes. Nonetheless, tax tokens offer a viable approach to raising capital for projects without external funding. It’s crucial, however, to establish clear upper limits on capital raised this way.

https://members.delphidigital.io/reports/show-me-the-money (2023-07-21)

The category leader is currently Unibot, an on-chain trading tool that you interact with in Telegram. It acts as a user interface towards DEXs, providing users with functionality that they couldn’t access beforehand. Some of the features include limit orders, protection against MEV, copy trading and a new launch screener.

Each transaction done through Unibot can occur up to a 1% fee, with 40% of those transaction fees going to holders of the token. Unibot is also currently rolling out Unibot X, an on-chain terminal that lives in your web browser.

https://github.com/tonkeeper/wallet-api?tab=readme-ov-file#authentication-methods

Maximum security mode: Users who use separate offline devices can sign their transactions using a QR code.

The Signer app seamlessly integrates with existing wallets to ensure compatibility. It offers additional security by encrypting user keys without overcomplicating crypto transactions while keeping keys accessible to users via a password. With Signer, users can approve transactions using QR codes or by pairing them with the Tonkeeper app, all while keeping their private keys offline. It's a great option for security-conscious Tonkeeper power users.

https://cryptohayes.substack.com/p/airhead

Airheads is the first Ordinals collection to use a leaderboard system where your wallet size determines your tier. Unlike other collections with random attributes, Airheads have a clear hierarchy. This approach leverages recursive inscriptions to push the boundaries of what a collection item can represent, making Airheads the only collection genuinely designed for those who invested early and took the most risk.

Airheads are unique Bitcoin Ordinals designed to showcase and flex your wealth. Each Airhead is an inflatable, balloon-like character generated using recursive art to visually represent the size and value of your digital portfolio at the point of mint. With 10,000 Airheads available, these characters use sequential ranking and tier differentiation to reflect asset weightings according to the leaderboard, making them a fun and competitive way to display your wealth.

https://messari.io/project/notcoin/news

https://messari.io/project/hamster-kombat/news