TGI-3: 🔠 Social Capital, 💯 Top 100 Coins & 🐜 Economic Termites

Zi and Stephen are hosting again! TGI-3(sum): 3 hours of 3 friends over 3 beer 🍻. Infinite sum of timeless friendship and harmonic hearts. “Forever dinner party” as 不散的筵席.

Here are our 2-hour recordings on Twitter Space and YouTube Live.

⏳Zi: Social Capital in the Creation of Human Capital

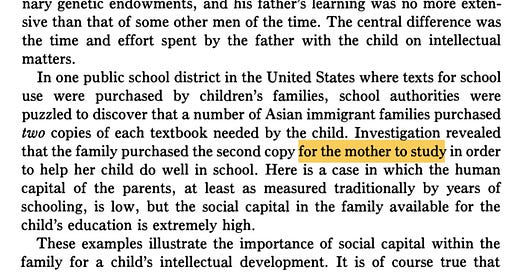

Social Capital in the Creation of Human Capital," James S. Coleman illuminates the power of social capital, a multifaceted yet undervalued asset that shapes education and human development. Coleman categorizes capital into three distinct types: physical, human, and social. He points to social capital as being intricately woven into societal relationships and structures, underscoring its role in guiding both individual and collective actions.

Coleman's unique perspective reveals social capital as a kaleidoscope of obligations, norms, and authority relationships. Unlike physical or human capital, it's not bound by the confines of the tangible or the individual. Instead, it thrives in the connections between people, serving as the bedrock of societal organization.

修身 > 齊家 > 治國 > 平天下 – 欲修其身者,先正其心... 欲誠其意者,先致其知,致知在格物。

通過明確自己的信念和目標,來讓自己頭腦清醒,是非曲直分明。正念分明後就要努力在待人處事的各方面做到真誠二字,努力斷惡修善,久而久之自己的修養就起來了,有智慧了。這時就可以幫助大宗把采邑經營好了。家是諸侯國的縮影,把自己的家經營好了的人也一定可以把國治理好。一個能把自己國治理好的人,那麼他也一定能協助天子讓世界充滿和諧,天下太平。

🍻 TGI-3(sum): ⏳ Generational Wealth & ❤️🔥 Perpetual Governance

Zi and Stephen are hosting again! TGI-3(sum): 3 hours of 3 friends over 3 beer 🍻. Infinite sum of timeless friendship and harmonic hearts. “Forever dinner party”: good friends and conversation happening in perpetuity. 不散的筵席. Gardener, not carpenter : a strong and fair central leader who sets the tone and enforces the rules. At any given moment, this per…

❤️🔥 Stephen: Top 100 Coins vs Economic Termites

Robinhood’s 2024 roadmap: Winning “Active Trader” market with options, futures, and crypto. 23.9M funded customers, 1.68M gold subscribers ($5 per month), $130B assets under custody, $11.2 billions net deposits. Annualized revenue per employee was $1.1 million in Q1, up 47% year-over-year, with 2,228 employees.

We exclude tokens for wrapped assets, plain forks, community memes, inactive teams, enterprise sales, social games, governance votes, and open AI.

BTC (store of value), ETH (secure settlement), SOL (fast messaging)

TON (mobile consumers), NEAR (account sharding), ARB (fraud proofs), OP (rollup kits)

TIA (data availability), GRT (open indexing), AR (permanent storage), PYTH (pull oracle), W (cross bridges)

MKR (algorithmic stablecoins), AAVE (liquidity lending), JUP (meme launchpad), DYDX (perpetual exchange)

APT (dependency language), SUI (Silicon Valley), FTM (sustainable fees), STRK (cryptography research), THOR (Bitcoin ecosystem), SEI (low latency)

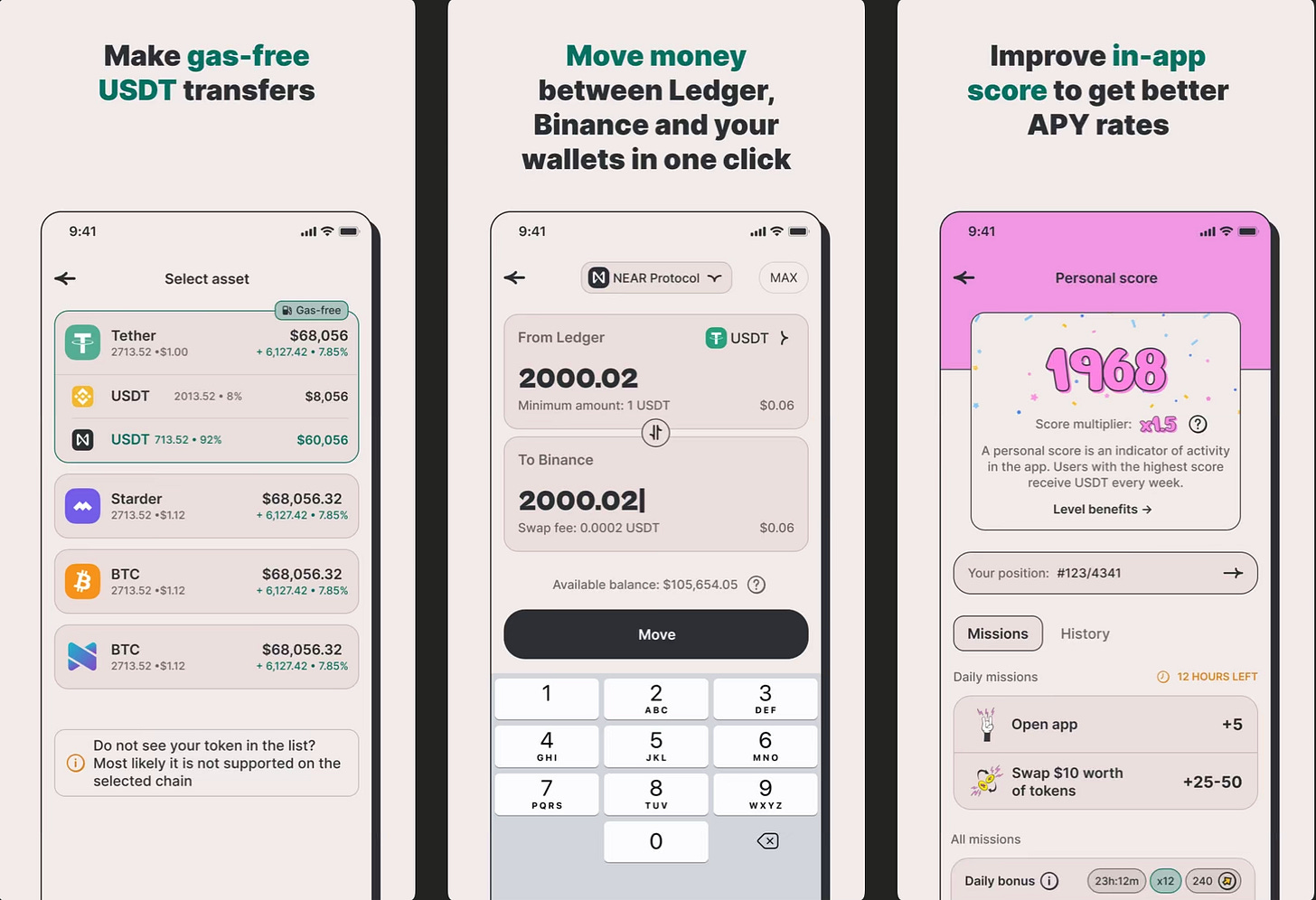

Memecoin trading tools like BonkBot generated tens of millions of dollars in revenue through Telegram’s user interface. TON-based applications, such as StormTrade, now enable users to trade perpetuals, cryptocurrencies, stocks, and equities using the same interface.

StormTrade facilitates over $10 million in trading volume daily, and we believe that similar TON-native Telegram bots will become the preferred user experience for many traders. With TON’s self-custody wallet, users don’t need to remember their seed phrase; instead, they can simply use Telegram and their email as backup.

– Paul Veradittakit at Pantera: Investing in TON Network

NEAR's Account Aggregation aims “to offer users the ability to transact on any blockchain through a single account and interface with Chain Signatures, enabling NEAR network to have [Multi Party Computation] MPC nodes that are jointly signing transactions and messages”; and, a Fast Finality Layer for Ethereum Layer 2s, reducing transaction times from the current minutes or hours to just three-to-four seconds, while also decreasing transaction costs by a factor of 4,000.

Messari’s Narrative Games: Part 1 writes “Ethena or MakerDAO likely to be the source of the next meta... [but] Pendle's future yield speculation and Morpho and Gearbox's leveraged farming have reduced the room for new innovations... an opportunity must offer yields significantly above market rates (15-20%) and support large capital pools (upwards of $1 billion) [such as] liquidity mining incentives during the 2020 DeFi summer, veTokens by Curve, and Anchor’s 20% yield on stablecoins.”

Today, DYDX is an L1 token — used as gas on the dYdXChain and as the asset validators must bond. It is a revenue-positive token, as all fees earned by the network go to validators. dYdX v3 was a revenue-positive application, but all that revenue went to the dYdX Foundation — so the token was undisturbed.

DYDX’s token economics finally makes sense and has a clear path to sustainable value accrual.”

– Delphi Digital’s The Year Ahead for DeFi 2024

Messari’s Dissecting Derivatives Data writes on dydx v4: all revenue generated by the protocol accrues to the tokenholders either through staking rewards or, optionally, to the community treasury to fund future growth.

DYDX will implicitly benefit from the entire pool of revenue, whether it be as a proxy claim on treasury assets or similar.

It has become common to heavily scrutinize a token for its amount of value accrual. In many cases, it is more accurate to think of the token as exposure to a high growth company that just happens to pay a massive dividend. The situation is much more palatable when considered in the context of Amazon and AT&T stock. For these reasons, 100% of fees as earnings offers a good baseline for evaluating a newly productive DYDX token.

– Delphi Digital’s DYDX Valuation Analysis & DEX Perps Comparison

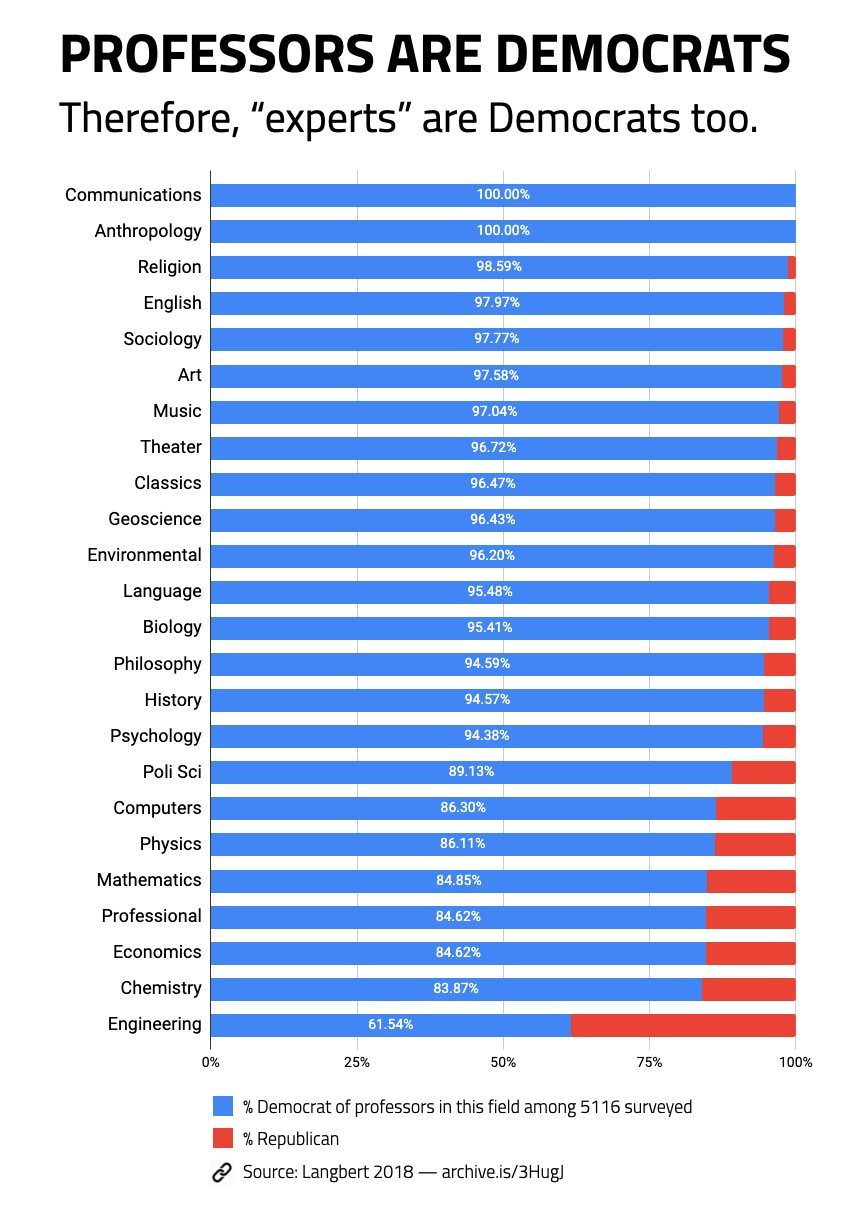

It’s simple: once blues gain total control, they begin funneling tax dollars to Democrat affiliates.

This is how you get a $100B train in California where no train is built but Democrat unions get paid. And this is how the homeless industrial complex makes money, by getting people addicted to drugs and then getting paid by the size of the problem.

This is also how [Black Lives Matter] BLM burned down black businesses while lining blue pockets, and why student loan relief goes to Democrat voters, and in general why so much public money produces so little today in the way of public goods.

– Balaji: California is not a democracy. It’s a one-party state.

“Verisign: The Most Profitable Company. Verisign has hiked prices every year, up to the maximum set by the government – until Trump removed the price cap altogether in 2018.

Today, Verisign is the single most profitable company in the stock market, a great example of an economic termite. In 2013, its operating margins were 54.7%, by 2023 they grew to a crazy 67.1%. Verisign doesn’t invest this money; in 2023, it spent $882 million of it on stock buybacks.

– Economic Termites Are Everywhere: instances of monopolization big enough to make investors a huge amount of money, but not noticeable. #1country

[Stephen] Okay. Uh let's not do intro of the bio as we always do but just like we're going to talk today. So I'm gonna give one minute contacts up. I can jump into your thing because yours is much more structure coherent. Now, jump back to the top 100 thing. Okay, so, welcome everyone. Uh, I think today, we want to bring back the Silicon Valley culture, if not the whole teacher of Google. Why Harmony antennas started to really, really have the best ideas over some beer over someone We didn't have any guests today but two of us as we always have been to dive very, very deeply. So today's topic is about social capital human capital, how to think about the Next Generation. Finance and for harmony. And for myself, I really don't think talk about today. The top 100 calls what I think of them. What the economic term rights. Is how I'm thinking of the Perpetual of the finance Market. But for that, I think you are way more prepared to really come up with a great presentation as a page. So, go ahead. Yeah. So, let

[Zi] Me just up here. One little thing. Why we're doing this. I think it's because we're gonna hopefully we're gonna increase our number of audience. Um, Think women, especially Stephen you've been hosting this for Probably for a better part of like, six plus years now, right? And I like to always quote, like famous on writers, or John, you know, for today, I think the the most apropos from John Lennon. Interesting stuff. The most interesting ideas in life happen to be written in between the margins, right? And the most exciting moments are usually when you're unplanned. And I think TGI for the better Pro 76 plus years is actually probably one of those instances if you think about it, whether it being Harmony Here, Solana. Believe it or not. Before they went big. Uh, Once Upon a Time, was actually a regular Gathering. Every Thursday we used to host, says in Sunnyvale, back in 2017. 2018.

[Stephen] Good. So, this

[Zi] Is kind of like the band getting back together again. Uh, We can catch a lightning in a bottle twice.

[Stephen] Yeah,

[Zi] And for me today, the topic and our central thesis in terms of what's keeping me excited for the past. Uh, a little over a year and a half now which is this concept of social capital. Yep. Is I think it does has a kind of a latent potential to unlock tremendous economic Opportunities. And kind of rewinding a little bit for people who are listening for the first time. By and large. I think we understand the word capital fairly well. Right? Usually, we understand from the Adam Smith days. Welcome a nation. The number one Capital, we're gonna talk about is labor, Capital our human capital, right? The size of the economy. You should try to get on, how big is your population? How many people do you have? Uh, they're highly educated or what is kind of the productive Workforce? Even your unemployment rate is always kind of look at, Pretty gablometer of your human capital. So I think this, the research I have done kind of reading have done in the past couple weeks. Basically, what is kind of the correlation or the direct connection between social capital and human capital,

[Stephen] Right? And just

[Zi] Kind of round out, the kind of the even the bigger picture, which is the economic Opportunity. That's all afforded for the, you know, eight billion. Plus people on this planet, usually it is usually predicated of human capital natural Capital, right? Do you have access to certain, you know, exolid minerals, Financial Capital, which is going to talk a little bit more about about Intellectual Capital, which is your IP and social capital is reading more about the relationship. The share resource resources that you have within a network within the community. And to kind of double click a little bit before I pass the mic back to you which is the most Atomic unit of social capital. Is. The family unit that you have. If you think about it, everyone has some unit of social capital. Some small portion of it. You're born with it. Meaning, you're born into a family. Let's say you have two loving parents who are really are informed who are really kind of caring about your upbringing. Providing the necessary resources. And then, you know, we kind of go up, you know, as you go to school, as you go to work, that's social capital will continue to accrue and get bigger, uh, case in point, just kind of really rounded out this idea. Your social capital, usually shows your family and then once you get to school, you have your network of students Facebook being a really good example, right? You can build a whole social network based on social capital LinkedIn, is another really good example. You can build a whole large scale platform based on your co-workers. Yeah.

[Stephen] Right. And then

[Zi] There are kind of a smaller Niche segments, basically, on mutual interests, say, you're on GitHub or YouTube or Twitter, you have a similar interest card. Tiktok these are kind of really kind of the large scale. That has been kind of playing right in front of our eyes for the past 20 years. And that's kind of the connection. I want to make today, social capital leads to human capital and human capital can actually be predicated on social capital.

[Stephen] Right? So

[Zi] Passive mic back to you.

[Stephen] Yep,

[Zi] I'm just checking

[Stephen] In my, um, so I want to ask one question. I want to touch a little bit about what myself is going to talk about today. So that my our audience know that they'll be quite like two different topics today and um it always has been right. We used to do DJI There were a few times 100 people that to be able to entertain a few ideas in our hair. So that our audience know what's coming or we put out in the blog but also like our Channel today in particular, I know you read quite a few books to come up with this topic, this title, this thesis, this journey of you for the next few years. So I want to just ask one question so that you will hone into that and I'll jump back to the Perpetual how many tie to your Finance idea, but also like, why I top out the top 100 cones today. So the question for you is,

And how would family? Be important part of social finance. Social Capital, human capital, and most of all the Next Generation was, right?

[Zi] I think not to be too philosophical, but I think, you know, all of us are born Capital Rosa, right? Meaning, you don't know what you don't know, right? And at the kind of the earliest age, if you think about it, it will informed family. Usually teach you, not only the value of knowledge, like at formal education, Also going to really teach you. So I don't say the meaning of, um, you know, her work or the meaning of like, what is the value of money? How do you earn money? How do you access kind of a production Capital, right?

[Stephen] These are all kind

[Zi] Of, sort of things that we don't think about. It's always kind of happening, uh, intuitively naturally, but there hasn't been any kind of a formalization. I think, if you think about, like, what differentiate social capital, and let's say, um, Financial Capital, which you can talk a little bit more about those are pretty well. Formulated meaning Financial capital, you can can Relatively easily, but social capital. I think we just kind of take it for granted. It's like oh, it's intangible. We all we always know it's there, right? So I think how and why is basically one? How do you actually capture it? How do you effectively measure it and measure in a way? Not just a kind of a, a one canonical definition. Because even my money, uh, something like meme coin or the Pavlogger tokens. There's actually very different, uh, galvanizing perspective and definition. What defines store value, or what defines, as a kind of a Unit of our measurement, right? So there's these all these are things that opt for debate and up for kind of a public discussion. So the inch is really predominantly say, hey I don't know what, I don't know, in terms of social capital, right? So let's read some books and research but papers in the past, 10 plus years. And how do you actually connect the dots? And I think that's kind of what's most exciting about things. You don't know figuring things out. Okay, right? So do that, we're doing a classroom now,

[Stephen] Sad. So, I definitely want a home in on the family, part about how you structure the entire Finance social, especially with the Next Generation, which completely make sense, but there's no new Thing that I, Thing is amazing that you're building on top of battery for them, right? Oh, let me quickly touch on top uh 100 coins and Perpetual Exchange and Futures, and, and the options so that, like, hopefully there will be some Synergy what we're talking about today. And for the broader audience, understand what Harmony is doing, what my service PC about. This week topping, I particularly picked the top 100 coins. And if you are there, like, interesting reading I saw this week, because We don't everyday talk about what the calm prices, what the market is doing. Where's the macro? Like what are the interesting project is there? Because? So we're just busy very deep being very focused narrow. On the other hand, like, once a quarter, definitely once a year, I pop out two right either, what is going on with the entire industry or marketing? Why are we busy at all? Are we just busy mining coins? Loving coins anymore? Not even liquidity anymore, just points. Or are there really a trend and a traction that? That already happened already really well proofing. So I really quickly put together of the, like 100 list because that's what I really, really do. When I, every time I come back to look at, Look at the. The hundred coins. So that I tell the team, I tell many of the treasury management many of the investment thesis that we must be picking a theme to look at if we invest in on, why are there still value in a few months in a few years are likely for treasury management and for many of us still in the long term long-term investment long-term building towards to convalue is what the value? That we're here.

[Zi] Yeah. So

[Stephen] I identify all of the 50 by To we search down row by row with some of my teams, some of my friends like what are still the like thesis that I myself at least can form towards the top 100 coins out there but also like what can they will learn. So it's

[Zi] Very easy

[Stephen] To just invest in my points and Minds value like mindlessly. But I want that to definitely inform my investment in church like uh like SS but also myself Learning for harmony to the building to capture the value. But also myself really believing that web3 blockchain which will have MX5, can your style and but myself understand that while these have been a proven narrative, what we're learning from it. The good thing is we quickly already excluded many things that myself won't be talking about myself, won't be invested meme coins. Project Enterprise sales and I'm very happy to answer it. If you're interested, just you, why I'm not locking on those right in particular even the school. Games entertainment. And even though even strictly shows, show games, right?

[Zi] Some

[Stephen] Of the pure governance talking. I even exclude AI tokens. So there are quite a few things I exclude already.

[Zi] So let me just kind of unpack it a little bit like the cover part a lot, right? By the way, a little side note. Uh, you reading like having a less than 100 tokens or 250. It kind of brings me back to 2017 and 2018.

[Stephen] It

[Zi] Was giant. I was bullish enough. You had a warm the ambition back in uh, 27 years. Hey let's read the top 100.

[Stephen] Yep,

[Zi] White papers. Wow. You know what? That was actually a valuable lesson, learned. What I was reading. Uh, Steven's actually, you know what, the best way to learn. The best way to get better at something, is actually just doing it. So instead of I think you're probably right, like maybe I would say probably less than five white papers and you just dropped it on your own right? And I was busy having the in the Batcave reading but going back to the kind of mean topic, right? I think, So you kind of really fortify what you're saying, is this number one, I think just kind of listening out the top 100 and really extracting the quintessential, the Core Essence. What each token represent? What is it kind of the simplest way to describe or cultivating, a narrative that describe that, maybe cover, 70 80 percent of the value, or the heal of the token. I think that has not been talked about quite a while, right? Because I think Or more than you know close. You know we're clocking around like 16 plus years now. I think you know the things has constantly evolved, but the things that you're evolving is basically, actually there is a center of gravity. Now for example, just kind of a giving yourself a little layup. Yeah. Let

[Stephen] Me just name

[Zi] The top five

[Stephen] Bitcoin. What

[Zi] Is the kind of the core narrative for Bitcoin?

[Stephen] Now I roll straw

[Zi] Valley store value. Why is that

[Stephen] Okay? They're multiple, right? And I just need two, three words to capture for the top 100 and everything can be proven. And pick only after this could be amazing, that Bitcoin is sticking as well. I'll say even payment can work one day. Definitely not some of the the earlier lightening and section oh yeah but small value in comparison to the 100. If not ten thousand next coins is the easiest way to article everywhere. Y b b. You occur an ultrasound money behumatical but a store value of doing nothing else quite immutable by now, like strawberry is migrated 100, agree

[Zi] With that and just double click on that idea a little bit. Um, the reason success of the Bitcoin ETF is a really,

[Stephen] Is

[Zi] It really kind of a galvanizing barometer of this meaning. Just a little fun fact why I think Bitcoin ETF for the BlackRock one just past 20 billion dollars as under management which is already way ahead. You know, the most optimistic projection. Yeah. Five

[Stephen] Percent

[Zi] Of right. And it has already uh, way surpassed uh, go ETF. That's the fastest growing form of ETF. There's

[Stephen] No one wanted is catching

[Zi] Up the rate of growth

[Stephen] That's ETF. Right. But go as a classes still come true,

[Zi] Be patient, be patient. It's not average. It's only been like less than a year, right? It's only six months, right? So, so that's a no longer a controversial statement. Yeah. Right. And I think that's kind of really, if you don't believe in Bitcoin, uh, let's say 10 years ago ago, Every major institution around the world is pouring, their kind of a asset under this particular asset class. Right? Well, that's what

[Stephen] I can say after a class. That's why Vanguard CEO is replaced, right? There

[Zi] You go. And then the next one, which is kind of a Is a shiny example of like, the another Beacon on top of the hill, which is our e, right? What is the kind of the core narrative for Eve, right,

[Stephen] I roll secure settlement. Okay, there are many. Things are innovated the last 10 years for him but then it will become well. That'd be interesting writing an investment thesis like, what I'm gonna learn how the narrative here is. Why am I going to learn that? I won't be wrong in a year. If I'm serious, right? So secure settlement, for many of the layer 2, secure settlement of executional And again, in comparison to every other like 100 things, right? Right? So that's going to be like, how I would say it to like, five years, five years from now, or like to tell my dad and to tell anyone that a few years. If you see me again, visit Jesus Christ, I'm

[Zi] Gonna scratch here, uh, because I didn't see Steven always loved to nerd out on the technical side, right? I think this narrative about secure settlement and consensus. You forgot to word, one of your probably top 10 favorite words, consensus. Should break it down a little bit in terms like layer, one, layer, two, and even like the kind of like layer three, right for us, um, because you're gonna break it down at a kind of a broad level right in terms like how this actually shaping up given that you talked about secure, and so

[Stephen] Yeah, so when you theme started, it will never have talked about it. The way that side channels and payment channels, and maybe the whole, uh, Cosma. Um, Even like six years ago, where Harmony Charter, the only story is discovery through shorter. No understand why daily Community. The way that to me should actually start where we even make sense. If necessary. And by now to think about layers, now everyone understandable like there are many ways to structure and do the whole parallel evm and scalability, but like if you couldn't mortalize, it layer ahead, you you will never understand how you can actually roll out on the Stick on the Fly, but now that you film can do layer by layer on the Fly. It's the most amazing thing, right? That's why when you say layer three it totally makes sense. Right, it started with Warfare that you can execute General Turing. Complete virtual machine, virtual bike hole that you can do any general competition execution. But now that execution is used to do secure settlement verification. Yeah, rather than just like I am doing a contract increment for your likes and your social social Now, you can really do like, other way to do proposals is your nice rules, so your knowledge booth generation. Now layer 3 then you don't need to care about how often, how you, how you do like even distributed in the same time read, uh, availability rather than just the data. Yeah. And

[Zi] I think just kind of really highlighting this point and I think there's actually a probably another topic that we should talk about. And maybe next time we'll invite Harmony RJ. Oh Nick. Why? Um, RJ. Actually, those completely against, I know, uh, I thought it's for just 10 minutes from here. Yeah, 10 minutes from now. Uh, but RJ was actually he's probably the most humble person but there was one moment in time. So I remember four years ago back in the Cupertino office, he said they're roughly only 200 people on the world around in the world.

[Stephen] Yeah. That

[Zi] Understand consensus for

[Stephen] Sure. And

[Zi] I'm one of them.

[Stephen] Yeah, he's definitely leading one, right? So maybe

[Zi] Rj will join us next time. Cheers to that. That's a call for watching. That's a call for Touch

[Stephen] On one more project. Yeah. So they can tie it back to your

So unless how many and even three hours when we finish off them, but I want to touch on one special Not because it's Perpetual it's something. I'm looking at something. I'm building something that I spend like 10 hours every day. They're thinking about is because there's a token value change. That have just happened. It'll be happening in the next few years that we all must or like, um, like talk about. Yeah. And that is back to why they took him as value and why we need to think about. Like when we talk about social capital, it's not just about how they were again, just to like, uh, like Point uh, like like hunting. This time was just a couple minutes time. You are this for longest time. Was a centralized cooperation to help the best way to do like, decentralized, professional Exchange but then talking this out and the Like to Value a curl

[Zi] Itself is not decentralized, do you mind just connecting that does a little bit because last week We talked briefly about how synthetic and financial instruments really truly unlock. Literally hundreds of billions if not showing that worth of financial opportunities and economic growth, right? And These are our synthetic instruments are usually called derivatives if you have any if you take it like Finance 101 or Eco one-on-one. Yeah you understand you usually talk about that as derivatives. Yeah. And

[Stephen] For

[Zi] Anyone who's taking calculus Derivative usually is expressed a d y DX. That's why Steve and I we last week out hey that was a brilliant of marketing, right? It's a really good term but you want to just kind of quickly explain what is dydx just for people who are listening? He's like, hey, they may not understand exactly what it is. Yeah.

[Stephen] On top about like the entire category of D5, right? Think about it, right? We know for a fact that now, it's proven, it's not just about a white paper or narrative, like, you can give the label a narrative to anything after any Trend but but Do we understand what happened? What have the entire T5? And I would say cryptography. Right now we understand how to have consensus so we can have open protocols that have a virtual validators and policies. We also know that by the time you can have Execution that you can upgrade mixing before you have satellites. You have many verifications based layers review and Harmony and fast and all that. But then the next one is really think about. Wow, we can actually have a market maker that can settle on the constant function constant plotter as a market making function to determine the price. Now you finally have a market, the simplest Market, you think of right to to side and then you can settle on the middle point which is the constant product of the Google. The surface, and the starting point, then it's higher under underlying. It is, I've been talking about spot price. I can swap internal that you can actually do landing. You can do, stable coins, you can do structure product, you can do the synthetic asset, you can do future, and option and all these are called derivatives. I'm not gonna go, we just talk about last way. Uh, Each of the product that would be breed by 10 of them that I can do the next few weeks. But the fact that if you think about you now, first have a token And now there are so many like four Bitcoins that have different tokens and him say no, you can arrest maybe RC20 as you want and uh, lose your thousand by that time. And and and then like activities are not even gonna talk guys, and you can swap it and you have a market that you come on, the prize, you can actually have any Functions and the formula of your value. That is exactly what date is mean. Since I've just talking about one price, one SL Two, participants after buying the seller, you can actually now describe the entire universe. I really was an entry features so

[Zi] Just to again, to right click on this a little bit so we're going to double click um. I think, again, I'm gonna invite, we're gonna invite Lee sometime. Now to this conversation, I know Wong, Lee's favorite, uh, writers on Charlie Monger. The the long time bot that they're Robin to, um, the Warren Buffett's, uh, Batman. Uh, Charlie Monroe, always said, and Warren Buffett also said this, which is Mark is a in the short term is a popularity contest. And the long term is a weighing machine, right? And much of, it's really the weighing machine terms, like determining the price Discovery and open market. Is no longer a facility based on one-to-one transaction, not just barter, right? Hey, five pounds of orange equals equals one pound of Apple, right. That's actually a very rudimentary very analog. We're actually determining the value of a particular unit of um, something of a unit value, right? And derivative synthetic instruments. Like, is actually another way of saying, hey there's actually a secondary and tertiary even like just multiple layers of actually price Discovery mechanism that can be built into it. The reason why I'm bringing this out is because Perpetual is actually taking account, not just on the dimension, dimensionality of like, what can you layer on top of it. There's a Time component. Right? So again, another kind of a layout for you, right? Can you talk about like how Perpetual actually as a Time component? That's kind of a critical way to assess a value to do price Discovery.

[Stephen] I will never come back to us. So let me uh answer that and quickly jump back to Why do ideas as a token? It's interesting. I'm only 1200 and we'll jump back to social file. Yeah. So dyvs as you ask, right? Why is time and Timeless for you? Such an interesting name. You are completely wrong.

[Zi] Yeah,

[Stephen] Spot is exactly that. Right. Exactly that spot you're trying to I don't know, a spot spot jump shot and you two people finish transaction transaction value is over

[Zi] Nothing else,

[Stephen] Right? Yeah. By the time you put in the time element in there, especially Perpetual meaning is never expired. Then things be very interesting, we don't talk about any Natural battle of something, and you can really speculate all the option of anything. You really describe the entire for the velocity and acceleration of the entire, especially in the context, what you

[Zi] Talked about last week which they Perpetual, that does not have a. Compound explorations because historically much of the Wall Street based on Perpetual kind of instruments. It is compound

[Stephen] Because

[Zi] Usually sound like, hey, five years out or three months out, right? But given that nowadays, we'll have a 24 7 virtual machine that runs completely globally distributed, and the code actually never sleeps. It doesn't need to drink. It doesn't need to take July 4th holiday. It doesn't have a Christmas bonus break. You'll just run in perpetuity, that's why well password to work.

[Stephen] About 1200 coins, and divine piece of

[Zi] Particular, the idea,

[Stephen] I mean, there are a lot of like 100 coins that I admire and aspire to, and I knew it was possible, it changed from a value less. Confidence, okay to Value occur in token. That finally, share the revenue. Much like every single NASA, and mssc took us that I think it is. And I'm claiming that every D by OG tokens maker and many of others will go to this part and we all need to think about it. You can talk about thinking about police, it's just a game it's just a way to get people to like come to your chair and create well, and then like go to a journey or you'll come to bring the TV. Like why is it you? And then the next level you have to learn something about when by the end King Kong just one maker. Ask you have to share the reference back to whoever hold the took it and then it will become sustaining. And that's my entire thesis. Yeah, or 2023 actually. But definitely now the thing about how to combat father and token to be single, right? And I want to bring it back now. I, my claim is many of the people I took them that is buying their By single the artworks. I want us to think about how you set about generational wealth, right? If we keep extracting Our current generation in Next Generation before even started. If you mind all the points already, if you give out, like, for your dinner, like what you say, 40 of the urine, what will be the next generation of people coming to sustainable, right? And I don't know whether you can type at the family and tell me how solo Capital will suffer. Yeah, so I think

[Zi] The, the central piece and I'll try to con Shot kind of the core thesis, right? Which is I think you can say, The hope and the optimism, you have for, uh, your the Next Generation. What are your kids or just like random stranger, right? That you hope their future is actually broader than what it was before. I think that's a universal concept right by the way that's actually probably a good really a main test whether if you actually don'

User

[Zi]: This is bizarre, man! These show notes look like JJ's whiteboard after a brainstorming session.

[Stephen]: Hang on, a little closer. Okay, still pretty rough. We've got six minutes... just double-checking if the mic is...

[Zi]: Our standards are Steve Chen's first YouTube video. You know, the founder of YouTube? The one that's like, "going to zero," "going to the zoo"? That's our bar, man. Low expectations, underpromise, overdeliver. That's the audio game. Okay, this sounds decent, actually picking it up nicely. At least we got that going for us.

[Stephen]: I can record. Okay, good. So, this is...

[Zi]: We're getting the transcript, recording... and I'll run the Twitter Space on my end too.

[Stephen]: Nice. If you want to…

[Zi]: I'm telling you, in five years, I'll be catching up to your 20,000 followers.

[Stephen]: You were close, I saw that. If you're going to be on Twitter anyway, you might as well record it.

[Zi]: No need, Twitter Spaces records automatically.

[Stephen]: Right, right. So, why are you…? Do you want to use your phone?

[Zi]: This is already recording.

[Stephen]: I know, but do you want to…

[Zi]: Stream it on there too?

[Stephen]: I thought you said you did. Oh, you are broadcasting. I'm broadcasting already. You're not using your phone to broadcast to your…

[Zi]: Yeah, I can broadcast... okay.

[Stephen]: Oh, I didn't realize. So, you are streaming now, but you're also just…

[Zi]: Participating. We're also posting the Space on our… that's my notification sound.

[Stephen]: Okay, so, just confirming…

[Zi]: Like I said, Steve Chen's first video. Low expectations, remember? Okay, yep, sounds good.

[Stephen]: Alright, 10 people already! We're killing it! Okay, so, like I was saying, low expectations. Same format as always, I don't know, maybe my…

[Zi]: Just add our Twitter handle. It'll be in the live stream.

[Stephen]: Can they see comments? No? Okay, let's disable comments. First time doing this, make sure…

[Zi]: We should've set this up on OnlyFans. One way or another, we're either getting canceled by Silicon Valley or our wives.

[Stephen]: So, I still don't know… Is this your official account?

[Zi]: Yeah.

[Stephen]: Okay, cool. I think it's good to start now.

[Zi]: Whoa, we're popular! 24 and counting! It's the compounding effect! Can I add you or…?

[Stephen]: Yeah, I'll send a request. Okay.

[Zi]: Okay, yeah, the music will stop after this.

[Stephen]: So I can't start now?

[Zi]: You can start. I just requested.

[Stephen]: "Allow to follow…" what am I following?

[Zi]: Yep. Same header, speaker…

[Stephen]: But I'm not adding you as a speaker.

[Zi]: I am a speaker. You muted me?

[Stephen]: Yeah, you should be muted. Okay… I guess this is it. Welcome, everyone. I’m…

[Zi]: Need to add some intro music.

[Stephen]: No music background.

[Zi]: Right, right. Just checking, just checking.

[Stephen]: Alright, let's do this. So, why don’t you…

[Zi]: See, I told you, man! We're going to be doing this more often. If this whole "influencer" thing takes off, we're retiring as founders and just live streaming. Need to add some fun back into our lives after 20 years of software engineering. You know what I mean? Needed a change of pace.

[Stephen]: Okay, let's ease into it. I think we're starting.

[Zi]: Alright, alright.

[Stephen]: Need my milk for this… Why don't you go first? Give us your intro. How about that?

[Zi]: Alright, I am Zi, aspiring influencer, and…

[Stephen]: 15 years in Silicon Valley, but no need for the whole bio today. Just introduce what we’ll be talking about.

[Zi]: We should probably write this down. Or use some generative AI for this…

[Stephen]: Let's skip the bio intro today and just dive in. I'll give a minute of context before jumping into your topic, since yours is much more structured and coherent. Then we can circle back to the top 100 coins.

Okay, so, welcome everyone! Today, we want to bring back that classic Silicon Valley vibe. Remember those late-night Google sessions fueled by pizza and beer, where the best ideas were born? We're diving deep today, just the two of us, like old times.

We're talking social capital, human capital, and the future of finance. I'll be honest, I haven't put much thought into the top 100 coins lately, or what I even call them anymore – I'm thinking more about the perpetual nature of the financial markets. But Zi, he's been burning the midnight oil, diving into research papers and prepping a whole presentation. So, take it away, Zi.

[Zi]: Just to add some color to why we're doing this… we're hoping to expand our audience. Maybe attract some, you know, female listeners. Stephen, you've been hosting this for over six years, right? And, to quote John Lennon, "The most interesting ideas in life happen to be written in between the margins." The best moments are unplanned, unscripted. And honestly, TGI, for the better part of its existence, has embodied that spirit. Think about it, Harmony, Solana… believe it or not, before they were big shots, they were regulars at our Thursday night meetups back in Sunnyvale in 2017, 2018.

[Stephen]: Good times.

[Zi]: It's like the band getting back together. We're catching lightning in a bottle again.

What's got me fired up lately is this concept of social capital. It's been a year and a half now, and I truly believe it holds the key to unlocking enormous economic opportunities.

Now, for those new to this concept, we all understand "capital" in its traditional sense, right? Adam Smith, "Wealth of Nations", labor capital, human capital. The size of an economy is often measured by the size and skill of its workforce. Unemployment rates, education levels - all indicators of human capital.

But what fascinates me is the relationship between social and human capital, and how it translates into real-world opportunities. Because traditionally, we've focused on human capital, natural resources, financial capital, intellectual property… but social capital often gets overlooked. It's the shared resources, the network, the community.

And the most fundamental unit of social capital? The family. Think about it - everyone is born into some level of social capital. Loving, supportive parents who invest in your upbringing provide you with a foundation. As you grow, go to school, enter the workforce, that social capital expands. Your network of friends, colleagues, online communities… it all contributes.

Take Facebook and LinkedIn, for example. These platforms are built entirely on the foundation of social capital. Facebook connects you with friends and family, while LinkedIn leverages your professional network. Even niche platforms like GitHub, YouTube, Twitter, and TikTok thrive on shared interests and community engagement. We've witnessed the power of social capital unfolding before our very eyes for the past two decades.

And that's the connection I want to highlight today. Social capital fuels human capital, and vice versa. They are intertwined, driving forces behind economic empowerment.

[Stephen]: Right, and…

[Zi]: I'm just checking…

[Stephen]: So, before we go further, I have a question to help you focus, and to give our listeners a better sense of where we're headed. I know you’ve been reading a lot and prepping for this. My question is this: How does the concept of family play a crucial role in the intersection of social capital, human capital, and next-generation finance?

[Zi]: That's a great question. I think, philosophically speaking, we're all born "tabula rasa." Blank slates. We don't know what we don't know. And it's within the family unit where we first learn, not just the value of formal education, but also the meaning of work, the value of money, and how to navigate the world of capital.

[Stephen]: These are all…

[Zi]: Exactly. These are fundamental concepts that we often take for granted. They're ingrained in us from a young age.

But unlike financial capital, which is quantifiable and well-defined, social capital feels intangible. We know it's there, but how do we measure it? How do we define it in a way that encompasses its diverse forms, from meme coins to influencer tokens? These are all up for debate.

And that's what's so exciting about this exploration! We're venturing into uncharted territory, trying to connect the dots and unravel the complexities of social capital. It’s about acknowledging that there’s so much we don’t know and embracing the process of discovery.

[Stephen]: I want to come back to the family aspect. How do you see family structures impacting this new world of social finance, especially for future generations?

But first, let me touch upon the top 100 coins, perpetual exchanges, futures, and options. This will give our audience context on what Harmony is building and what I'm personally focused on.

This week, I dove deep into the top 100 coins. It’s easy to get caught up in the daily grind, the price fluctuations, the latest trends. But taking a step back to analyze the bigger picture, especially on a quarterly or annual basis, is crucial. Are we just chasing hype, or are there fundamental shifts happening in the market?

I meticulously analyzed the top 100 coins, researching and debating with my team and colleagues. The goal? To identify the core value proposition of each coin, to understand why it deserves to be in the top 100, and to extract valuable insights for Harmony’s growth and my own investment thesis.

This exercise helped me refine my investment approach. It's easy to get swept up in meme coins and short-term gains, but focusing on long-term value creation requires a more discerning eye. I'm happy to delve into the specifics of why I excluded certain categories like meme coins, enterprise solutions, gaming, entertainment, governance tokens, and even AI tokens.

[Zi]: Let me just unpack that a bit. By the way, seeing a list of 100 coins… man, it takes me back to 2017, 2018. Those were the wild west days! Back then, you were ambitious enough to say, "Let's read the top 100 white papers!"

[Stephen]: Yep.

[Zi]: And that, my friend, was a valuable lesson. Reading through Steven’s countless white papers taught me that the best way to learn is by doing. You probably didn't even get through five before you said, "Screw it, I'm building my own thing." While I was stuck in the bat cave, reading…

But back to your point. Analyzing the top 100 coins and distilling their core narratives is crucial. What fundamental problem does each token solve? Can we encapsulate its essence in a few words? This exercise is about identifying the underlying value drivers that have stood the test of time, especially in a space as dynamic and ever-evolving as crypto.

Take Bitcoin, for instance. What's its core narrative?

[Stephen]: Decentralized store of value.

[Zi]: Precisely! And why is that?

[Stephen]: It's simple. It's secure. It's immutable. And look at the success of the Bitcoin ETF – it’s a testament to Bitcoin’s staying power.

[Zi]: Exactly! The BlackRock Bitcoin ETF just surpassed $20 billion in assets under management, exceeding even the most optimistic projections. It’s already surpassed the growth rate of gold ETFs.

[Stephen]: No one saw that coming!

[Zi]: Patience, my friend. It’s only been six months. This is no longer a fringe movement; it’s a paradigm shift. Major institutions are pouring capital into Bitcoin, solidifying its status as a legitimate asset class.

[Stephen]: It's the reason the Vanguard CEO got replaced. But let’s move onto the next titan: Ethereum. What’s the core narrative there?

[Zi]: This one’s a shining example of innovation. Ethereum, in its essence, is about secure settlement and consensus.

[Stephen]: You forgot my favorite word: Consensus! We need to break this down a bit. Layer one, layer two, layer three… How does this all connect to secure settlement, especially with everything you've been researching?

[Zi]: You always dive headfirst into the technical details. But you're right, the narrative surrounding secure settlement and consensus is crucial to understanding Ethereum’s value proposition. Six years ago, when Harmony was just starting, the focus was on cross-shard communication and scalability. We were trying to explain the concept of sharding to a world unfamiliar with blockchain technology.

But the beauty of how things have evolved is that the concept of “layers” has become more mainstream. We can now break down complex systems into digestible layers, making it easier to understand how they function and interact. From the Turing-complete EVM at layer one, to the various scaling solutions at layer two, to the exciting developments in application-specific rollups and layer three, it’s fascinating to see how innovation is happening at every level of the stack.

[Zi]: And this is precisely where things get interesting. Do you remember what RJ said a few years ago? He claimed that only 200 people in the world truly understand consensus.

[Stephen]: And he’s one of them.

[Zi]: He is indeed. Maybe we can get him on the show next time.

But before we get sidetracked, you were about to touch on another project, one that ties into your work on Perpetual Protocol.

[Stephen]: Right! While there are many projects I admire, I want to discuss one that has undergone a fascinating transformation: dYdX. It's not just because they're building a perpetual exchange, but because they exemplify a crucial shift in how we think about token value.

For the longest time, dYdX operated as a centralized entity. But recently, they’ve transitioned to a decentralized model, and their token has become a representation of the protocol’s value and future revenue. This is a trend I believe we'll see more of in the coming years.

Think about it: why do tokens have value? Why do we invest in them? It can't just be about hype and speculation. We need to move beyond that. Just like traditional companies share revenue with their shareholders through dividends, I believe successful DeFi protocols will need to do the same with their token holders. This shift towards sustainable, revenue-sharing models will be crucial for the long-term health of the industry.

[Zi]: You’re hitting a crucial point here. Last week, we talked about how synthetic assets and financial instruments, what we call derivatives, have the potential to unlock trillions of dollars in economic opportunities.

[Stephen]: Exactly!

[Zi]: And derivatives are essentially a way to express the rate of change of an asset’s value over time. It’s like calculus, dYdX! You have to hand it to them, that’s brilliant marketing!

But can you elaborate on what dYdX is for our listeners who might not be familiar with it?

[Stephen]: Absolutely. Think about the evolution of DeFi. We've cracked the code on consensus mechanisms, enabling secure and decentralized protocols. We've developed robust smart contract platforms like Ethereum and Harmony, capable of executing complex transactions and powering a wide range of applications.

The next frontier? Decentralized market making and sophisticated financial instruments. dYdX represents this evolution beautifully. They've created a platform where prices are determined by a constant product market maker formula, allowing for seamless trading and settlement of various assets.

And this is where derivatives come in. We’re no longer talking about just spot prices – we’re incorporating the element of time. With futures, options, perpetual swaps… you’re essentially betting on the future value of an asset. This opens up a whole new world of possibilities for speculation, hedging, and risk management.

[Zi]: And to your point about perpetuals, these instruments don’t have an expiry date. They exist in perpetuity, allowing for continuous price discovery and trading.

[Stephen]: Exactly! And this is where it gets interesting for the 1,200+ coins out there. dYdX's token model is compelling because it aligns incentives between the protocol and its users. By sharing revenue with token holders, they’re creating a sustainable ecosystem where everyone benefits from the platform's growth.

[Zi]: It all circles back to our earlier discussion about generational wealth and social capital. If we keep extracting value from future generations, how can we expect them to thrive?

[Stephen]: Exactly! Traditional finance has failed us in this regard. It’s designed to benefit the few at the expense of the many. But with crypto and decentralized finance, we have a chance to build a more equitable and sustainable system. One where value is distributed more fairly, and future generations have the opportunity to inherit not just wealth, but a more robust and resilient financial system.

[Zi]: That's the essence of generational wealth, right? It’s not just about passing down money or assets; it's about building a better future for those who come after us. And that’s where social capital plays such a crucial role.

You mentioned earlier that you ask everyone you meet about their earliest memory of their mother talking about money. What’s the significance of that question?

[Stephen]: It’s about understanding their relationship with money, their values, and how they view wealth. It’s fascinating to see how those early lessons shape our financial behaviors and beliefs.

I remember reading a paper back in 1986, and the one word that stuck with me was "family." It made me realize that building a successful company, or even an entire industry, requires fostering a sense of community and shared purpose. It's about creating an environment where everyone feels valued, supported, and empowered to contribute their best work.

[Zi]: I think you're absolutely right. Generational wealth, social capital, it's not just about individual gain, it's about building something bigger than ourselves.

You know, in the next 20 years, we're going to see the largest wealth transfer in history, as trillions of dollars move from the Boomer generation to Millennials and Gen Z. But true generational wealth isn’t just about inheritance; it's about the knowledge, the skills, and the values we pass down.

My biggest regret is that my mother never talked about money beyond emphasizing frugality. It wasn’t until much later that I realized managing money is a skill, just like playing the piano or running a marathon. The more you practice, the better you become.

Think about popular culture – shows like "Succession" highlight the pitfalls of inherited wealth without the skills and experience to manage it. The Roy children are a cautionary tale.

[Stephen]: It’s true. Money without purpose, without understanding, can be a recipe for disaster.

[Zi]: Exactly. It’s like that famous Charlie Munger quote: "In the short run, the market is a voting machine, but in the long run, it is a weighing machine." We need to equip future generations with the tools and knowledge to navigate the complexities of finance, to distinguish between speculation and value creation, and to make sound financial decisions.

And that starts with open and honest conversations about money within the family unit. It’s about creating a safe space for children to ask questions, make mistakes, and learn from experience.

You mentioned your wife, JC, takes the time to learn alongside your children, even though she doesn’t necessarily need to. That’s social capital in action. She’s not just imparting knowledge; she’s fostering a love of learning and a sense of shared purpose.

And with the rise of generative AI, we have even more tools at our disposal to bridge the knowledge gap. Imagine a world where parents can brush up on forgotten concepts alongside their children, using AI-powered learning platforms to foster a love of learning and a deeper understanding of the world around us.

[Stephen]: That’s an exciting vision for the future of education.

But we're running short on time. We have so much more to cover! Let’s shift gears and talk about…

[Zi]: Verisign!

[Stephen]: Yes! I was surprised to see how much people are still paying for domain names. It's like we're back in the early days of the internet.

[Zi]: Verisign is a prime example of regulatory capture and its unintended consequences. Thirty years ago, they were a seemingly insignificant entity, verifying domain names and ensuring the smooth functioning of the internet. Fast forward to today, and they've become a gatekeeper, wielding immense power and extracting exorbitant fees for a service that should be a public good.

[Stephen]: It's the original NFT!

[Zi]: Exactly! And just like with any monopoly, the lack of competition has stifled innovation and led to inflated prices. But the beauty of blockchain technology is that it allows us to reimagine systems like DNS, to create more transparent, equitable, and efficient alternatives.

[Stephen]: You're talking about decentralized identifiers, right?

[Zi]: Precisely! We need to move away from centralized control and empower individuals with greater ownership and control over their digital identities.

[Stephen]: This reminds me of what we were discussing earlier about generational wealth and the importance of distributing power more equitably. It’s not just about money; it’s about access, opportunity, and a level playing field.

[Zi]: Absolutely! Look at what happened to the telecommunications industry when VoIP and platforms like Skype emerged. They disrupted the status quo, broke down barriers to entry, and created enormous value for consumers.

[Stephen]: That was a classic example of innovation trumping regulation.

[Zi]: Exactly! And the same thing will happen with Verisign and other centralized gatekeepers. The internet was founded on the principles of decentralization and open access, and we need to fight to preserve those values.

[Stephen]: It's about building a future where everyone has the opportunity to participate and benefit from the digital economy.

[Zi]: Couldn't have said it better myself.

[Stephen]: We're almost out of time. Any last thoughts before we wrap up?

[Zi]: I think this conversation highlights the power of questioning assumptions, challenging the status quo, and thinking differently. Whether it's social capital, decentralized finance, or the future of the internet, we have an incredible opportunity to shape a more equitable, sustainable, and abundant future for all.

[Stephen]: Well said, my friend. Until next time!

[Zi]: Cheers to that!