Balaji & Dalio: Dollar Crisis 🔫 vs Cryptocurrencies ➗ on World Order 🏁

Specifically, we have an economic polycrisis — a combination of banking crisis, debt ceiling crisis, municipal budget crisis, bond crisis, commercial real estate crisis, Ukraine crisis, de-dollarization crisis, auto loan crisis, credit card crisis, medical debt crisis, student loan crisis, insurance crisis, trade war crisis, energy crisis, and sundry other cascading crises all happening at the same time, each with a ~$100B-$1T+ price tag.

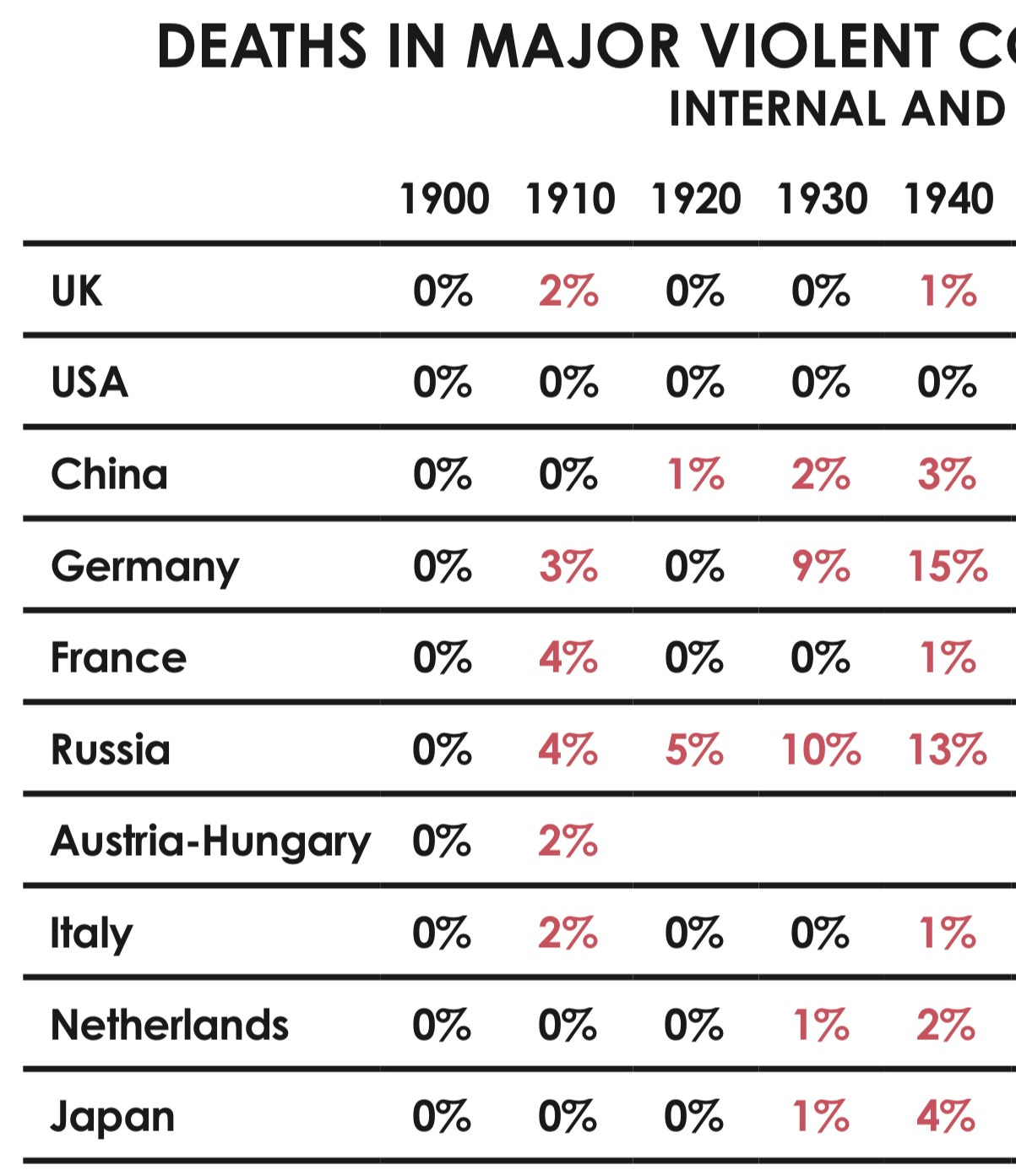

All this is happening at the same time the US is drawing down its strategic petroleum reserve, spending down the Treasury General Account, sharply increasing its debt, preparing for simultaneous conflict with both Russia and China, alienating its allies, experiencing antebellum levels of internal polarization, blocking the exits to other currencies, and suffering high levels of inflation.

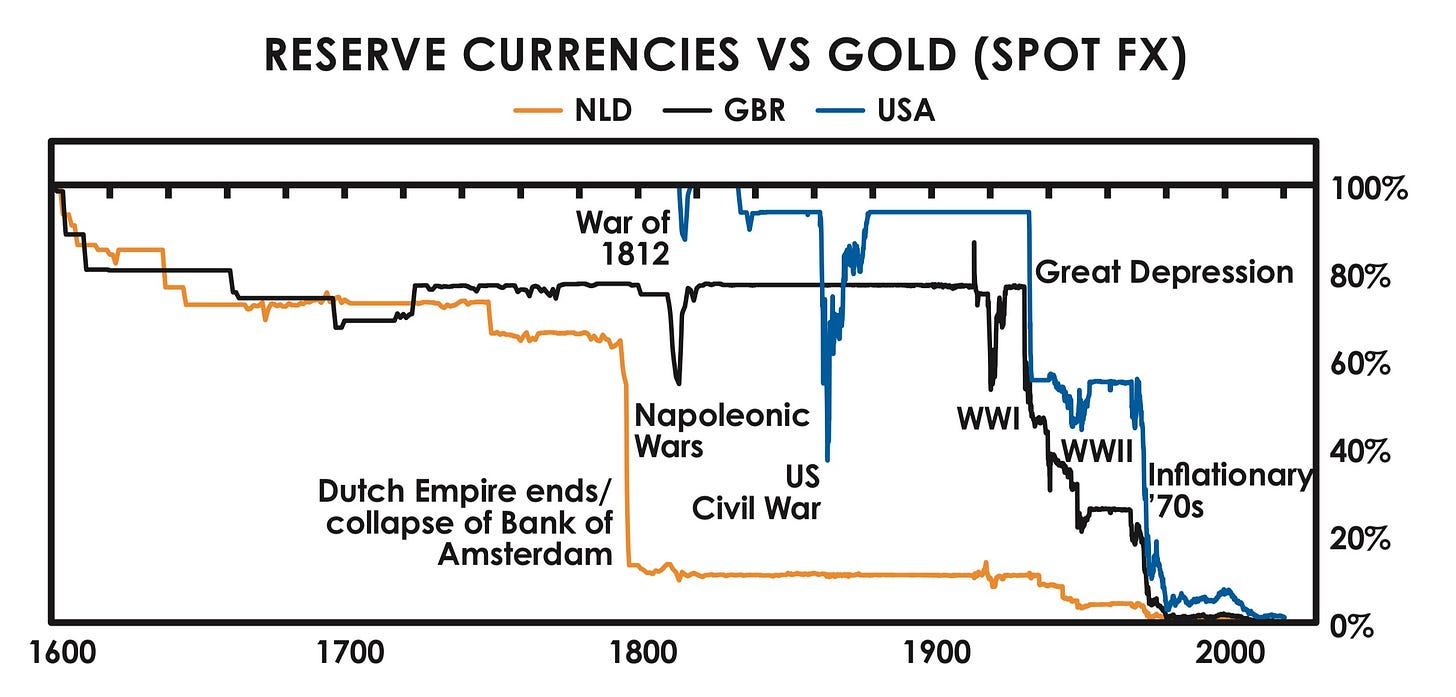

Others don’t believe the US can or will pay its $31T+ in debt. Not without printing trillions, at least. That’s what Ray Dalio says. Nouriel Roubini too. And arguably even Warren Buffett and Alan Greenspan. They all say it in different ways, namely that the US can technically extinguish its debt…by printing. This is called “monetizing the debt” or “debasing the currency”.

Balaji Srinivasan, PhD Thesis; October 2005. The [Bhatnagar–Gross–Krook] BGK and [Linearized Riemann State] LRS schemes for computing Euler and Navier Stokes flows.

Upwind schemes for the Euler and Navier-Stokes equations may be broadly classified into two distinct classes: those based directly on the macroscopic Navier-Stokes equations and those based indirectly on the Navier-Stokes equations via the Boltzmann equation. The former, conventional approach represents the majority of current research. However, recently gas-kinetic methods have gained attention as a robust alternative to the more conventional Navier-Stokes based ones.

I mentioned that I don’t really care about the jobs report that much. So what do I care about? I care about the fact that the Treasury + Fed (which we shall abbreviate as the US government)2 abused everyone’s trust by (a) selling hundreds of billions of dollars worth of bonds in 2021 on the pretense that interest rates would be held near zero and then (b) mass devaluing them in 2022 with surprise rate hikes, setting the stage for (c) not just the ongoing banking crisis but a crisis of the Western financial system itself.

If you want an analogy for what happened, imagine that Apple told Best Buy, Target, and Walmart that it was only going to be selling iPhone 10s for the indefinite future, and sold them billions of dollars worth of phones on the basis of that representation. Then after selling those billions, it turned around and launched the iPhone 11 — suddenly devaluing all the inventory it had just sold, and forcing Best Buy, Target, and Walmart to sell their billions of now-depreciated iPhone 10s for a 10-20% loss…small in percentage terms, but massive when multiplied across that much inventory, especially for something they didn’t expect to take a loss on. Had Apple done this — had it committed to not launching a new phone in writing to its buyers, and then reneged on that promise after dumping billions in old inventory on them, we’d call that fraud. Apple would have sold those assets on false representations, regardless of whether they knew they were going to devalue the assets at the time of sale.

Now, Apple probably wouldn’t do that! But that’s what the Treasury and Fed did to their banks in mid-2021. They sold billions of dollars worth of bonds at low interest rates, telling the banks over and over and over again that inflation was transitory and that they wouldn’t hike rates. Banks reluctantly “binged” on those bonds, and then — surprise! — the Fed hiked rates to the moon. And Treasury began selling new bonds with much higher interest rates, like the iPhone 11s in our analogy, thereby devaluing everything the government had just sold.

Whether intentionally or not, consciously or not, the US government executed the mother of all rug pulls on its own banks (and other financial institutions). Like Stalin killing his most loyal communists, Powell killed his most loyal capitalists, the biggest buyers of Treasuries. This is exactly what we’re talking about here, an enormous abuse of trust.

See, many financial institutions bought supposedly safe bonds from the government in 2021. But then that same government did a massive surprise devaluation of all of the bonds it had just sold — screwing over its biggest customers, from banks to insurance companies, causing the largest losses in bond history, and saddling institutions what Stanford researchers estimate to be literally trillions in unrealized losses.

Anyway, this is what happened in March 2023 when five huge banks died in quick succession, followed by a quick print called BTFP to cover up the Fed’s failure. Bond losses are why Roubini is saying “most” banks are insolvent and why Bank of America alone has $100B in unrealized losses. A similar phenomenon in Europe1 is why Germany’s central bank apparently has negative equity and pensioners face massive losses.

Hedging gets combinatorial. You can hedge bonds on many different parameters. Interest rates are just one parameter. Another might be the probability of sovereign default. A third could be inflation. A fourth might be exchange rate risk if you’re working from a foreign jurisdiction. And so on and so forth, and that’s just for bonds. It quickly gets combinatorial and you can’t hedge every possibility without giving up all your margin.

The Fed's Self-Bailout is ♾ + $25B

It then promptly devalued the assets it had just sold by hiking rates to the moon in 2022, causing massive unrealized losses for all bondholders. This is what led to the banking crisis of early 2023, when some of those losses suddenly became “realized” because depositors (not unreasonably) asked for the money in their checking accounts.

So: Fed lied, banks died. The Fed lied about keeping rates low, and banks died because they had bought bonds on the basis of those lies.

And as internal documents show, people at both Fed and FDIC knew that hundreds of banks had been rendered practically insolvent by their rate hikes, perhaps even most banks…but they didn’t tell you — the depositors.

See, Keynesianism is like Communism in that it sees no real difference between household and government assets. They recognize no moral limit on how much they can take from the population via inflation and seizure, only practical limits.

If you doubt this, ask a Keynesian if they would accept any hard limit on the money supply or upper bound on the tax rate. They won’t. And this is why they print trillions yet keep proposing “wealth taxes.” The implication is that every dollar can be diluted and every possession can be confiscated, if only the state can finagle some legal basis for it. Ideally via a 1000-page omnibus bill rammed through in the early hours over protest. The point being: your household assets will be taken to pay for what this failed state owes.

Because the traditional vehicle of the last few decades — the startup company — assumes a stable political environment that is no longer in evidence. For example, our literature on competition assumes founders are facing corporate rivals, not captured regulators. Our investment modeling assumes that some companies die over time from bankruptcy, not that many companies die at once from a failed banking system. And our theory around international expansion assumes that countries actually want economic growth, not that they’ll fight it with trade barriers, product bans, and regulations.

Even more fundamentally, if you’re in the West, you can no longer assume the power will be on, the roads will be open, the fires will be put out, or the crime will be put down. You can no longer assume your bank account will be there tomorrow, your passport will remain valid tomorrow, or that your speech will remain free tomorrow. You can’t just start a space company, or even a taxi company, without worrying about the politics of it all.

The Bitcoin ETF is the spiritual reversal of Executive Order 6102

Justice McReynolds' then-famous dissent denounced the ruling in the harshest terms, noting that the "Constitution is gone" and the "dollar...may be 30c tomorrow, 10c the next day, and 1c the day following".

It's not just the DC Circuit case. The ideological conflict between decentralization and centralization is reflected in the 3-2 vote for the Bitcoin ETF approval itself. Read Peirce's brilliant pro-liberty approval, Crenshaw's dour denial, and Gensler's reluctant approval.

You'll see echos of the gold clause case, but in reverse. This time, it is the centralized state that is being forced into a grudging institutional surrender. And a surrender it is, as Crenshaw's dissent makes clear:

"...there is no primary regulator for the bitcoin spot markets. Spot bitcoin ETPs will be participating in an unregulated, fragmented, continuously traded, global free-for-all. Even if there were a primary regulator for this market, much of it could be beyond the reach of U.S. regulation..."

Let that sink in! This is what the US establishment truly fears: not Bitcoin as "fraud", but Bitcoin as freedom. They want to rule not just you but the world, so they're scared of the prospect of "a global free-for-all..beyond the reach of US regulation". And they know that any spot ETF will bid up the price of self-custodied Bitcoin outside their control, as Satoshi intended.

Today there are about 2000 billionaires, so 4000/(4000+2000)=0.66 would mean ~66% of billionaires were from crypto, which is an overshoot. As I recall, back when my colleague estimated this the actual threshold was ballparked as $200k/BTC, as a point between $100k-$1M/BTC to guess when 2000 rather than 4000 new billionaires came from crypto.

Global Crypto Regulation: Who’s Hot and Who’s Not?

The Bahamas has been successful in attracting FTX, whilst Bermuda is providing a regulatory base for Circle. The heavy hitters in this group are Switzerland and Japan, who have both been early movers in crypto regulation and are generally viewed as crypto-friendly jurisdictions. In Europe, the likes of Portugal, Slovenia and Liechtenstein are worth highlighting for their favourable tax policies for crypto.

A significant new entrant into this category is the United Arab Emirates which has recently created the Virtual Assets Regulatory Authority “VARA”, as part of the vision to become a leading jurisdiction for crypto. This has already attracted large crypto firms such as Three Arrows. Watch this space...

4. Accommodating: Anguilla, Antigua & Barbuda, Bahamas, Belarus, Bermuda, Cayman Islands, Central African Republic, Georgia, Gibraltar, Grenada, Guernsey, Isle of Man, Jamaica, Japan, Jersey, Liechtenstein, Malta, Mauritius, Monaco, Norway, Palau Panama, Portugal, Puerto Rico, Saint Kitts and Nevis, Slovenia, Switzerland, Ukraine, United Arab Emirates, Uruguay, Uzbekistan, Vanuatu.

https://www.wired.com/story/balaji-srinivasan-ditch-chaos-country-cloud/

A Billion Here, a Billion There: Crypto Remittances Are Suddenly Real Money

“Before Bitcoin, like most migrants, she would send her money via the international transfer companies Western Union, MoneyGram, or Vigo. They all charged her, on average, $10 for every $200 she sent. Meanwhile, companies like Mexican crypto exchange Bitso charge commissions as low as $1 per $1,000 sent.”

The nation of El Salvador, which recently passed a law treating Bitcoin as legal tender, relies on remittance payments for over a fifth of its GDP according to figures from the World Bank.

The most valuable collectibles will always be the most culturally significant ones, and there is nothing more culturally significant on the internet than memes. And love it or hate it, NFT memes have the media’s undivided attention.

The free and open meme economy will enable savvy memesters to use existing memes as on-chain templates, rewarding the original creator with ownership in the new meme. We’ll even be able to trace a meme’s distribution/’spread’ in real-time as it’s engaged with, invested in, and templated.

The 2021 Crypto Crystal Ball: Halftime Edition

Su Zhu, Three Arrows Capital. Several central banks will announce substantial stakes in BTC. Most investment banks and private banks will announce crypto offerings. DeFi TVL will pierce through $100B. Coinbase IPO will trigger a frenzy of M&A. Several large public companies will issue BTC-related capital structure instruments. Bitcoin dominance to go significantly higher. Options markets volume to become over 50% of all crypto derivatives markets. Island nation formed with crypto as the main currency.

Larry Cermak, The Block. Market structure continues to mature with options having another big year and Binance finally launches an options offering that will directly compete against Deribit. PayPal launches a stablecoin on Ethereum and stablecoins start finding a product-market fit in areas outside of trading. Non-custodial derivatives take off due to Optimism and capture 10% of CEX’s open interest by year-end. Coinbase market cap is above $80 billion at one point, which leads to the repricing of other pure crypto play companies. M&A starts heating up with traditional companies targeting profit-generating crypto companies. FATF crypto guidance starts getting implemented, which will put pressure on jurisdiction-less crypto-to-crypto exchanges.

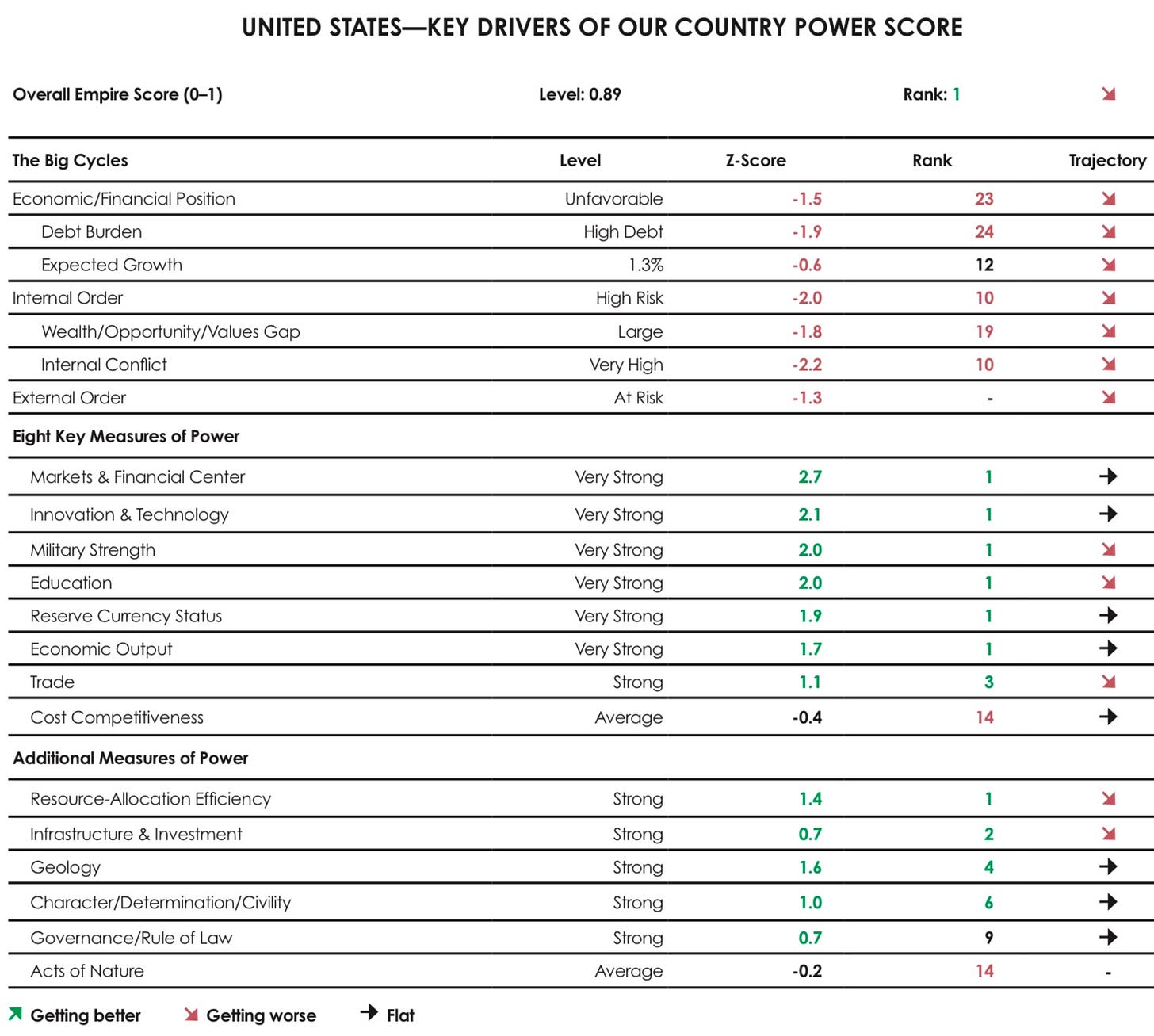

Dalio on Countries & Empires

https://economicprinciples.org/downloads/cwo-power-index.pdf

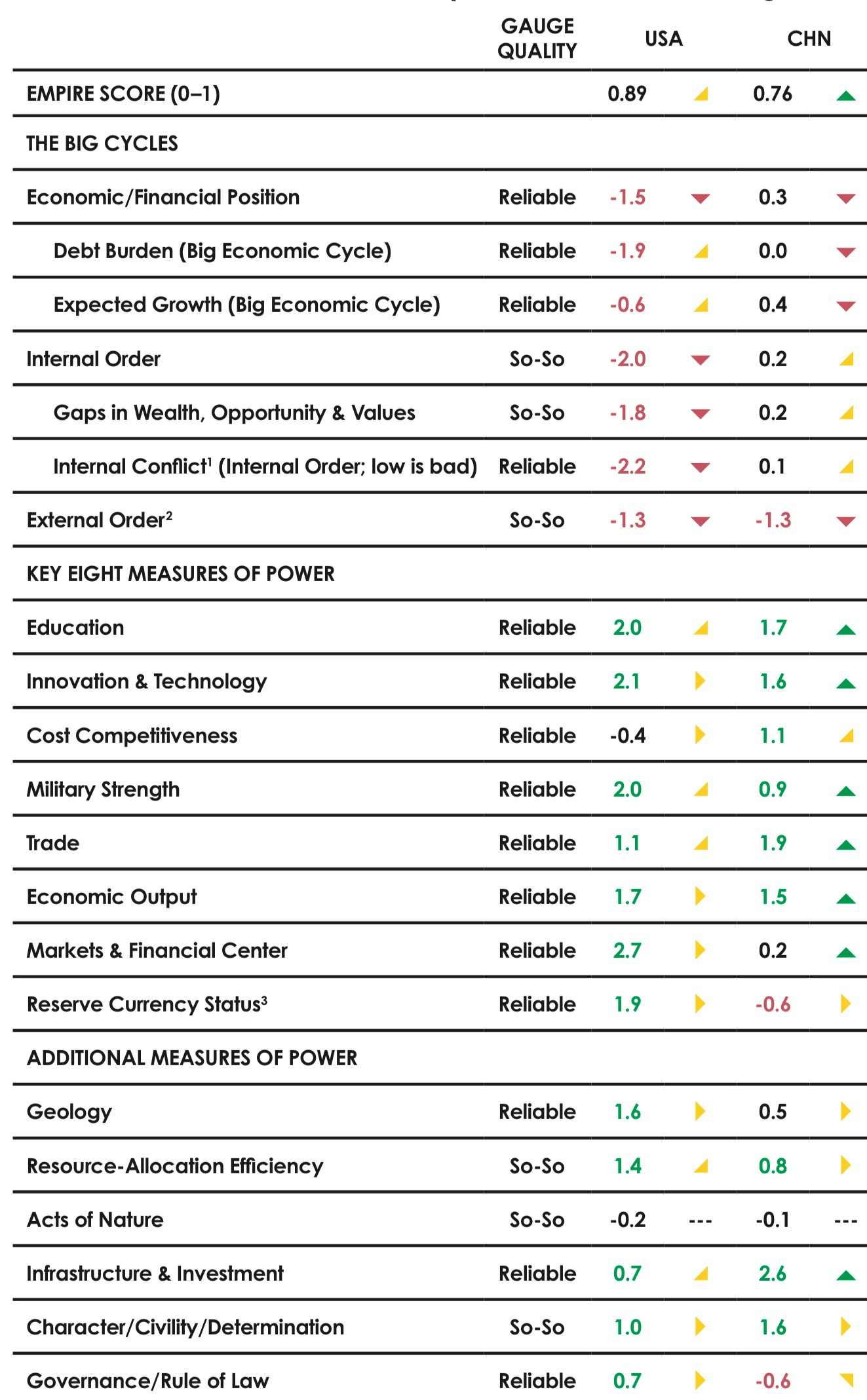

The United States is in an unfavorable position in its economic and financial cycles, with a high debt burden and relatively low expected real growth over the next 10 years (1.3% per year). The United States has significantly more foreign debts than foreign assets (net [International Investment Position] IIP is -68% of GDP). Non-financial debt levels are high (274% of GDP), and government debt levels are high (127% of GDP).

The bulk (99%) of these debts are in its own currency, which mitigates its debt risks. The ability to use interest rate cuts to stimulate the economy is low (short rates at 0.1%), and the country is already printing money to monetize debt. That said, being the world’s leading reserve currency is a large benefit to the US. If this were to change, it would significantly weaken the US position.

https://www.economicprinciples.org/DalioChangingWorldOrderCharts.pdf