♣️ Black Forex: Yen Carry Trade 💹, Yield Curve Control 🪝

How does Japan economy and JPY impact $ + ₿ + 🥇? Stay boolish, and “Push the Button.” Hayes says: “The only observable effect is how Bitcoin correlates with dollar-yen.”

https://cryptohayes.substack.com/p/the-easy-button (2024-05-20)

What is YCC [Yield Curve Control]? It is when a central bank is willing to print infinite amounts of money to buy bonds to fix the price and yield at a politically expedient level. As a result of YCC, the supply of money increases, which causes the currency to weaken.

What is this dollar-yen swap arrangement? The Fed is prepared to print infinite amounts of dollars so that the BOJ [Bank of Japan] can forestall raising rates, resulting in UST [United States Treasury] sales.

https://dollarendgame.substack.com/p/tokyo-drifting-into-a-currency-crisis (2024-04-27)

Worse yet, recall that the central bank already owns over half of the entire bond market, due to decades of Yield Curve Control creating an infinite bid for JGBs.

In late November of that year, the Yen again approached 150, and Kuroda responded by making the first big move other than forex intervention, raising the cap on Yield Curve Control of the benchmark 10 yr JGB to 0.5%. This triggered a flurry of activity in the bond market, and even led to an emergency margin call issued by the Japanese Securities Clearing Corporation.

https://members.delphidigital.io/reports/the-dark-night-rises-part-1#the-us-china-japan-conundrum-9b92 (2024-07-11)

Japan also has one of the largest USD stockpiles that it can selloff and reallocate towards cheaper yen-based assets, which have become more attractive given the JPY’s dramatic decline.

Curbing CNYJPY appreciation, for example, has become more pressing amid the JPY’s rapid decline this year. Meanwhile, Japan can’t really afford higher rates — and the country’s unsustainable fiscal path (extreme Debt/GDP levels), and immense scale of debt monetization will continue to put pressure on the JPY if left unchecked.

https://cryptohayes.substack.com/p/spirited-away (2024-08-06)

If the setup is convex-Bitcoin, I will aggressively add positions as we have reached the local bottom. If the setup is correlated-Bitcoin, then I will sit on the sidelines and wait for the eventual market capitulation.

The mega assumption is that the BOJ will not reverse course, cut deposit rates back to 0%, and resume unlimited JGB purchases. If the BOJ sticks by the plan it laid out at its last meeting, the carry trade unwind will continue.

https://members.delphidigital.io/feed/honey-wake-up-a-new-hayes-just-dropped (2024-05-23)

… becoming less important to pick specific crypto projects and instead just ride the liquidity waves. There will be projects that outperform, for sure, but in general, if central banks are pumping more money into the system, everything should go up.

Satoshi created Bitcoin precisely for situations like yield curve control (YCC) and a potential dollar-yen swap line. Bitcoin is Satoshi’s gift to the world, allowing us to preserve our wealth against the chaotic swings in monetary policy.

https://dollarendgame.substack.com/p/the-gold-endgame-begins

https://dollarendgame.substack.com/p/what-is-money-show-dollar-endgame

The People's Bank of China emerged as the top purchaser of gold among central banks in 2023. In 2023, the central bank of Poland emerged as the second-largest buyer of gold globally, acquiring 130 tons of the precious metal. Singapore had the third highest net gold purchases in 2023, driven by purchases by the Monetary Authority of Singapore (MAS), which bought 76.51 tons, but didn’t say why.

As the world divests from Treasuries and (attempts) to move away from the dollar, the first step will be a rapid re-monetization of gold and bitcoin, leading to rapid price increases and a shattering of the paper markets that have dominated the West for decades.

https://members.delphidigital.io/reports/market-musings-through-the-fire-and-flames

Owning crypto assets is venturing out as far as you can go on the risk curve with respect to asset allocation – nothing is more risky and volatile in nature. So when global markets and heavyweight factors take a turn, people run for the exits. Again, correlations to 1, blah blah.

Unfortunately for crypto, in the event of a sudden deleveraging event, people tend to liquidate their most liquid/risky positions first. And since crypto is the most risky asset class (that also happens to trade liquid markets 24/7), it should come as no surprise that crypto markets get rekt.

https://dollarendgame.substack.com/p/godzilla-returns (2024-08-04)

Japan was a large funding mechanism for carry traders first because of their zero-bound interest rates, which make it extremely cheap to borrow in Yen - at one point with certain time deposits rates were even negative, which meant borrowers got paid to take out loans.

But the other reason why Japan built up such a massive carry trade- (which Deutsche Bank analysts estimated at a staggering $20T USD equivalent!) is because of the lack of volatility in the monetary policy itself.

https://cryptohayes.substack.com/p/shikata-ga-nai (2024-06-20)

The Japanese banks still crystallise the losses on the bonds because they sell them to the BOJ at current market prices. The BOJ now has UST duration risk going forward. If the price of these bonds falls, the BOJ will have an unrealised loss. However, this is the same risk the BOJ is currently running on its trillions of yen-sized Japanese Government Bond portfolio.

The BOJ is a quasi-government entity that cannot go bankrupt and does not have to adhere to capital adequacy ratios. Neither does it have a risk management department that forces a reduction in positions if its Value-at-Risk rises due to massive DV01 [Dollar Value of 1 basis point] risk.

https://bmpro.substack.com/p/rapid-acceptance-of-bitcoin-as-safe

This week, the Bank of Japan (BOJ) released their newest monetary policy statement, removing the hard upper-limit on the 10-year Japanese Government Bond (JGB), replacing it with a “reference” rate of 1%. I wrote a post back in 2021 predicting the eventual failure of yield curve control (YCC), and it seems that day has come.

The yen continues to crash against the dollar, breaking 150 yen per dollar, but their economy has never regained its footing. The yen is pushed lower by the infamous Japanese carry trade, where market participants take out low-interest debt in Japan, swap for dollars, then make investments which yield over the Japanese interest rate. With US rates sky high for the time being, this carry trade is more attractive than ever and putting significant pressure on the yen. By letting long-term rates overshoot 1%, the BOJ is giving up on YCC.

https://dollarendgame.substack.com/p/the-boj-is-trapped

So the BoJ will keep printing, rates are now not negative but also not supposed to “rise too rapidly”, and Ueda is beginning to succeed in his goal of what Nakamura terms “Yield Curve Control, Control”. This essentially means changing the definition of YCC every so often to keep the market on its toes- guessing what the next move will be.

Stock prices can rise, completely disconnected from the real economy. In fact, maybe equities are just front-running larger devaluations of the currency that are coming- a sign that people want to get out of cash and into an asset that will at least somewhat keep pace with the yen devaluation.

In Wednesday’s move, the Bank of Japan raised its benchmark interest rate to 0.25%, further unwinding the monetary-stimulus policy it has pursued for most of the past quarter-century. The benchmark rate was previously set in a range between 0% and 0.1%.

The bank said it would gradually reduce the amount of its government bond purchases by half to ¥3 trillion a month by early 2026, or the equivalent of about $20 billion.

https://cryptohayes.substack.com/p/group-of-fools (2024-06-06)

The problem is the weak yen. I believe Bad Gurl Yellen stopped the rate hike Kabuki theatre performance. It is time to get down to the business of preserving the Pax Americana-led global financial system.

If the yen isn’t strengthened, the big bad pinko commie Chinamen will unleash the dragon of a devalued yuan to match their chief export competitor Japan’s super-duper cheap yen. In the process, US Treasuries will get sold.

https://members.delphidigital.io/reports/bitcoins-global-breakout#global-breakouts-all-around-us-969b (2024-03-01)

https://cryptohayes.substack.com/p/left-curve

All the major economic blocs (US, China, European Union “EU” and Japan) are debasing their currencies to deleverage their government’s balance sheet. All four major economic blocks enact policies to financially repress savers and engineer negative real yields. China, the EU, and Japan ultimately take their monetary policy cues from the US.

2024 is a critical year for the world as many large nation-states will hold presidential elections. The US election is crucial globally as the ruling Democratic party will do anything in their power to stay in office. As I said before, Pax Americana’s fiscal and monetary policy will be aped by China, the EU, and Japan, which is why it is important to follow the election.

https://members.delphidigital.io/feed/riding-market-momentum (2024-08-01)

Raoul and I also dive into other important macro factors like the JPY carry trade unwind, global liquidity outlooks, and the most important chart in crypto I’m watching right now (spoiler: it has to do with SOL).

https://www.wsj.com/finance/currencies/yen-hits-34-year-low-as-hopes-for-boj-rate-increases-fade-d3d0da2d (2024-03-27)

The yield gap between U.S. government bonds and Japanese government bonds remains wide, making U.S.-dollar denominated assets appear more attractive and encouraging the so-called “carry trade,” when investors borrow cheap yen and sell the funds for dollars to be invested in higher-yielding securities.

The returns could be substantial, considering that the two-year U.S. Treasury yield was recently at 4.593%, while the two-year Japanese government bond yield was 0.191%.

The yen's slide to multi-decade lows has wrong-footed global investors, cementing the currency's reputation as one of market's most enduring "widow-maker" trades. Betting on a stronger yen became a popular trade.

That finally happened this month. Dowding thinks the weakness of the yen will continue to fuel inflation, forcing the Bank of Japan to continue raising interest rates. He also expects the reversal of the carry trade.

Lex Fridman / All-In on 🥇Bitcoin, 🥈Ethereum & 🥉Money

“Bitcoin also functions as an apolitical alternative to central banks, allowing international movement of capital without needing to resort to the legal, regulatory, and political institutions that are necessary.”

https://cryptohayes.substack.com/p/zoom-out

How Pax Americana and the collective West allocate credit will resemble how the Chinese, Japanese, and Koreans do it. Either the state will directly instruct the banks to lend to this or that industry/company or banks will be forced to buy government bonds at below-market yields so that the state can hand out subsidies and tax credits to the “right” businesses.

In either case, the return on capital or savings will be lower than nominal growth and or inflation. The only way to escape, assuming no capital controls are erected, is to buy a store of value outside of the system like Bitcoin.

https://members.delphidigital.io/reports/no-pain-no-gain#the-dollar-debt-monetization---monetary-inflation-f148 (2024-04-12)

Howell also believes the broader trend of monetary inflation will continue to benefit monetary inflation hedges and has likened Bitcoin to “exponential gold”. Relative to other fiat currencies, the USD is still king. I certainly don’t believe that the yen will be a strong currency. “Japanification” of the US bond market, to which Howell poses: You end up with the Bank of Japan owning most of the debt. Okay, fine, but what’s the cost of the Japanese economy?

Howell believes the current Treasury market dynamics indicate “surreptitious yield curve control,” which is likely bad for the long-term health of the US economy. If you look at the numbers that are coming out of the Treasury in terms of the quarterly refinancing statement, those numbers were the numbers that you would’ve seen in Latin America, not in the USA.

https://wublock.substack.com/p/opinion-sec-is-chasing-the-difficulties (2024-03-25)

However, should the BoJ decide to increase interest rates, the dynamics of this trade could shift dramatically. Higher Japanese interest rates would likely strengthen the yen against the US dollar, reducing the attractiveness of the yen carry trade. Furthermore, if the BoJ ends its Yield Curve Control (YCC) policy — aimed at keeping long-term interest rates at a target level — it could lead to higher yields on JGBs, reducing their price and affecting the collateral value for those engaged in the carry trade.

https://www.wsj.com/finance/stocks/is-this-1987-all-over-again-whats-driving-the-market-meltdown-4d107126 (2024-08-05)

We don’t know yet if any hedge funds have been taken out by the big moves in markets, which have brought heavy losses for those engaged in the “carry trade”of borrowing cheaply in yen and buying higher-yielding currencies such as the Mexican peso or dollar. But already traders are betting that the Fed will slash rates, with a supersize cut of 0.5 percentage point priced into futures for the September meeting.

https://members.delphidigital.io/reports/pro-crypto-insider-talks-july-2024 (2024-07-31)

https://www.realvision.com/videos/pro-crypto-insider-talks-july-2024-G2qA

Impact of the JPY carry trade unwind. Global Liquidity outlook for 2H 2024 heading into 2025.

The end carry trade, people in crypto are used to this when leverage builds up and then it’s a leverage flush, particularly the direction a weak dollar, which is what I think we’re headed into for the rest of this cycle.

https://www.wsj.com/finance/stocks/japan-stocks-fall-sharply-after-weak-u-s-jobs-data-yen-strengthening-3903689f (2024-08-05)

Known as the carry trade, this strategy was yielding money for investors. Then the BOJ raised rates, causing the yen to appreciate about 7.6% against the U.S. dollar over the past week.

The rising yen fed on itself on Monday because of a squeeze on the carry trade, said strategists and traders. Investors who had borrowed yen were hit with margin calls as the currency jumped, meaning their bankers were insisting on more collateral. Those investors were forced to buy yen to cover their previous positions, pushing the currency higher and triggering still-further margin calls.

https://cryptohayes.substack.com/p/heatwave

The precarious period for risky assets is April 15th to May 1st. This is when tax payments remove liquidity from the system, QT rumbles on at the current elevated pace, and Yellen has yet to start running down the TGA. After May 1st, the pace of QT declines, and Yellen gets busy cashing checks to jack up asset prices.

If you are a trader looking for an opportune time to put on a cheeky short position, the month of April is the perfect time to do so. After May 1st, it’s back to regular programming … asset inflation sponsored by Fed and US Treasury financial shenanigans.

https://dollarendgame.substack.com/p/the-monetary-event-horizon

In June, the interest expense paid for the last twelve months hit $852B- a 28% compounded annual growth rate. If this keeps growing at this rate, we will be paying $1.78T in interest alone in 2025. And $2.28T in 2026.

https://members.delphidigital.io/media/pro-crypto-insider-talks-may-2024 (2024-05-28)

Yellen went to China twice. The Chinese have a dollar shortage, the Japanese have a dollar shortage, hence is why the yen keeps falling. There is going to be some source of liquidity handed to China, because nobody wants the Chinese to devalue. There’s a whole bunch of reasons around this. So I think there’s dollar liquidity in the system.

That’s all central banks, including the Chinese, including the Japanese, including– there is no difference between the central bank and the government. Zero.

https://cryptohayes.substack.com/p/mayday

When the average muppet equates quantitative easing (QE) with printing money and inflation, it spells trouble for the elites. Therefore they need to change up the nomenclature and method of providing the junkie, that is, the fiat financial system, its hit of monetary heroin.

But make no mistake – by reducing the rate of QT from $95 billion to $60 billion per month, the Fed is essentially adding $35 billion per month of dollar liquidity. When you combine the Interest on Reserve Balances, RRP payments, and interest payments on US Treasury debt, the reduction in QT increases the amount of stimulus provided to the global asset markets each month.

Many investors have been participating in the so-called carry trade. Here’s how that works: an investor borrows the currency of a place where interest rates are low, like Japan or China, and uses it to invest in a currency where interest rates are higher, like Mexico. The trade depends on the borrowing currency remaining cheap, and market volatility remaining low.

Hedge funds and other speculative investors were holding more than 180,000 contracts betting on a weaker yen on a net basis, worth more than $14 billion, at the start of July, according to CFTC data. By last week, those positions had been cut to around $6 billion.

https://www.wsj.com/finance/stocks/global-stocks-markets-dow-news-08-05-2024-35da4a74 (2024-08-05)

Instead, the strengthening yen has squeezed the carry trade. Investors who borrowed yen to fund their bets have been forced to buy more of the currency by bankers insisting on additional collateral. That is pushing the yen even higher, prompting more margin calls.

https://cryptohayes.substack.com/p/bad-gurl

All other major central banks like the People’s Bank of China (PBOC), Bank of Japan (BOJ), and European Central Banks (ECB) will also print money because now that US monetary conditions are loosening they can print money without weakening their currencies. This is great news for Japan, China, and Europe. Each one of these countries faces financial issues.

These central banks can ease as well because the Fed’s policy will have the most impact due to the truly mind-boggling sums involved. That means on a relative basis, any money printing done by the PBOC, BOJ, and ECB has less impact than the Fed. When translated into currency terms, the yuan (China), yen (Japan), and euro (Europe) will strengthen vs. the USD.

https://members.delphidigital.io/feed/paradox-of-the-dollar (2024-05-06)

Ultimately, it is in basically all policy interests to stop this self-reinforcing dollar wrecking ball (both Trump and Biden want to rebuild / re-shore U.S. manufacturing while the EU, Japan, and China are all importers of energy, food, and other raw materials). Because of the alignment of technocratic interests towards a controlled decline of the dollar (generally good for assets), I think that has to be the base case.

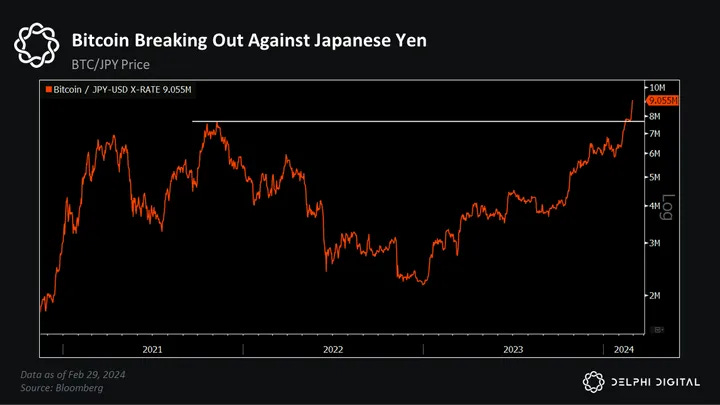

https://members.delphidigital.io/reports/bitcoins-global-breakout#technicals-favor-the-bold-e225 (2024-03-01)

BTC had already made new highs against currencies of countries suffering from high inflation (e.g. ARS, TRY, ZAR) — but now it’s breaking out to fresh all-time highs relative to several major currencies. Like the Japanese yen (JPY).

https://members.delphidigital.io/media/pro-crypto-insider-talks-april-2024 (2024-05-03)

The dollar screaming higher is the opposite of currency debasement in a lot of ways. It is it notable that when you put Bitcoin against other major currencies outside of the dollar, it’s still at or close to prior highs, and certainly it’s still higher than prior cycle highs of 2021, and you look at the yuan, or the yen, the Aussie dollar, South Korean won.

So a lot of this, again, ties back in that currency debasement narrative, the fact that the dollar is stronger, and the fact that we’ve had the expectations of Fed cuts push back, which has also helped to push up longer-dated yields, or actually short and long dated yields.

https://members.delphidigital.io/feed/the-dollar-strikes-back (2023-08-18)

This situation is probably close to doomsday and signals a collapse in other governments’ currencies and disastrous geopolitical issues as investors flee to more robust assets like the dollar, BTC, and gold. We may be seeing the early stages of this scenario. JPY (-6.6%) and CNY(-8%) have struggled lately against the dollar due to their economic weakness, rate cuts, and potential return to QE. The EUR could also start trending down against the DXY soon if they experience challenging headwinds, which may require QE and lower rates.

https://members.delphidigital.io/reports/the-end-game#worse-comes-to-worst-0da4 (2023-05-09)

Timing is everything. And timing the End Game is reminiscent of Arthur Hayes’ kaiseki meal — the destination is known, but the path is not. To restate in plain English, there’s no obvious point along the debt-to-GDP continuum where everyone finds religion and the system collapses.

End Gamers love to fearmonger about America’s debt-to-GDP, which sits at 120%. But that figure actually looks quite robust when compared to countries like Japan, whose debt-to-GDP weighs in at a hefty 241%.

https://members.delphidigital.io/reports/liquidity-cascades#caught-in-the-loop-0da0 (2022-09-23)

A central bank taking an ever-increasing role in its domestic financial markets has been pioneered by nations like Japan. This route poses its own set of problems, as we have seen with the Japanese central bank’s YCC (yield curve control) experiment.

BTC is the most levered bet on global monetary debasement. In the unlikely scenario that the Fed can remove itself from financial markets to a significant degree, will BTC remain an attractive asset? The question shifts to the intrinsic value provided by BTC in the form of decentralization, self-custody, and cross-border transfer of capital.

https://members.delphidigital.io/reports/btc-production-cost-market-insights-and-fuel-deep-dive (2022-07-18)

In our latest chartbook, we noted the dollar’s latest rally has come at the expense of the EUR and JPY, both of which are seeing material long-term technical breakdowns. EURUSD is trading at its lowest level in 20 years as the outlook for the euro area continues to weaken relative to its cross-Atlantic trading partner.

https://members.delphidigital.io/reports/the-bitcoin-bull-case-defi-treasuries-stable-regulation-the-delphi-debrief (2020-12-11)

If the Fed fails to deliver any major change, the upside risk to US Treasury yields is likely to jump. Even if they do decide to up the ante on asset purchases, a modest increase may fall short of market expectations.

If the market thinks there’s going to be yield curve control, then we can assume that BTC, gold, and mining stocks will take off. Yield curve control is rocket fuel for the scarcity trade.

https://messari.io/report/what-kind-of-safe-haven-asset-is-bitcoin (2020-03-03)

Stock markets worldwide experienced their worst week since the global financial crisis in 2008. United States treasury bonds rallied hard, with yields plummeting to their lowest point in history. Traditional safe haven currencies such as the Japanese Yen and Swiss Franc also caught bids as investors looked to protect themselves from the turmoil, liquidating nearly everything else in the process.