🧩 Minimal-on-Chain (MoC) Solvers: Quest Lotteries 🎰, Flip Bridges 🌉, Social Wallets 👛

Use calldata inscriptions as contract parameters and .country top domains as service staking. Simply substitute all variables and shortcut all logics from a program template – like a whole-program-optimization or partial evaluation in compilers.

No transaction indexing, web frontend, contract signing, wallet support. No upgradable contract, security council, governance tokens, emergency votes.

Harmony is bringing “ONE Finality” with data sharding for 2024. Via calldata inscriptions and embedded wallets, users can manage token portfolios and web domains and AI bots without smart contracts. Imagine bridging native assets such as USDC for $0.05 in seconds, or rebalancing portfolio assets across chains, or auction content on top .country domains, or share restaurant recommendations with generative models – ALL onchain with ONE tokens!

Our mission is “to scale trust and create a radically fair economy”. Harmony’s driving toward 1-second, single-block finality. Our Shard 1 with low fees and high data availability is perfect for gaming or AI or social applications. With community tokens, multisig tools, game templates, Telegram bots, mobile apps – let’s help every ONE create in Harmony!

For example, how to secure tokens for recurring transactions against key loss? First, send $100k tokens to the contract’s custody address to initialize. Second, either of predefined wallets A or B can send some token to the contract’s reload address to trigger sending $100 to a predefined hot wallet C.

Inscribe to be on i.country, and come test usdc.country and usdt.country! See Harmony 2024 Roadmap and join our ETH Denver’s events.

Telegram Lottery & More Minimal Services

Social Lottery on Telegram. Rewards are based on levels of “Online Users” in Telegram chat. Like treasury hunts on anotherworld.gg (9.country). Add @harmony1bot. Snapshot “online users” per hour.

Spreadsheet for AI store. 10 million rows of restaurant ratings as inscriptions for generative agents on Telegram 1bot.

Minimal Quest Lottery

Send an inscription transaction with your favorite tweet to the lottery address 0x3abf101D3C31Aec5489C78E8efc86CaA3DF7B053. A daily winner gets 1000 ONE tokens and 100 HOG tokens as of Jan 18th, 2024.

The winner is the latest transaction with the closest ending 2 digits to the starting inscription transaction that announces the daily prize amount. Your tweets will be displayed on the premium 2-letter .country domains.

For example, if the starting transaction id is 0x…aa, the latest inscription at ab.country wins over that at f5.country – assuming no inscription at aa.country and because the hexdecimals 0xab - 0xaa = 1 is smaller than 0xf5 - 0xaa = 75.

The daily prize amount and the participating transactions are on the explorer page for the lottery address. Later, i.countrywill host a leaderboard and special announcements for side quests.

Lotteries, raffles, sweepstakes.. are token games with blockchain randomness. Social rewards from Telegram bots, Twitter promotions, .country domains!

Minimal Telegram Wallet

Our goal is to enable financial transactions and autonomous economy among “small social groups”. Our product is a Telegram bot with an embedded, non-custodial wallet per each Telegram group.

The key is to support group actions via in-app messaging and multi-signatures. Emoji reactions for casting votes or even for approving transactions of small amounts. cross-chain portfolio management for project treasury or day traders.

Support our new initiatives such as minimal-on-chain solvers – including flip tokens across networks like bridges, daily lottery for group quests, reoloading external wallets via trancriptions.

Later, support native assets and transactions for major chains Ethereum-compatible (Base, Arbitrium), Bitcoin, Cosmos-compatible (Celestia, Rune), Solana. Also, seamless interactions with Telegram’s native TON Wallet (with fiat gateways to Bitcoin) – and Apple Pay on its iOS clients as well as our own forked deploy.

Telegram bots, such as Unibot, BookieBet, and Boxbet, have provided a makeshift mobile experience that was previously lacking. Telegram bots peaked at 35% of Azuro daily volume, settling around 15%. Their arrival marks a turning point in Azuro’s growth trend, suggesting a truly complete mobile experience would be a powerful catalyst.

Account abstraction, TG bots, PWAs, infrastructure improvements, alternative blockchains like Solana, etc should allow DEX UX to approach that of CEXs over the next few years.

During Unibot and Banabot mania, Telegram bots peaked at 35% of Azuro daily volume. This figure has since settled at ~15%.

– Delphi Digital on The Year Ahead for Infrastructure 2024

Are there new Bot APIs or enhanced features for supporting client-side states per Telegram groups? Let’s study technical architecture and product design of Unibot, Telefrens, BookieBet, Boxbet, Banabot. Which of these bots are open source, which non-custodial, and which with most tractions?

See our post “🤖 Telegram bots & clients: 🛡️ Self-custody wallets & 👨👩👧👦 Multi-signature transactions“.

Minimal Flip Bridge

Swap native tokens or bridge across networks without signing transactions with smart contracts. Send $ONE tokens to a plain wallet address on usdc.country and receive $USDC. Optionally specify a target network and a wallet address one/0x… in the transaction field calldata to bridge. Support the top 1000 networks and assets via auctioned domain names such as btc.country and eth.country.

Easy onboarding with any wallets to acquire any native tokens. Eliminate security risks with smart contracts, transaction signing, frontend deploys, bridge custody, asset whitelists, or miner extractions. Like Over-The-Counter (OTC) services but via inscription, or intent-based protocols like Uniswap X, Anoma, Chainflip, Across.

Flip native tokens across networks in 4 seconds & $0.05 fee? For example, the website usdc.country is a minimal page that reads:

We as the usdc.country operator hold the wallet labelled “ted” for the two networks with the same address: the first wallet ted:one with $ONE tokens on Harmony ONE network, while the second wallet ted:base with $USDC tokens on Coinbase BASE network.

For example, a user Alice sends $10 in $USDC tokens on Base from her wallet alice:base to our wallet ted:base. Off chain, our backend tracks all transfer transactions toward our wallet on Base. At the conversative pricing (using the high price of the last hour on Binance) of $0.100, as an illustration, we send 100 ONE 0.00%↑ tokens on Harmony from our wallet ted:one to her wallet alice:one.

In reverse, for example, a user Bob sends 100 $ONE tokens on Harmony from his wallet bob:one to our wallet ted:one. Off chain, our backend tracks all transfer transactions toward our wallet on Harmony. At the conversative pricing (using the low price of the last hour on Binance) of $0.995, as an illustration, we send $99.5 in $USDC tokens on Base from our wallet ted:base to his wallet bob:base.

On the main webpage, the latest high price is next to the ted:base wallet address and the latest low price is next to the ted:one wallet address. Anyone can verify the past transactions of usdc.country on Harmony’s block explorer and Base’s block explorer.

Both Harmony and Base networks produce blocks every two seconds. Sending ERC-20 or HRC-20 coins costs less than $0.01 on Harmony and, most recently, about $0.05 on Base. In total, bridging native tokens $USDC on Base to and from ONE on Harmony can be as fast as four seconds and as cheap as $0.06.

We as the usdc.country operator is staking 100,000 $ONE tokens as the bond for good service under a 2-out-of-3 multisig wallet with .country governors. Users may dispute bad pricing or lost transactions within our service guideline and our bond amount. To provide sufficient liquidity on both sides, we regularly rebalance the assets on the wallets ted:one and ted:base via centralized exchanges.

We cover the cost of backend infrastructure, exchange operations, and governance engagement. We make money from the price difference of bridging the two tokens and from rebalancing the two wallets. We lease the premium domain usdc.country for trust and branding from monthly open auctions.

Minimal Social Wallets

How to secure tokens for recurring wallet transactions against key loss or guardian theft? Have a hot wallet with a capped amount, then reload from a social wallet guarded by 2 or more operators. How to make the social reloading as simple as a send transaction? Have a minimal smart contract (almost dumb!) for the single purpose of token custody and social reload. Similar to multisig smart wallets like Gnosis Safe and Argent, but only a few lines of code fully instantiated with predefined transfer amounts and operator addresses.

contract SocialWallet {

receive() external payable {

if (msg.sender == 0x..aa || msg.sender == 0x..bb)

payable(owner).transfer(100 ether); }}No need for transaction indexing or web frontend needed. No need for contract signing or wallet support. No upgradable contracts, security councils, governance tokens, or emergency votes. Simply substitute all variables and shortcut all logics from a program template – like a whole-program-optimization or partial evaluation in compilers.

The absolutely bare example is securing against key loss with two social wallets, that is, a 1-of-2 multisig safe but minimal onchain. First, anyone can send $100k ONE tokens to the contract’s custody address to initialize. Second, either of predefined wallets A or B can send 0 ONE token to the contract’s reload address to trigger sending $100 ONE to a predefined hot wallet C. Third, optionally, either can send a token to the contract’s recovery address to trigger sending all remaining tokens to the other operator.

Let a smart contract access the calldata field of a simple send transaction as a parameter for dynamic customization. Inscription games begin.

Questions & Reference

Which ordinal or inscription projects support minimal-on-chain services – such as intent-based protocols like Uniswap X, Anoma or Chainflip?

“Now that you could write smart contracts on Bitcoin, it turned out that building an AMM DEX was very simple. It took us just a couple of days.” A month after deploying Uniswap on Bitcoin, Punk 3700 connected it to Ethereum layer-2 network Optimism and says it can trade with two-second latency and low transaction fees.

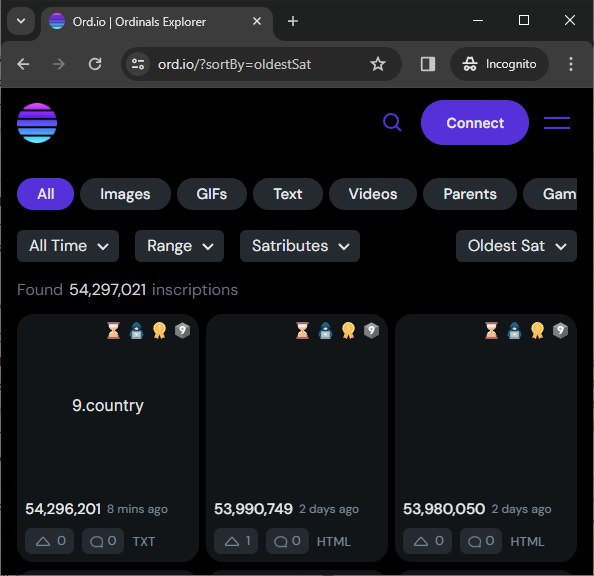

Leonidas, the founder of Ordinals marketplace Ord.io, is very excited about the new Web3 experiments on the Bitcoin layer 1 as well. He believes that “the release of the Ordinals protocol earlier this year ended a long period of stagnation” for the chain. He’s seeing a whole new wave of developers flood into the Bitcoin ecosystem, who are “eager to build everything from NFT marketplaces to DeFi protocols.”

”People won’t believe it when it’s presented to them now. It’s not going to operate exactly like Uniswap, but other high-value digital assets will emerge on Bitcoin. That’s what Ordinals and recursive inscriptions will evolve into. They will become a new form of programmable assets and code.”

– @maxparasol at Cointelegram on DeFi, Dex, AMM, Uniswap with @punk3700, @huuep, @CarloFoxXYZ, @tobynovum, @LeonidasNFT

What licenses does US-based entity Uniswap Labs operate under for Uniswap X?

Following the announcement of Uniswap V4, Uniswap Labs announced a 0.15% fee on transactions made on its Uniswap Labs-owned web UI and Wallet. The company is now making $1 million per month in front-end fees, as the new fee structure sits atop what the underlying protocol charges users on behalf of its liquidity providers. This looks like a double dip, and I hate the optics, as does Haseeb. (Messari)

Delphi Digital on The Future of On-Chain Liquidity

Existing RFQs such as 0x, CowSwap do not appear to be having this negative affect on LPs, routing roughly 80% of order flow to DEXs. UniswapX is more centralized and its existing user base dwarfs that of current RFQs, but this is a noteworthy point nevertheless.