🍻 TGI-3(sum): ⏳ Generational Wealth & ❤️🔥 Perpetual Governance

Zi and Stephen are hosting again! TGI-3(sum): 3 hours of 3 friends over 3 beer 🍻. Infinite sum of timeless friendship and harmonic hearts.

“Forever dinner party”: good friends and conversation happening in perpetuity. 不散的筵席. Gardener, not carpenter : a strong and fair central leader who sets the tone and enforces the rules. At any given moment, this person has a certain intangible but very real instinct of the vibe of the group.

Full 2-hour voice recording & transcript: https://recorder.google.com/e17f86ae-ab48-4b0e-a21a-0e8b82adddd8

⏳ Zi Wang at Timeless worked on Google Chrome, Google X, Android and Nexus from 2006-2015. He was Google’s first global creative director for its hardware division and co-founded a Google research lab.

Zi founded Quantum Bakery, a startup partnering with Google, Corning and Toyota to develop consumer products with ambient intelligence. He holds a bachelor’s degree in computer science and a master’s degree in economics.

❤️🔥 Stephen Tse at Harmony has been obsessed with protocols and compilers since high school. He reverse-engineered ICQ and X11 protocols, coded in OCaml for more than 15 years, and graduated with a doctoral degree in security protocols and compiler verification from the University of Pennsylvania.

Stephen was a researcher at Microsoft Research, a senior infrastructure engineer at Google, and a principal engineer for search ranking at Apple. He founded the mobile search Spotsetter with institutional venture capital; Apple later acquired the startup.

Generative Summary

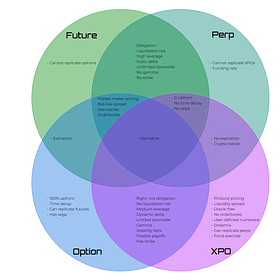

Derivatives are fascinating, particularly perpetuals. They offer continuous settlement, which is unlike anything traditional finance has seen.

Imagine the entire universe being static, no change in speed, no acceleration. That's what traditional finance is like. But with perpetuals, you can measure the speed and acceleration of the market, opening up a whole new dimension of understanding.

This leads to a thousand times more leverage. You can build richer structures, extract more value from the market, and gain a deeper understanding of its dynamics.

But what about social capital? I think it's a major asset for the younger generation. Traditionally, you needed financial capital or a certain age to participate.

But blockchain eliminates those barriers. It's permissionless, allowing anyone to participate regardless of age or financial status.

It's about upward mobility, giving everyone a fair chance to participate in the economy.

Social capital has a real value. Just look at Elon Musk and Twitter. He paid billions for social influence.

But we need to move beyond vanity metrics. Social capital should be about making a real impact, contributing value to your community, and building something meaningful.

And it's about minimizing governance, creating open, sustainable ecosystems that thrive without centralized control.

The key is to create a launchpad, a platform where new projects can launch and flourish. It's about fostering innovation and empowering the next generation of entrepreneurs.

It's about building a future where everyone has the opportunity to succeed, where social capital is truly valued, and where blockchain technology empowers us to create a better world.

⏳Zi: Intergenerational Theft ► Upward Mobility

Inequality is inherent to the market, but when wealth is entrenched and mobility suppressed, that’s cronyism, not capitalism.

Generational Wealth Disparity: Over the past two generations, young people are earning less money on an inflation-adjusted basis while costs for housing and education have soared. This has led to a breakdown in the social contract, with younger generations experiencing less prosperity than their parents at the same age.

Economic Frustration Among Youth: There is a significant disparity in the perception of the American economy between older and younger generations. Older individuals feel optimistic, whereas younger people feel disillusioned and angry due to diminished opportunities and economic prospects.

Minimum Wage Stagnation: The minimum wage has not kept pace with productivity. If it had, it would be around $23 per hour, instead of its current lower rate. This stagnation is a deliberate policy to keep youth labor undervalued.

Housing Affordability Crisis: The median home price has dramatically increased, making it difficult for younger generations to afford homes. The cost of permits and other regulatory barriers has been manipulated to protect the interests of incumbents and elevate their own net worth.

Higher Education Inequities: admission rates to prestigious universities have plummeted, and the cost of higher education has skyrocketed. Universities are increasingly focused on luxury and exclusivity, neglecting their public service mission.

Intergenerational Wealth Transfer: There has been a purposeful and massive transfer of wealth from younger to older generations. This includes the manipulation of policies like Social Security, which disproportionately benefits older people regardless of need, to the detriment of the younger population.

Emotional and Mental Health of Youth: The proliferation of social media and its negative impact on young people’s mental health is highlighted. Galloway criticizes tech giants like Mark Zuckerberg for prioritizing profit over the well-being of the younger generation.

Love for Children as a Motivating Factor: The core message is a call to action: if society truly loves its children, it must take bold steps to reverse these damaging trends and invest in the future well-being and prosperity of the next generation.

❤️🔥Stephen: “In Chapter 8 “Wealth", Steven Pinker argues that economic growth has been a major factor in reducing poverty, disease, and other forms of hardship around the world. He notes that while income inequality has increased in recent decades, the overall trend has been towards a more equitable distribution of wealth.

”Pinker also points out that technological advancements and free trade have helped to create new wealth and opportunities, particularly in developing countries. However, he cautions that continued economic growth is essential for addressing remaining challenges such as climate change and inequality. By embracing reason, science, and humanism, Pinker believes that we can continue to make progress towards a more prosperous and just world.”

Intergenerational Theft: Upward Mobility Through Social Capital

Upward mobility, the idea that each generation will be better off than the previous one, is under threat. Economic indicators and social trends paint a worrying picture: younger generations are finding it hard to achieve the same level of prosperity as their parents did. Despite significant economic growth in recent decades, this has not translated into prosperity for people in their 20s and 30s. Instead, they often face unprecedented financial pressures due to policies that disadvantage younger generations. These contribute to a significant decline in their economic prospects and overall well-being. We propose that Social Capital Protocol, enhanced by the economic incentives inherent to blockchain, can significantly improve the situation for the younger generation.

Erosion of Economic Opportunity

Here’s the realities facing our youth today. For the past two generations, inflation-adjusted incomes have stagnated or declined, while the costs of education and homeownership have skyrocketed. The fundamental social contract, which once promised that each generation would be better off than the last, is crumbling. Today, a 30-year-old's prospects are markedly poorer than those of their parents at the same age. This erosion of opportunity is nothing short of an intergenerational theft of prosperity.

Rising costs of education and housing

Stagnant wages — Between 1979 and 2020, productivity in the U.S. workforce increased by 61.8%, yet worker wages only saw a modest increase of 17.5% [2]

Regressive tax policies favoring wealth accumulation over income generation

Inadequate social safety nets for children and young families

The rising costs represent significant barriers to upward mobility for young people. Wage stagnation and the increasing disparity between corporate profits and worker compensation have further exacerbated income inequality. While asset ownership has become a key driver of wealth creation, access to such assets remains elusive for many young people due to financial constraints and systemic barriers. The implications are glaring: only one in five people under 34 feel optimistic about the country's direction. This is in stark contrast to the older generation, many of whom remain confident in America's future. We are left with a deep generational chasm, one that breeds resentment and disillusionment among the young. This righteous indignation stems from the realization that the prosperity once guaranteed to them has been withheld.

A clear indicator of our devaluation of young labor is the minimum wage, which has remained stagnant despite increasing productivity. If wages had kept pace, they would be around $23 per hour. Instead, the cost of living has soared, with housing prices vastly outstripping income growth. In pre-pandemic times, the average mortgage was $1,100. Today, it exceeds $2,300 due to rising interest rates and home prices. Regulatory barriers have driven housing costs to untenable levels, enabling established property owners to profit while locking younger people out of homeownership.

This is not an accidental phenomenon but a deliberate policy choice. The wealth of those over 70 has increased significantly, while those under 40 have seen their share of the nation’s wealth shrink by half. The same goes for higher education. Universities have adopted an LVMH-like approach, creating scarcity to justify soaring tuition fees, thus undermining their mission to provide upward mobility.

Moreover, the disproportionate rise in corporate profits compared to wages further underscores the imbalance. The last 40 years have seen capital triumph over labor, making it easier to become a billionaire than a millionaire. Higher education should empower the bottom 90% to climb into the top 10%, yet it has become a tool to create a super class of billionaires. The intentional transfer of wealth continues to exacerbate inequalities, and public policy decisions, such as ballooning Social Security costs, have prioritized the older generation at the expense of the young.

Today’s policies also undermine the mental health of young people, many of whom face growing anxiety, depression, and even self-harm. The relentless pursuit of profit, especially by tech companies, has exposed young people to societal ills that erode their well-being and the fabric of society.

To right these wrongs, we must recognize that we have the resources to tackle these issues. Reforms should include a progressive tax structure, restoring the IRS, reforming Social Security, and implementing a negative income tax. Investments in universal pre-K and vocational programs, coupled with raising the minimum wage and age-gating social media, could significantly improve the future prospects of young Americans.

Policy Recommendations:

To address this intergenerational inequity and invest in the future of young Americans, a comprehensive approach is necessary. Proposed interventions include:

Education Reform: Increased investment in public higher education to reduce tuition costs and expand access, with a focus on vocational training and non-traditional degree programs.

Housing Affordability: Policies to incentivize the development of affordable housing, streamline permitting processes, and address zoning restrictions that limit housing supply.

Progressive Taxation: Implementing a more progressive tax system that ensures corporations and wealthy individuals contribute their fair share, while providing tax relief for low- and middle-income families.

Strengthening Social Safety Nets: Expanding access to affordable childcare, universal pre-K programs, paid family leave, and a negative income tax to provide a basic income floor.

Addressing Mental Health: Investing in mental health resources and support systems for young people, including school-based programs and community initiatives.

Regulation of Social Media: Implementing age restrictions for social media platforms, promoting digital literacy and responsible technology use, and holding platforms accountable for harmful content and algorithms.

National Service Programs: Encouraging civic engagement and fostering a sense of community through national service programs that connect young people from diverse backgrounds.

Conclusion: Investing in the next generation to ensure they inherit a nation of opportunity and hope. The challenges facing young Americans are complex and require a concerted effort to address. By acknowledging the intergenerational theft taking place and implementing policies that prioritize investment in education, housing, and social support systems, we can create a more equitable society and ensure that future generations have the opportunity to achieve the American Dream. This requires a shift in our collective mindset, recognizing that the well-being and prosperity of the younger generation are not only a moral imperative but also essential for the long-term health and sustainability of our nation.

References

Waking Up From the American Dream

For the first time in U.S. history, young people are no longer better off economically than their parents were at the same age. An American born in 1940 had a 92% chance of doing better than his or her parents. Someone born in 1970 had a 61% chance. A millennial born in 1984, who’d be thirty-seven today, only has a 50% chance. I worry about the effects of age-based inequality. Immigrants, like my parents, come to America so their kids can make better lives for themselves. That used to be attainable. Now young people are fed up. They have less than half of the economic security, as measured by the ratio of wealth to income, that their parents did at the same age. Their share of wealth has crashed. I believe that fading economic opportunity and mobility is a disease, and the symptoms are shame, frustration, and rage. Young people—men in particular—have already found outlets for those feelings: chat rooms on Reddit, meme stocks, and violent protests are all signs of burgeoning boredom and frustration.

Stock Market Participation

For the past twenty-five years, roughly half of American households have had a personal stake in the stock market thanks to 401(k) retirement accounts, mutual funds, and the internet, which turned business news and investment media into a Main Street product and rendered the market our primary economic indicator. In 1989, less than a third of U.S. households had any holdings—direct or indirect—in the stock market. By 2019 that share had increased to roughly half. This was an improvement, but it did little to slow the runaway train that is wealth inequality. The fact remains that nearly half of American households don’t have any stake in the stock market. Furthermore, the distribution of stock is enormously uneven.

The wealthiest 1% of Americans hold almost half the stocks owned by households. The bottom 80% hold just 13%.

Billions of People Work Their Way Out of Poverty In less than forty years, billions of people have improved their lot and made it out of extreme poverty. That’s a low bar—$1.90 per day, which is subsistence living even in low-cost economies—but it’s still a change for the better unlike anything in history. The rolling back of poverty has been particularly remarkable in China. In 1990, 750 million Chinese lived below the international poverty line. Today, it’s less than 10 million. Most of these people still have low incomes, but the economic engine they’re a part of continues to churn. In 2019, there were 100 million households in China with wealth of more than $110,000.

Productivity is an economic measure of efficiency: the ratio of output to input. U.S. productivity has increased at a remarkably steady rate since the 1950s, meaning we keep getting better at getting more value out of our labor, equipment, and raw materials. From 1950 to the mid-’70s, average compensation kept pace with productivity, meaning the benefits of productivity gains went to those doing the work. Since then, productivity and wages have decoupled. The value of our output has kept climbing, but the compensation of our workers has stopped reflecting it. Between 1973 and 2014, net productivity grew 72%, but hourly worker compensation grew just 9%. This left worker compensation at less than half what it would have been if the two had stayed in line. In other words, our nation kept winning, but our workers only got to cash in half their chips. The money started going somewhere else.

Since then, productivity and wages have decoupled. The value of our output has kept climbing, but the compensation of our workers has stopped reflecting it. Between 1973 and 2014, net productivity grew 72%, but hourly worker compensation grew just 9%. This left worker compensation at less than half what it would have been if the two had stayed in line. In other words, our nation kept winning, but our workers only got to cash in half their chips. The money started going somewhere else.

❤️🔥 Stephen: Zero Parameters & Immutable Governance

In our first launch, we will deploy a fully open source and fully onchain project similar to Arbitrium’s GMX or Optimism’s Panoptic. We avoid the complexity of off-chain matching of orderbooks such as dYdX or Vertex. Since Panoptic relies only on Uniswap V3’s pools for liquidity and pricing, we avoid the fragmentation of assets and the attacks of oracles. Ideally, to stay robust among all market conditions and to avoid any governance attacks, the smart contracts should require no configurable parameters to deploy or even become immutable against upgrades.

🎯 On-chain & 💞 Open-source Perpetual Options in Harmony

Our goal is to make useful products and earn sustainable fees for Harmony’s DeFi ecosystem. Currently, onchain derivatives – such as options, futures, leverages – are the best market fit for a fast blockchain. They require very minimal dependencies: simply a token exchange such as Uniswap V3, and around $1M liquidity of even a single pair like ETH-USDT.

Then, with the simplicity of Uniswap’s pools and Robinhood’s fees, we can scale the product for the mass. Our user interface will skip the price charts or the order feeds. Instead, visualize how buying an option contract or a future contract will perform against different price points and time scales. Show the potential profit and loss given the maximum leverage!

We are working on a market research titled “Open Source and Onchain Derivatives”, listing all derivatives projects that their code are shared and that their executions are smart contracts.

🌳 Perps: Invincible Summer of 💪 1000x Leverage + 🕐 1-second Orderbook

Why perpetuals? Are 1000x leverages and 1-second orderbooks profitable? Let’s make Harmony’s Shard 1 the future DeFi platform – with fast transaction finality, cross-chain liquidity, and generative agents. We are building 1. power perpetuals that unify stablecoins and margined futures; 2.

The future is fully onchain with smart contracts – including asset custody (wallets), order matching (books), trade clearing (settlements).

Avoid dependencies against attacks or extracted values – including price oracles (volatility), maker bots (arbitrage), token incentives (governance).

Minimal product with no charts or sliders or steps – just long or short ETH-USDT at 1000x leverage, seamlessly bridged via LayerZero.