1Market 🎰 as Binary Options for 🧨 Explosive Politics 🥊 on Polymarket ∩ Telegram

Introducing 1Market, the massive game of binary options on presidential elections, popular votes, and sports champions. As a Telegram mini app via our onchain perpetual exchange, 1Market offers 0-step wallet setup, 1-click instant bets, and 2-side market liquidity.

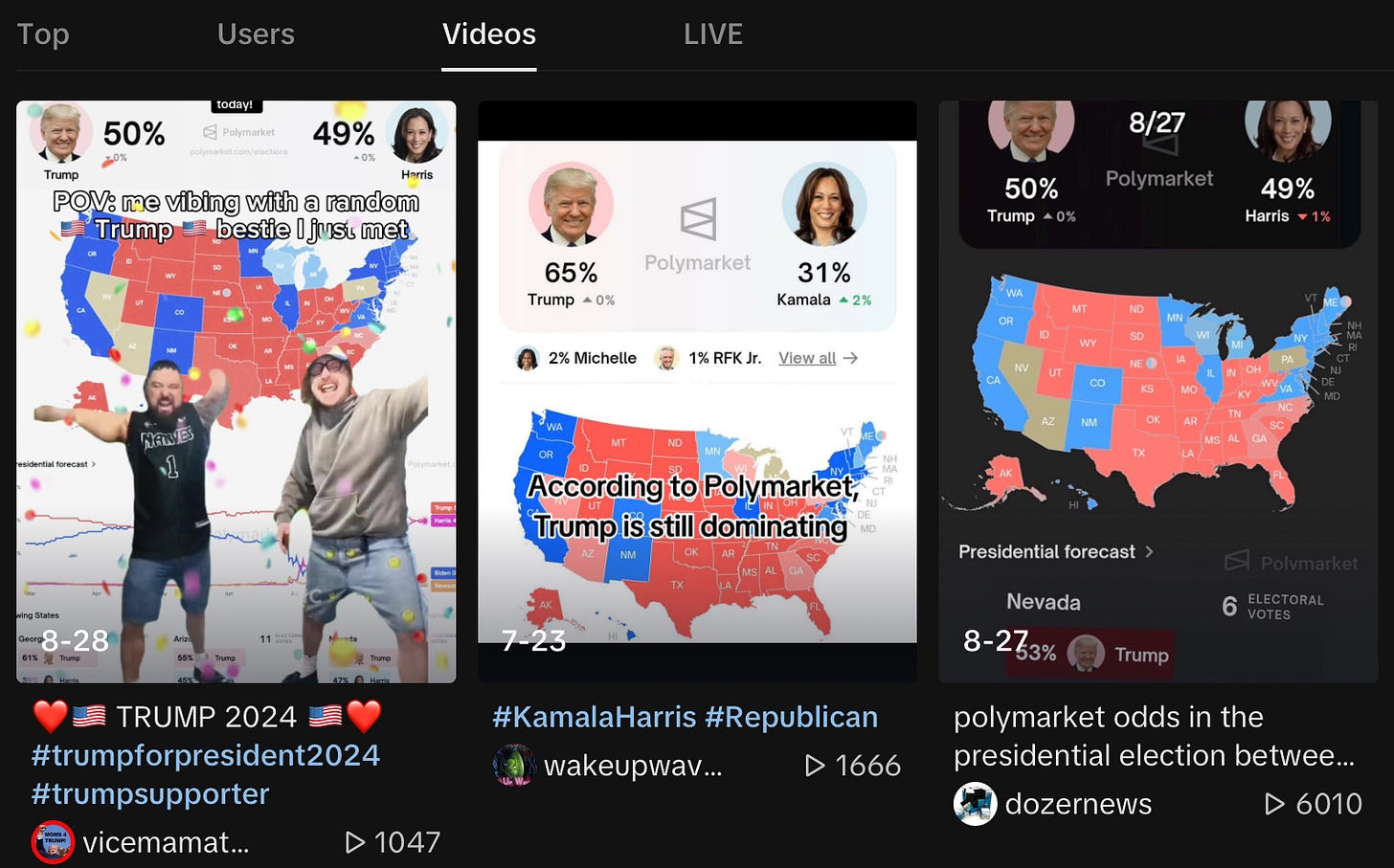

1Market for Harmony Shard 1 with ONE 0.00%↑token, like POLYmarket for POLYgon, appeals to 1 billion consumers: Gen Y (digital native) with crypto investment, Gen Z (mobile ready) with memetic community, or Gen 𝛂 (video obessed) with meta attention.

Things fall apart; the centre cannot hold / Mere anarchy is loosed upon the world.

The best lack all conviction, while the worst / Are full of passionate intensity.

https://members.delphidigital.io/feed/bet-prediction-markets-on-drift (2024-08-20)

Available liquidity from the $500M+ deposited into Drift (important). This is the most important aspect of Drift’s prediction market. Polymarket is at $12M 24-hour volume compared to on-chain perpetual eclipsing $4.5B. Through integrating preexisting Drift deposits with BET, Drift is solving a difficult issue: getting users to deposit into your platform. In a way, Drift is using its market fit for perpetual as a means to grow its market share for prediction market.

Both these markets have ‘deep’ liquidity relative to Polymarket, but given the positioning of the orders, I suspect it is more arbitrage-focused/spoofing than wanting to take a directional position. This is because the liquidity is thin around the mark price. Additionally, there is very little open interests (OI) on the two markets (< $300k combined).

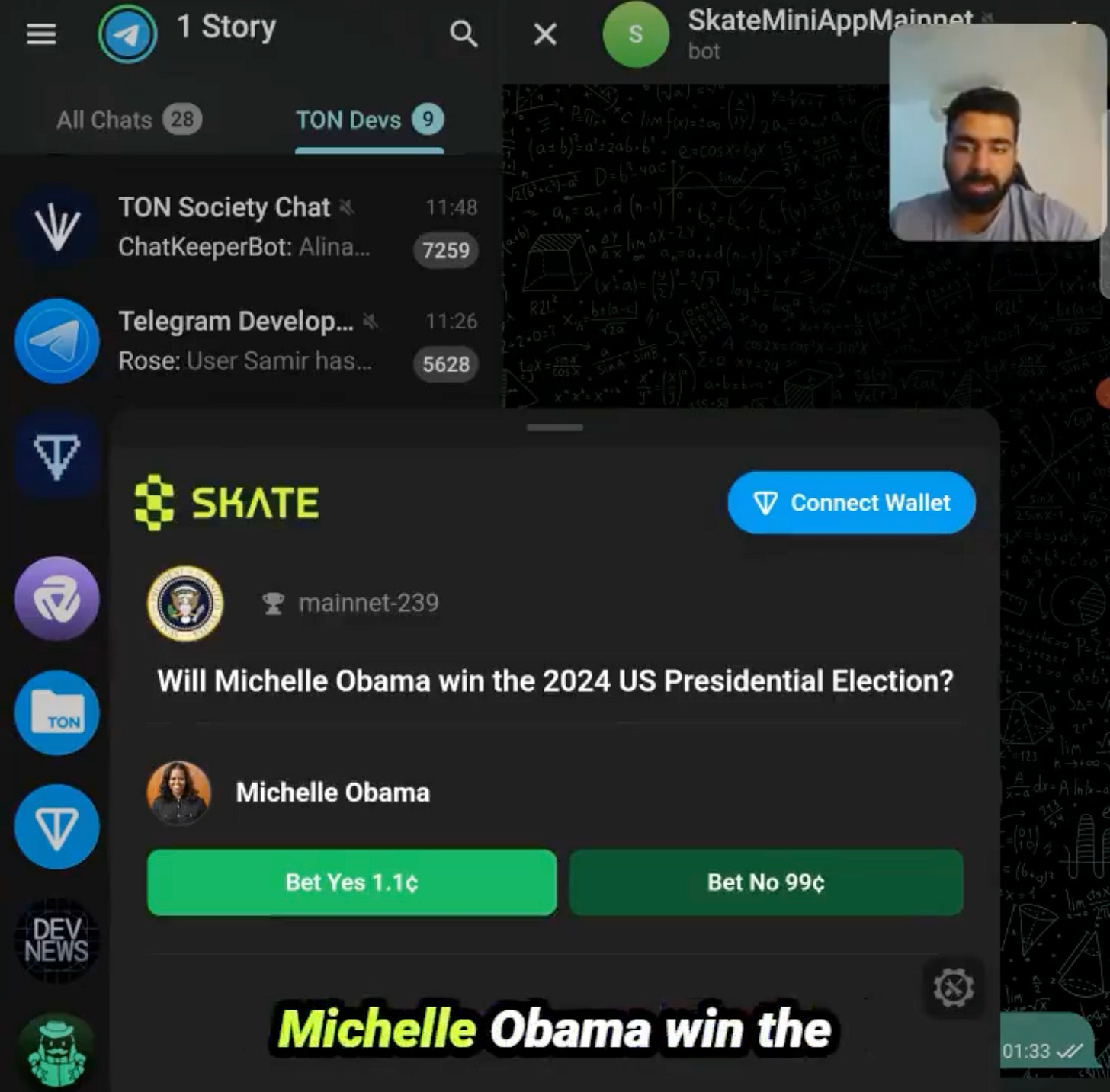

https://followin.io/en/feed/12295321 (in chinese or tweet: Using Polymarket on Telegram? How SkateChain seamlessly integrates it into the TON ecosystem)

Skate relies on a hub-and-spoke architecture and leverages the EigenLayer to achieve fast finality. A periphery is deployed for each chain that the user interacts with, but for the same application, there is only one kernel application, which is why there is a single application state.

Users express their intentions within the Telegram mini-app on TON, and this intention is picked up by the executor and executed on the kernel deployed on Skate. This kernel currently basically stores the mapping of the proxy contracts, multi-signature wallets and their TON addresses deployed by users on Polygon, and enables all callbacks from TON to Polygon.

https://vitalik.eth.limo/general/2024/08/21/plurality.html (Plurality philosophy in an incredibly oversized nutshell)

Twitter's Community Notes, whose note ranking system is already designed to favor notes that gain support across a wide spectrum of participants. One natural path toward improving Community Notes would be to find ways to combine it with prediction markets, thereby encouraging sophisticated actors to much more quickly flag posts that will get noted.

Prediction markets are a purely financial mechanism: they do not distinguish between $1 million bet by one person and $1 million bet by a million unconnected people. Per-person subsidies prevent people from outsourcing the bets that they make with these subsidies, eliciting participants' knowledge and insights and running a Polis-style discussion platform that encourages people to submit their reasoning. Perhaps using soulbound proofs of previous track record on the markets to determine whose voice carries more weight. Prediction markets can be a tool for retroactive public goods funding: quadratic voting for the after-the-fact piece (evaluation), and per-person subsidies for the before-the-fact piece (prediction).

https://messari.io/report/yes-or-no-on-polymarket (2024-08-12)

Polymarket (the largest distributor of conditional tokens) gives out higher rewards to liquidity providers who provide bids within a tighter spread. We believe most market makers on Polymarket would not be on the platform were it not for the daily rewards.

Polymarket’s CEO has hinted at the potential to turn on fees. Sportsbook users are accustomed to over 4% in average fees; Polymarket can justify the fee premium over a traditional DEX. New prediction markets have come from Vega Network, Drift on Solana, Predict.fun on Blast, and developers on TON and MegaETH – experimenting with leverage, offering more “degen” market types such as parlays, using futarchy for DAO governance proposals.

https://blog.vega.xyz/colosseo-release-part-ii-ec32bcc5846b (2024-08-08)

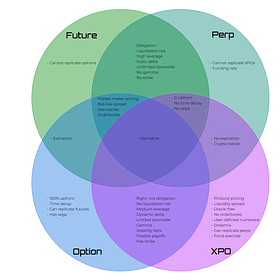

Prediction Markets (Capped Futures): The Colosseo II release introduces the ability for users of the Vega network to create and trade on prediction markets, where settlement is based on specific event outcomes. By combining capped futures and binary settlement, capped futures can effectively be used to create prediction markets, with LPs quoting “odds” via the bids and asks they’re willing to offer.

https://docs.predict.fun/developers/technical-overview

At the core of this system are smart contracts such as the

ConditionalTokenscontract, which is based on the Gnosis Conditional Tokens standard. It allows tokens to be split into new conditional tokens (also known as positions) and merged back into the original backing token. Once a condition is resolved, the contract adjusts the conditional tokens to reflect the final outcome, enabling users to redeem them according to the results.Another key component is the

CTFExchangecontract, which facilitates the on-chain execution and settlement of off-chain orders. When two orders are matched, the contract handles swaps between binary outcome tokens (ERC1155) and a collateral asset (ERC20). TheCTFExchangealso interacts with theConditionalTokenscontract to manage the splitting of collateral into different positions and their eventual merging back into collateral based on pairs of buy/sell orders.

https://vitalik.eth.limo/general/2021/02/18/election.html (Prediction Markets: Tales from the Election)

I bought my NTRUMP on Catnip, a front-end user interface that combines together the Augur prediction market with Balancer, a Uniswap-style constant-function market maker. Catnip was by far the easiest interface.

More interest in prediction markets going forward, not just for elections but for conditional predictions, decision-making and other applications as well. The amazing promises of what prediction markets could bring if they work mathematically optimally will, of course, continue to collide with the limits of human reality.

https://www.natesilver.net/p/betting-markets-think-biden-should (2024-07-19)

While I have complicated feelings about the relative merits of models and prediction markets [1], this is one of those times when prediction markets are probably the more useful tool. That’s because political events have been unfolding faster than polls or models have time to catch up with them.

Just in the past week, Trump was shot at and nearly killed, named J.D. Vance as his running mate, and accepted the Republican nomination with a very long speech in Milwaukee. Meanwhile, of course, Democrats are trying to figure out what to do about Biden, and our model isn’t accounting for the possibility that another candidate could replace him. Are traders reacting negatively to Trump’s meandering acceptance speech yesterday? No, not really. If you zoom into the Polymarket data, you’ll find that the market was essentially unchanged before and after the speech.

https://docs.drift.trade/prediction-markets/prediction-markets-intro

The security council (an elected multisig under realms governance) also acts as the resolver for all prediction markets. After an indicated resolution time, the resolution step is to update the oracle (to a fixed value 0 or 1) and setting an expiry date.

After the expiry date is set, users can only trade the market in reduce only mode (no new entrants or risk-increasing positions). After expiry date and settlement is triggered, users can settle their positions at the settlement price (determined by the stable resolution oracle).

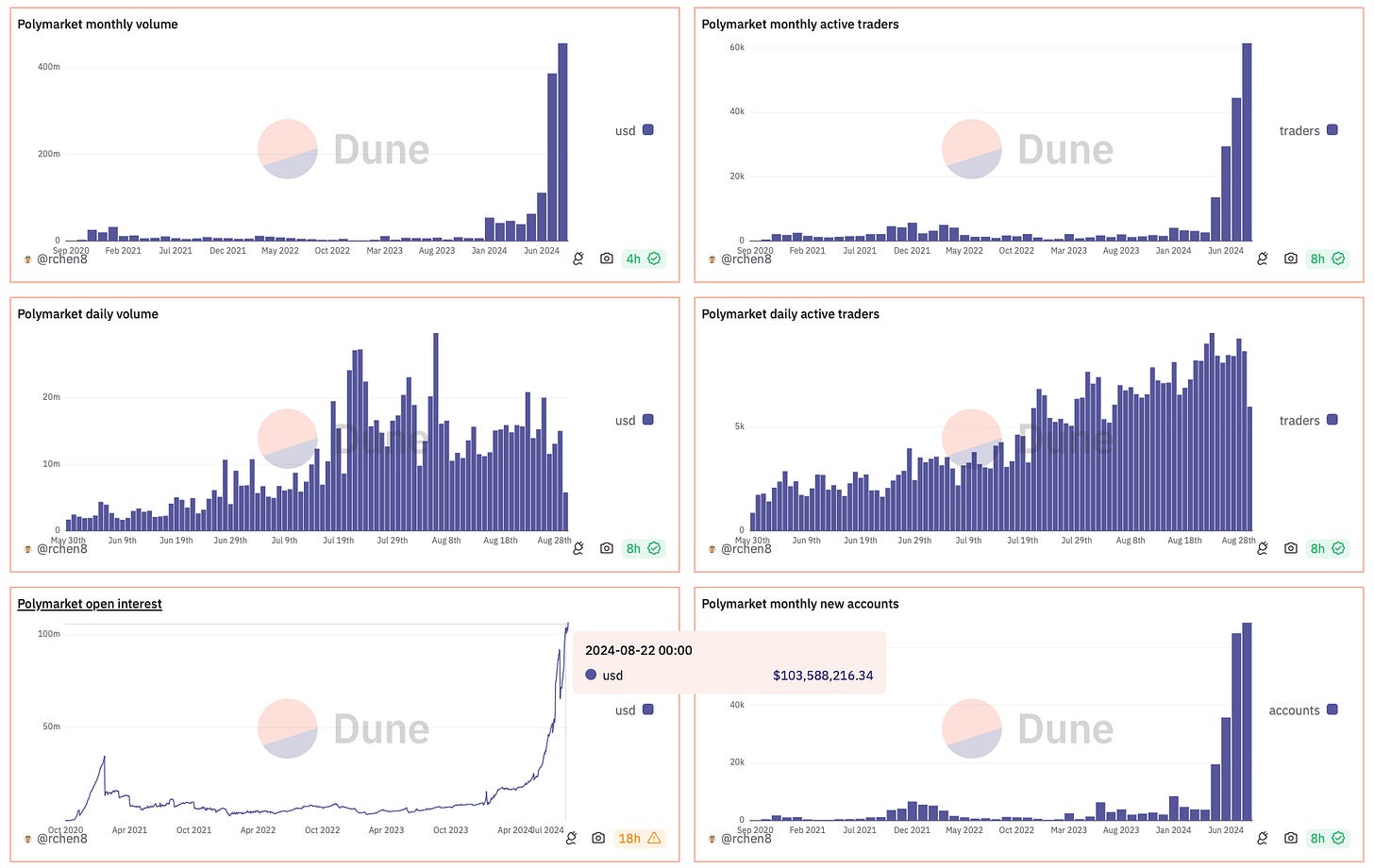

https://dune.com/lifewillbeokay/polymarket-clob-stats (vs rchen)

The GX.country suggests allocating 65% to LPs, 25% as a rebate to traders, and 10% to a trading competition. This structure incentivizes trading by double rewarding traders directly and discouraging unproductive activities like arbitrage and funding rate farming.

An extensive evaluation of 82 derivatives protocols was conducted. Each protocol was assessed based on several key factors: whether all its components are onchain, if the GitHub repository is open, if the protocol is on an EVM chain, the type of oracle it utilizes (push vs. pull), its traction within the market, and more.

As the DeFi landscape continues to evolve, Harmony's approach to building its derivatives ecosystem will remain flexible and responsive to market demands and technological advancements.

Each trade earns yield automatically, powered by Drift’s borrow/lend engine. Hedge on a Unified Platform: B.E.T allows the creation of “structured bets” — Create hedged positions by going long on a prediction market while simultaneously shorting Bitcoin. Utilize over 30+ tokens: Use your favorite Solana tokens — not just USDC, from yield-generating stables to LSTs!

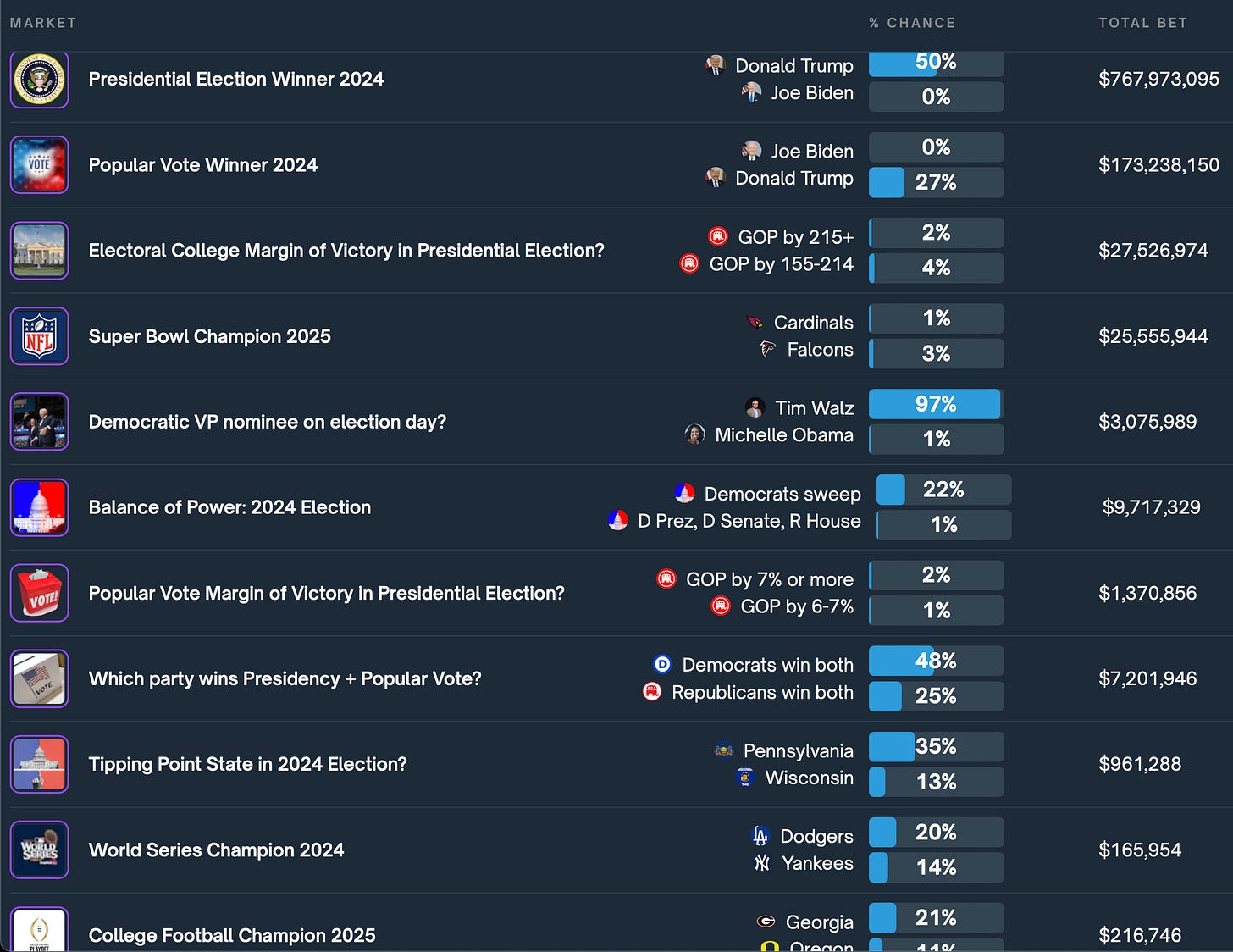

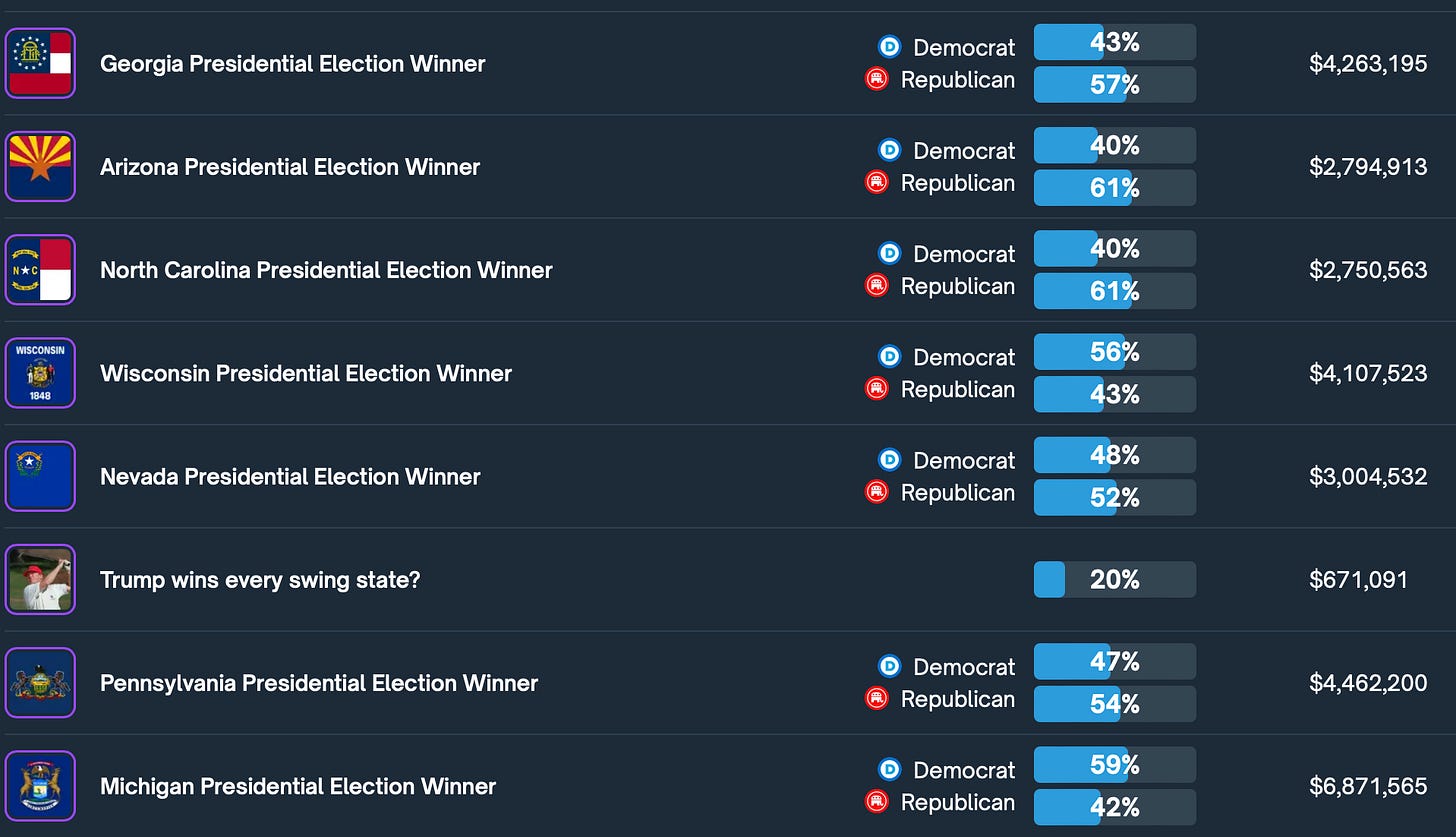

https://polymarket.com/markets/politics/swing-states (electoral college)

https://vitalik.eth.limo/general/2024/01/30/cryptoai.html

Prediction markets have been a holy grail of epistemics technology for a long time; I was excited about using prediction markets as an input for governance ("futarchy") back in 2014, and played around with them extensively in the last election as well as more recently. Meet AIOmen, a demo of a prediction market where AIs are players. People are willing to bet tens of billions on sports, so why wouldn't people throw in enough money betting on US elections or LK99 that it starts to make sense for the serious players to start coming in?

Hence, there is a need for a higher-level game which adjudicates how well the different AIs are doing, where AIs can participate as players in the game. This usage of AI, where AIs participate in a mechanism where they get ultimately rewarded or penalized (probabilistically) by an on-chain mechanism that gathers inputs from humans (call it decentralized market-based RLHF?)

https://iosiro.com/audits/thales-binary-option-market-smart-contract-audit

Other users wishing to partake in the market could mint new pairs of BinaryOption tokens (both Long and Short positions). Unlike the initial market creator, these users were charged a small fee for minting. This fee was distributed to the Thales Markets' fee pool and market creator. The minted tokens could then be sold or bought on any compatible third-party exchange or transferred, as the tokens adhered to the ERC-20 token standard.

https://www.nytimes.com/2024/05/17/business/elections-betting-prediction-markets.html

Offshore prediction markets provide a different perspective. Polymarket, which accepts only cryptocurrency, shows Mr. Trump ahead, as do betting sites in Britain and Canada that, like Polymarket, bar U.S. residents.

https://www.maximumtruth.org/p/prediction-markets-legal-case

The Iowa Electronic Markets is also exempt, as it holds the only other “no action” letter from the government — but you literally need to mail a check to fund an account there, and traders are limited to $500. It’s an academic’s hobby, not a business.

Manifold Markets has been a play-money market up till now, but in about a month, it will add a bit of a real-money aspect to the site, in which traders will win real-money prizes which are proportional to investment performance. Their strategy leans on an exemption in the law for sweepstakes, which are legal.

https://medium.com/inception-capital/the-prediction-market-primitive-e48a055676bf

The main open question lacking precedent is more in the direction of liquidity allocator AIs, AI players, and the development of self-improvement and goal-directedness in AIs — the evolution from basic machine learning to verifiable AI agents.

AI arbiters work faster and at much lower cost. xMarkets is building in this direction. Prediction markets at this scale would enable a different user experience, one that is more like Tinder or TikTok. Dither is another token recommendation AI with a token-gated Telegram alert bot, that takes a time-series modeling approach to token recommendation. Pond is building a decentralized foundational model of crypto, which has been applied in AI-generated token recommendations derived from on-chain behaviors.

https://www.maximumtruth.org/p/government-to-ban-all-us-election

CFTC regulations implemented after the 2010 Dodd-Frank Act prohibit event contracts that involve terrorism, assassination, war, gaming or activities banned by federal or state law.

But the regulations didn’t define “gaming,” which has led to disputes over whether the existing prohibition applies to contracts based on sports matches or political elections. Friday’s proposal spells out a definition of gaming that covers wagers on elections, sports or awards contests, meaning that such contracts would be barred.

🎯 On-chain & 💞 Open-source Perpetual Options in Harmony

Our goal is to make useful products and earn sustainable fees for Harmony’s DeFi ecosystem. Currently, onchain derivatives – such as options, futures, leverages – are the best market fit for a fast blockchain. They require very minimal dependencies: simply a token exchange such as Uniswap V3, and around $1M liquidity of even a single pair like ONE-USDT.

https://members.delphidigital.io/reports/a-new-framework-for-understanding-moats-in-crypto-markets#social-apps-7314 (2024-08-29)

Where value will ultimately accrue within the blockchain stack, The “Fat Wallet” Thesis: existing wallets may vertically integrate down the stack by enshrining native DEXs and other apps within their interfaces.

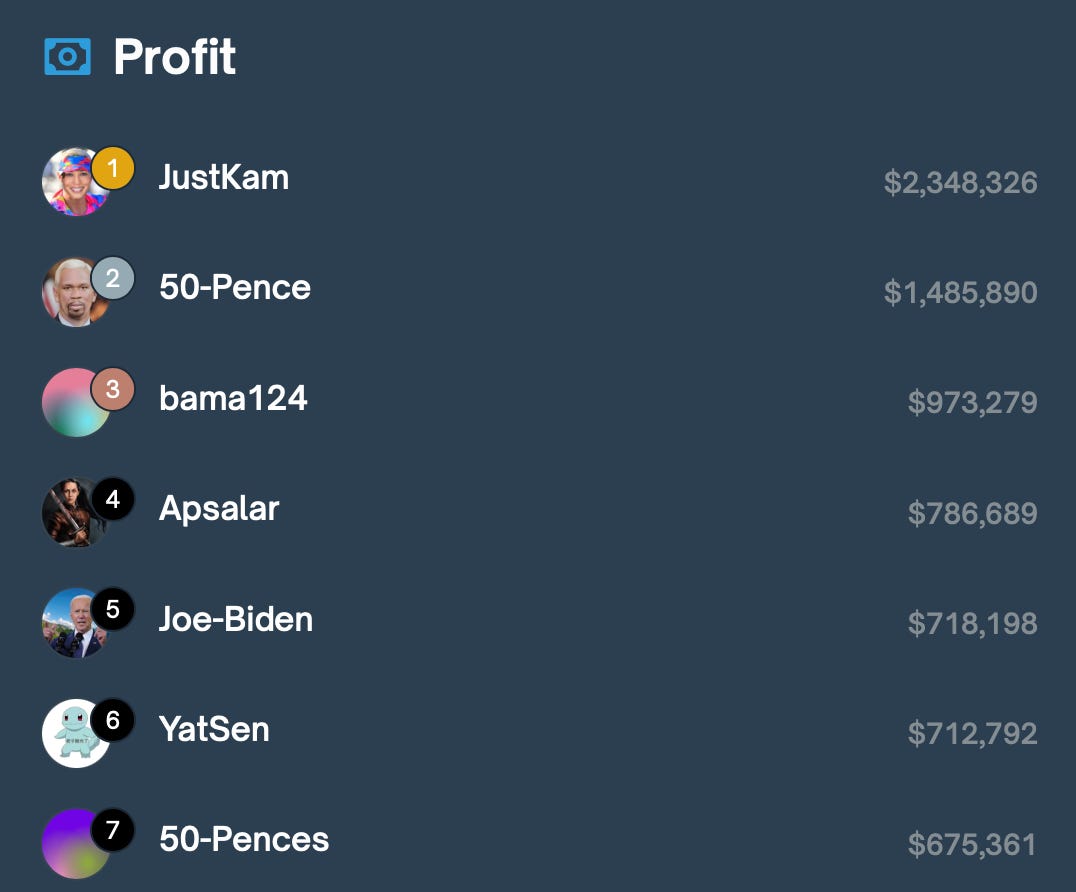

Perps DEXs such as Hyperliquid integrate social leaderboards that allow users to track the most profitable traders and possibly even replicate their strategies. Other apps such as pvp.trade also seem to be taking an implicitly more social approach by allowing friends to directly trade against one another. Instead of allowing user’s accounts to compose across a unified protocol layer, apps such as friend.tech and Fantasy Top have instead opted to build in a siloed environment with the hope of raising switching costs and thus owning the network effects themselves – but relinquishing the fundamental value prop of crypto social (i.e., social graph composability).

https://cn.ft.com/interactive/165538/ce (Kamala Harris draws level with Donald Trump in race for the White House)

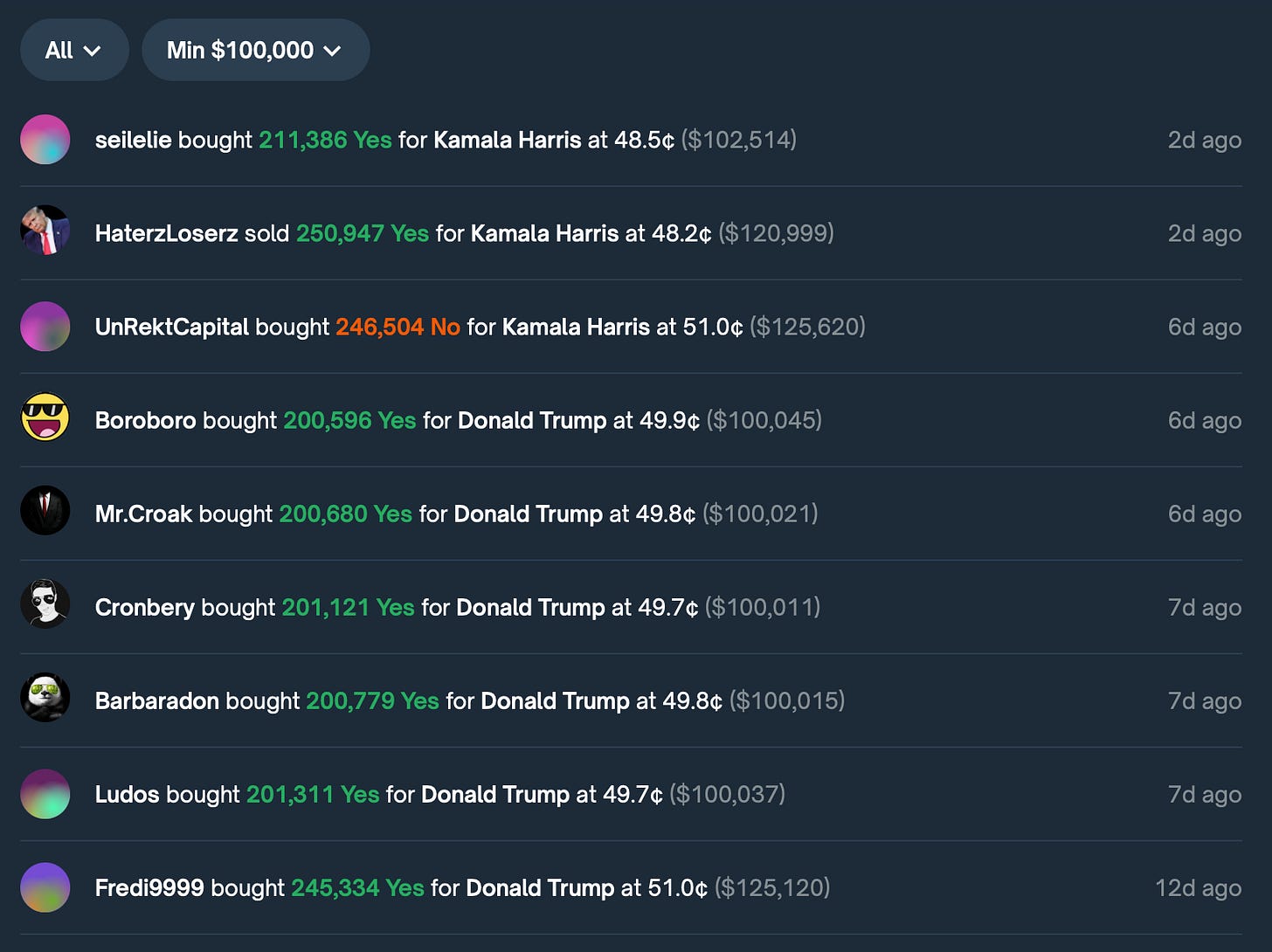

Predictive traders closely tracking the race have noted these shifts. Harris has eclipsed Biden’s pre-debate price on two prediction markets, Polymarket and PredictIt, though they still see her as a slight underdog to Trump, whose own price spiked after he was shot in an attempted assassination on July 13.

https://www.ft.com/content/32134dd1-8215-43c9-a2db-f37912612393 (Is political prognostication a fool’s game?)

The profit-motivated mass trading on prediction markets has been an attractive option. Prominent of these include PredictIt, a market allowed by but later fighting with the Commodity Futures Trading Commission (as I write in late July: Trump, 54 cents; Harris, 48 cents), and Polymarket, a crypto prediction platform with the venture backing of Peter Thiel (Trump, 59 cents; Harris, 38.3 cents). More than $440mn has been wagered there on the White House winner. Silver has reportedly joined Polymarket as an adviser.

https://en.wikipedia.org/wiki/Polymarket

According to the CFTC, Polymarket offered "substantial cooperation" throughout the investigation which resulted in the company receiving a lower fine. In May 2022, Polymarket appointed J. Christopher Giancarlo, a former Commissioner of the CFTC, as chairman of its advisory board.

https://benjaminsturisky.substack.com/p/do-prediction-markets-work (2024-08-01, also on Delphi Digital)

Disregarding external markets to hedge/use (these do not always exist), arbitraging this market is effectively the same as purchasing a singular coin flip at 48c. The second reason is theoretical and highlights information asymmetry. If prediction markets are used as the sole source of truth for event probability, it is likely traders would be unwilling to arbitrage the market. That changes the model significantly because now a trader needs to be willing to take on the directional risk while simultaneously betting that the bidder at 52c has no asymmetric information.

Though blockchain technology isn’t necessary for this type of application, Polymarket uses a network called Polygon, which operates 24/7 and sits atop Ethereum, where transactions cost fractions of the chain’s normal fees.

However, instead of US dollars, customers who want to make trades on Polymarket use the dollar-based stablecoin USDC. But even that is changing. Last Wednesday, Polymarket announced it is enabling users to pay for their bets using bank transfers and credit cards through a partnership with Miami-based MoonPay.

https://www.ft.com/content/e08c6c09-f9ce-45e1-bc81-a23e075ba610 (Who are the favourites to become Kamala Harris’s running mate?)

Josh Shapiro (Governor of Pennsylvania). Harris needs a boost in the swing state of Pennsylvania, site of Trump’s recent assassination attempt, and Shapiro could help deliver it… his Jewish background could be a liability on a ticket already holding the first African-American female candidate. However, according to prediction market Polymarket, he is currently the favourite to be Harris’s running mate.

Self-custody, with Safe, enhances security by requiring multiple signatures for transactions, reducing the risk of unauthorized access compared to single-signature EOAs. It also ensures users maintain full control over their assets, avoiding the risks tied to third-party custodianship.

With decentralized dispute resolution with UMA, a resolution request is sent to the Optimistic Oracle when a market is created. Users can propose resolutions, followed by a challenge period. Disputes are handled by submitting them to UMA's Data Verification Mechanism (DVM) for a decentralized vote by token holders. This process removes the need for centralized authority, enhancing trust and fairness in prediction markets.

“This would enable users to place bets on predictions markets directly through Twitter via Blinks… significantly enhancing composability by allowing capital allocation without leaving social applications,” Bautista said.

https://www.kucoin.com/zh-hant/learn/crypto/what-is-polymarket-and-how-does-it-work

First Cat Memecoin to Touch $1B Market Cap: As meme coins gain popularity, Polymarket featured a market predicting which cat-themed memecoin would first reach a $1 billion market cap. Traders used trends and social media buzz to make their predictions, reflecting the speculative nature of the memecoin space. $2.1 million of bets have been placed so far on this poll on the Polymarket platform.

Bitcoin Price Dip in August: During periods of high market volatility, Polymarket users predicted specific dip levels for Bitcoin prices in August. These markets allowed traders to bet on various price points, incorporating their analysis of market trends and macroeconomic factors. So far, $125,000 has been placed by users who expect the Bitcoin price to dip to $55,000 or lower in August.

Augur is not the first online service that allows people to buy and sell predictions like shares. Since 1988 it has been possible to bet on American elections via Iowa Electronic Markets (IEM), run by the University of Iowa. PredictIt, a site based in New Zealand but with a largely American audience, and Betfair Exchange, a British service, also let users bet on political events. Some firms run such markets internally, for instance to predict demand for a product. All have the same goal: to gain insights into the future by giving those who hold useful information an incentive to reveal it.

https://www.economist.com/interactive/us-2024-election/prediction-model/president/how-this-works

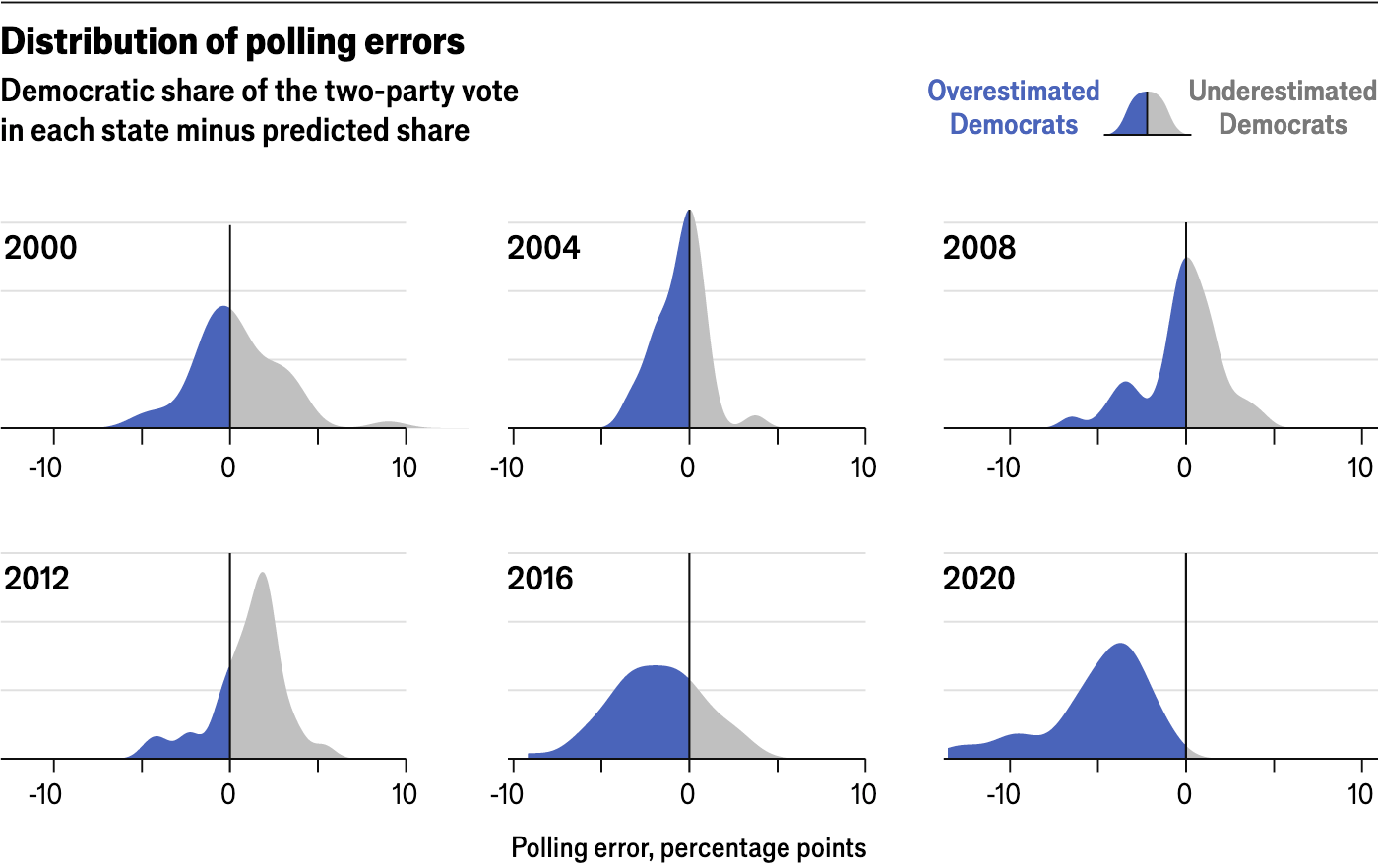

Drew Linzer, a political scientist, in 2013 uses a statistical technique called Markov Chain Monte Carlo (MCMC), which explores thousands of different values for each parameter in our model, and evaluates both how well they explain the patterns in the data and how plausible they are given the expectations from our prior.

For example, what would the election look like if all online pollsters over-estimated the Republicans’ vote share by five percentage points? How about if all national polls over-estimated Democrats by two? If state polls of Michigan are oscillating by ten percentage points at a time, the model will incorporate more uncertainty in its prediction of the vote there—and in its predictions of the vote in similar states, such as Ohio.

https://www.economist.com/interactive/us-2024-election/trump-harris-polls

Their approach treats each poll as an imperfect estimate of some “true” support for each candidate. A statistical model is used to estimate the “true” voting intention, given recent polls. The model takes into account differences in methodology between polls and the partisan tilt of individual polling firms’ output.

https://defillama.com/protocol/polymarket#information

Competitors: Azuro ($7.56m), Thales ($332,881), ZKasino ($237,981), MegaMoon ($182,852), PRDT ($169,097), Lumi Finance ($5.67m), Gnosis Protocol v1 ($5.19m), Augur ($1.99m), EtherFlip ($1.85m), WINR Protocol ($1.51m).

Investors: 1Confirmation, Balaji Srinivasan, Calvin Liu, Electric Feel Ventures, Jack Herrick, Josh Hannah, Kain Warwick, Kal Vepuri, Marc Bhargava, Meltem Demirors, Naval Ravikant, New Form Capital, ParaFi Capital, Polychain Capital, Robert Leshner, Robot Ventures, Stani Kulechov.

2024-05-14 Series B - Raised $45m Investors: Founders Fund, 1Confirmation, ParaFi, Vitalik Buterin, Dragonfly Capital.

https://www.kucoin.com/zh-hant/learn/crypto/top-politifi-coins-to-watch

The MAGA token primarily functions as a speculative asset in the PolitiFi market. It has been used to engage communities through meme culture and political satire. Additionally, the decentralized autonomous organization (DAO) behind MAGA has directed proceeds from token sales toward charitable causes, such as assisting homeless veterans and combating child trafficking. This dual approach of speculative investment and social impact has broadened its appeal.

https://blog.ton.org/ton-foundation-and-hash-key-group-announce-a-strategic-partnership

TON recognizes Hong Kong’s emerging status as a Web3 center and is eager to provide the local community with the means to innovate on TON Blockchain. This collaboration aims to fuel the Hong Kong Web3 renaissance by fostering innovation, easing access to digital assets, and backing new projects in the TON Ecosystem, setting the stage for significant changes in the blockchain and cryptocurrency sectors.

Improved Liquidity for Prediction Markets (ethz.ch)

The theoretical section reviews mechanisms of order books, AMMs, and market resolutions, as well as game theoretic properties of prediction markets. In the data analyses we scrape and study over 2 million transactions, analysing biases and accuracy against several dimensions.

Through this data analysis we identify problems with liquidity provisioning for converging prediction markets, and we propose the Smooth Liquidity Market Maker (SLMM) to address this issue. The SLMM is expected to improve liquidity provisioning, and thereby increasing both trading volume and the accuracy of prediction markets.

A $45m Series B led by Founders Fund and insiders 1confirmation and ParaFi + Vitalik Buterin & Dragonfly. And a $25m Series A led by General Catalyst + Polychain, Joe Gebbia (AirBnB cofounder).

https://predxai.medium.com/intent-centric-prediction-market-with-ai-and-web3-technology-f65dd48a5c41

Combining high-speed blockchain infrastructures, such as the SEI network, to facilitate real-time data updates, this innovation extends beyond long-term event trading, potentially impacting short-term sports gambling and voting in decentralized organization governance, finally contributing to creating a fair, informative, and belief-driven decentralized community.

Thales is a decentralized peer-to-peer parimutuel market built on Optimism and Polygon. Unlike other DApps built on top of Synthetix, Thales does not utilize Synthetix liquidity. Rather, Thales utilizes what they consider the most censorship-resistant and immutable stablecoin, sUSD, as the main collateral asset. Other stablecoins such as USDT, USDC and DAI are available as collateral but to become a market maker, you must mint options by depositing sUSD.

From the Synthetix ecosystem, Thales, Kwenta and Lyra have received an OP allocation thus far. Thales’ unique users paled in comparison to other protocols, but this is largely attributed to decentralized prediction markets failing to gain meaningful traction. Factors include a lack of betting options, unfriendly UI/UX, and barriers to off/onboarding.

https://www.nytimes.com/2023/11/10/business/presidential-election-betting.html

Betting on U.S. elections takes place abroad. Betfair in Britain runs a robust market. And unregulated offshore betting is conducted on Polymarket, which uses cryptocurrency and was fined $1.4 million by the C.F.T.C. for running afoul of its rules. Then there’s FTX, the failed cryptocurrency exchange that was headed by Sam Bankman-Fried, who was convicted this month on seven counts of fraud and conspiracy. It ran an unregulated, offshore prediction market in the 2020 election cycle.

https://messari.io/report/going-poly-market (2024-05-31)

However, the same lack of a token could potentially open it to competitors that “vampire attack” its users and liquidity with incentives. To combat such a threat, Polymarket will have to build competitive moats. There are some network effects in a prediction market of greater users, more markets, and better liquidity.

Another moat could be DeFi composability. For example, allowing users to take a loan against a position on Donald Trump winning the US Presidential Election would truly be a unique proposition. Polymarket has built the backbone of a decentralized polling market and can create additional speculative features on top of the core protocol for monetization.

In the end, the market was resolved as YES, upholding the disputer and confirming that Volodymr Zelensky was indeed named as TIME’s 2022 Person of the Year.

https://www.nytimes.com/2023/10/08/technology/prediction-markets-manifold-manifest.html

The basic idea behind Manifold Markets and similar platforms, such as Kalshi and Polymarket, goes like this: Markets aggregate information. The more information they aggregate, the more accurate they tend to be. And if enough people make enough bets, with enough information behind them, markets can tell you something useful about the future.

What they are mostly not, at least where real money is concerned, is legal. This year, the Commodity Futures Trading Commission rejected a proposal by the prediction market start-up Kalshi to allow its users to wager on which party would control Congress — saying that allowing users to gamble on elections would be “contrary to the public interest.” That agency also fined Polymarket, a cryptocurrency-based prediction platform, $1.4 million for offering unregistered options trading last year.

https://benjaminsturisky.substack.com/p/prediction-markets (2024-05-27, also on Delphi Digital)

Market-making prediction markets are not profitable because of share tail risk. There are ways to counteract this by setting bids a fixed percentage lower and asking a fixed percentage higher than the mark price. This allows some room to lower risk as the market maker only takes on positions cheaper than their “fair probability.”

https://gem.azuro.org/cases/boxbet

The beauty of Azuro's system, as utilized by platforms like BoxBet, lies in its guarantee of zero interference with payouts. By conducting all betting activities on-chain and managing transactions through smart contracts, Azuro ensures a level of fairness and transparency that centralized operators cannot match. This approach eliminates the possibility of withheld or delayed winnings, providing players with the confidence that their earnings will be distributed promptly and fairly, a cornerstone of Azuro's commitment to revolutionizing the iGaming experience.

https://members.delphidigital.io/feed/first-impressions-parcl (2024-02-27)

Parcl is a real estate perps platform on Solana. It’s an interesting concept exploring the crossover between RWAs and prediction markets. The LP style feels similar to Synthetix perps: it’s a monolithic pool with an aggressive velocity-based funding rate system that keeps OI fairly balanced across all markets.

https://members.delphidigital.io/feed/the-metadao-thesis (2024-08-26)

MetaDAO is building decision markets. It’s similar to Polymarket but with some key differences. In a prediction market, you bet on what you think will happen. In a decision market, you bet on what you think should happen. Prediction markets are passive. You sit on the couch, watch the game, and bet on who you think will win. You have skin in the game but no control over the outcome. Decision markets are active. By speculating, you are actually influencing the outcome.

At the heart of MetaDAO is “futarchy,” which is essentially just prediction markets for decisions. Futarchy is not a new idea. It was invented by famed economist Robin Hanson in 2000, and Vitalik wrote about it in 2014. But MetaDAO is the first attempt to bring futarchy onchain.

https://www.nytimes.com/2024/04/12/business/trump-biden-stock-market.html

After trailing for months, President Biden has moved slightly ahead of Mr. Trump in the betting on Predictit, the longest-running commercial prediction market in the United States. On Betfair, a robust British prediction market that is officially closed to U.S. residents, Mr. Biden has moved within one percentage point of Mr. Trump. Polymarket, an offshore market that accepts only cryptocurrency, shows Mr. Trump slightly ahead.

https://members.delphidigital.io/reports/heads-or-thales-exploring-the-potential-of-positional-parimutuel-markets (2024-02-27)

Exotic Markets – Harness the flexibility of parimutuel markets to allow users to create markets for any query with a legitimate data source. Disputes are resolved by the community through a fair and trustworthy process. Political elections and COVID-19 statistics have proven to be fantastic use cases for exotic markets, and have played a key role in the rise of Polymarket.

Impermanent Loss – Augur v2, Polymarket, and Omen marked a shift to CFMMs for prediction markets’ second design wave. The simplicity of the AMM experience and rise of sidechains/L2s alleviated UX woes. Polymarket seeded its liquidity pools with house money to help it scale, but the adversarial LP environment resulted in poor sustainability.

This problem is so pronounced that Polymarket itself has urged users to withdraw liquidity as markets near resolution. One side resolves at 0 and the other at 1, sometimes at a moment’s notice. This makes providing liquidity a fool’s errand. Impermanent loss renders CFMMs completely impractical for prediction markets and sports betting.

In most markets, Polymarket’s volume was sporadic and traders consistently rugged LPs through impermanent loss. Polymarket mitigated this by acting as a major liquidity provider itself, with minimal transparency around their performance.

https://members.delphidigital.io/feed/cryptos-killer-use-case (2024-05-24)

Polymarket– Decentralized prediction market that allows users speculate on anything. Swaye– A prediction market and battle royale game available on Farcaster where players can create markets, bet against friends and earn rewards. Parcl– A prediction market for real estate, allowing liquid exposure to the asset class.

And we are merely scratching the surface of what wallets can be- aggregators of data from prediction markets and becoming a news provider, curators of crypto events from X and Farcaster, etc.

https://en.wikipedia.org/wiki/Nate_Silver

[Even in 2012] FiveThirtyEight's growth is staggering: where earlier this year, somewhere between 10 and 20 percent of politics visits included a stop at FiveThirtyEight, last week that figure was 71 percent. One in five visitors to the sixth-most-trafficked U.S. news site took a look at Silver's blog.

FiveThirtyEight team predicted on November 8, 2016 that Clinton a 71% chance to win the 2016 United States presidential election, while other major forecasters had predicted Clinton to win with at least an 85% to 99% probability.

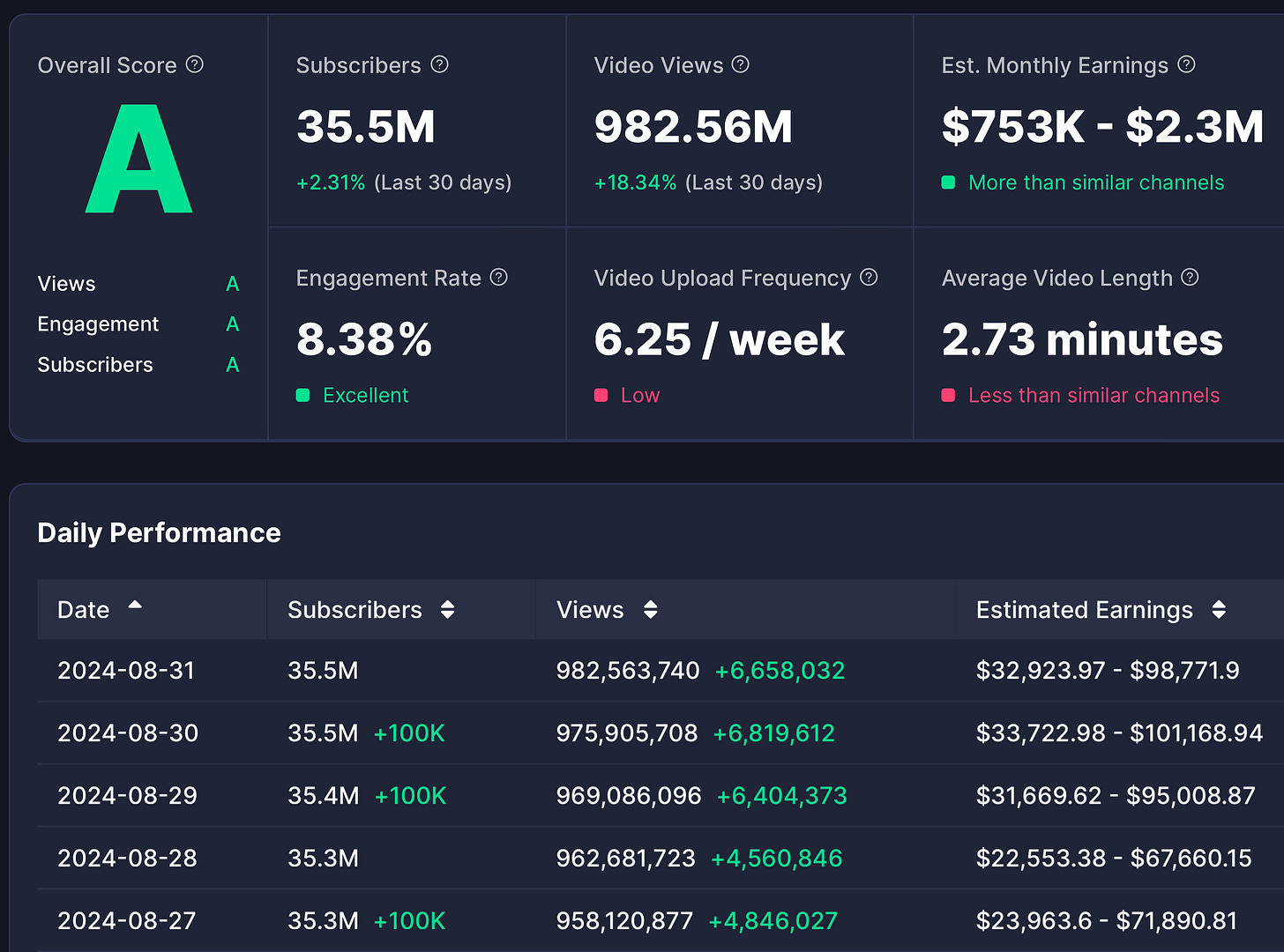

https://socialblade.com/youtube/channel/UCozwejESfvl88CBBL0KgEhw

https://members.delphidigital.io/reports/farcastoooor#frames-6e0d (2024-02-09)

Almost immediately after their launch people started to use them in a variety of interesting ways such as silly mini-games, shopping cart experiences for e-commerce, a distribution channel for subscription services, on-chain token minting, prediction markets etc. Many other cool examples here.

This market will resolve to “Yes” if Donald J. Trump wins the 2024 US Presidential Election. Otherwise, this market will resolve to “No.” The resolution source for this market is the Associated Press, Fox News, and NBC. This market will resolve once all three sources call the race for the same candidate. If all three sources haven’t called the race for the same candidate by the inauguration date (January 20, 2025) this market will resolve based on who is inaugurated.

https://members.delphidigital.io/feed/eth-etf-political-news-and-speculation (2024-05-21)

Polymarket odds have been surging in response to the news, up from 13% to 64%. There is an interesting caveat here (and arguably the reason odds are not higher) that the approval of the 19B-4s does not fulfill the claim of the ETF being “approved”. In the case of a conflict, UMA governance acts as the “Supreme Court,” so it should be very interesting to see what happens, assuming the 19B-4s are approved by the deadline.

https://members.delphidigital.io/feed/future-polymarket-arbitrage (2024-05-18)

Right now, there is some disparity between Polymarket’s and the sportsbooks’ odds on different games. However, this isn’t capable of being arbitraged because the Vig on sportsbooks is higher than the disparity between odds.

https://members.delphidigital.io/feed/tokenless-protocols (2024-06-20)

Polymarket – Polymarket is the leading prediction market platform. They just raised $45M in their Series B, and a token seems likely.

https://members.delphidigital.io/feed/on-chain-options-too-early-or-in-need-of-a-rebrand (2024-02-10)

Options may just need a rebrand. Perhaps something closer to binary options over the Greek-derivative-math-nerd shtick. The idea is simple: if you think on-chain prediction markets and binary options on events have a bright future, why wouldn’t the same apply to crypto markets? Instead of American/European options, you could just have fixed strike binaries. BTC will trade above $50K by June 1, 2024; yes or no.

We know retail and degens, at large, love simple instruments. But perhaps the reason stock market degens gravitate towards options is just the lack of spot volatility, thus amplifying the need/desire for instruments with higher implied leverage. Which would imply that we’re actually years — maybe a decade — away from on-chain users caring about options.

https://www.linkedin.com/pulse/parafi-capital-insights-polymarket-paraficapital-toloe/

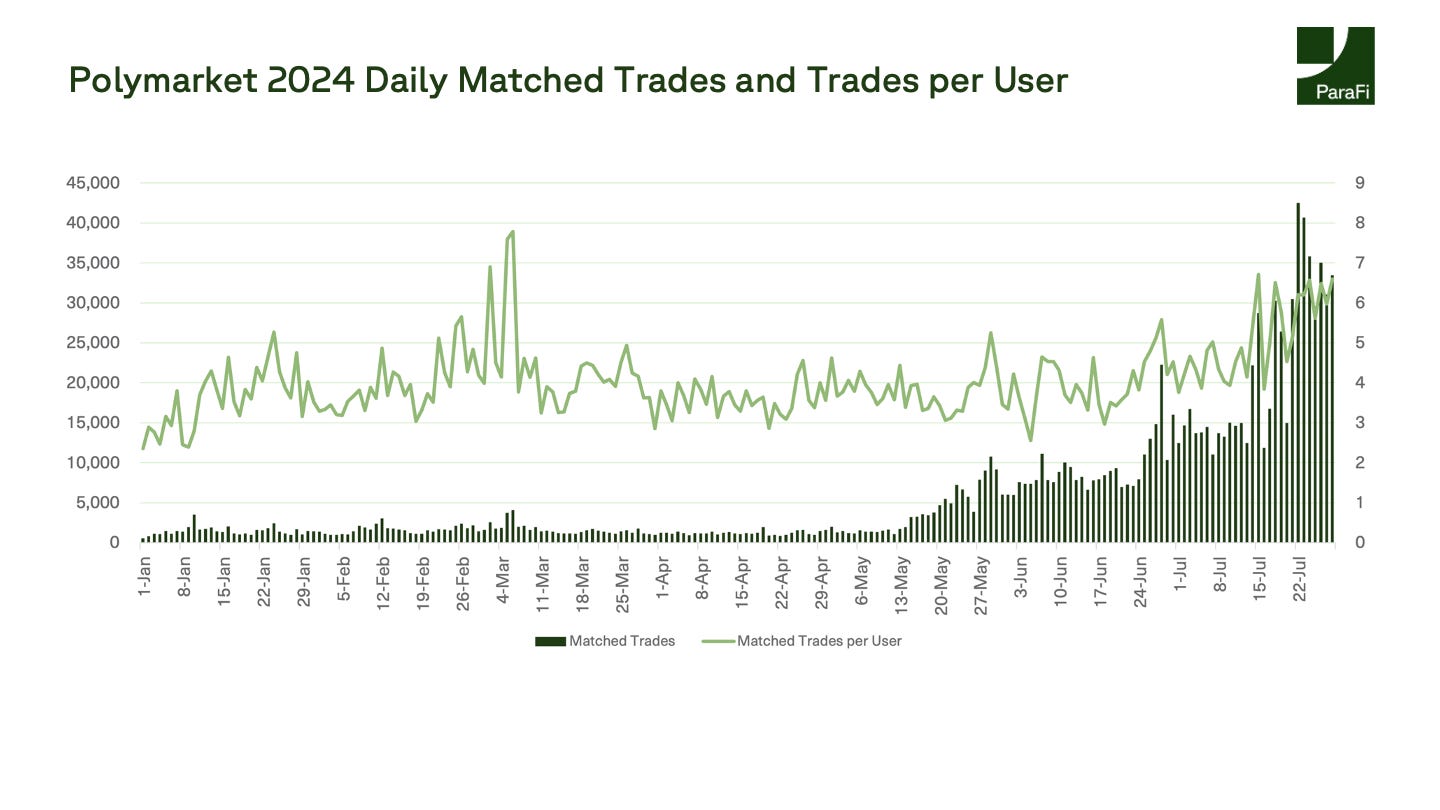

ParaFi is the single largest investor in Polymarket. Polymarket has seen $688 million in trading volume year to date and weekly active users grow ~14x from around 1,400 to 20,000+. Daily page views have grown 10x with cumulative page views crossing 32 million, with daily page views peaked at 1.3 million and daily visitors peaked at 185,000.

Of the almost 70,000 total addresses that have used Polymarket, only 42% made their first trade in an election-related market. Some non-election markets: Olympic medal count, Taylor Swift’s engagement timeline, and GPT-5 launch date.

The new investment comes on the heels of a proposed ban on trading of derivatives betting on political contests and sports games from the US Commodity Futures Trading Commission as it cracks down on so-called event contracts. “A lot of the reason why certain people don’t like prediction markets in the US kind of dates back to pretty puritanical thinking about betting,” Joey Krug, a partner at Founders Fund said about the CFTC proposal.

An artist at heart, he became obsessed with p2p file sharing during the height of the music sharing era. From there when he came upon bitcoin, it was an easy jump to understanding the inherent value of a global peer-to-peer asset network. When Ethereum was announced in 2014, he was an early follower, and is believed to be the youngest participant in the pre-sale. He cites Hayek’s famous essay “The Use of Knowledge in Society” for inspiration

https://messari.io/crypto-theses-for-2024

9.8 Bet-To-Play Gaming & Information Markets. Prediction markets are the largest and easiest subset of “curation markets,” which we desperately need as a probabilistic alternative to disastrously inaccurate “independent” fact checkers or more community sentiment-driven products like Community Notes.

Finally, it’s batshit crazy to me that we can’t bet on prediction markets (I’m smarter than you), but we can bet on ourselves in things like online gaming (I’m better at FIFA). The sports betting and iGaming markets are growing by mid-double digit percentages year over year, and Kel thinks “bet-to-play” models could add $10 billion per year in revenue to Fortnite alone.

The market size is staggering, the gambling element makes it a perfect gray market use case for crypto, and the ability to wager on crypto games could give them a marginal benefit that helps put them over the top of other centralized gamemakers.

https://members.delphidigital.io/feed/my-list-of-interesting-things (2023-08-07)

I’m been thinking that prediction markets (e.g. Polymarket) could become a new kind of consumer behavior that is enabled by crypto. It’s one of those things that the industry has been working on for a while and hasn’t yet reached its 0-to-1 consumer moment, but could explode quickly when it does — just like OpenSea did in 2020.

https://vitalik.eth.limo/general/2018/04/20/radical_markets.html

Prediction markets allow people to bet on the probability that events will happen, potentially even conditional on some action being taken ("I bet $20 that unemployment will go down if candidate X wins the election"); there are techniques for people interested in the information to subsidize the markets. Any attempt to manipulate the probability that a prediction market shows simply creates an opportunity for people to earn free money (yes I know, risk aversion and capital efficiency etc etc; still close to free) by betting against the manipulator.

Prediction markets for content curation (use prediction markets to predict the results of a moderation vote on content, thereby encouraging a market of fast content pre-moderators while penalizing manipulative pre-moderation).

https://members.delphidigital.io/feed/odds-of-spot-btc-etf-approval-rise (2023-08-02)

The likelihood this plays out by the end of the month though is probably nothing more than wishful thinking. But for those looking to take a flyer on a quick domino-effect approval, Polymarket is offering a relatively cheap call option on a swifter-than-expected outcome.

https://members.delphidigital.io/media/check-the-chain-navigating-gamblefi (2023-06-08)

Jordan delves into the captivating domain of on-chain gambling. They will provide an analytical overview of crypto casinos and prediction markets, including Polymarket and Rollbit.

https://messari.io/report/b2p-the-real-10x-paradigm-shift-in-crypto-gaming (2023-02-07)

The markets for sports betting and iGaming combined for ~$10 billion in revenue through 11 months (2021) in the U.S. alone. eSports revenue lags behind its projected 650 million person viewership numbers for 2023. That number would be good enough for eighth in the world among all sports, well ahead of baseball, golf, and even American football. Despite that, revenue for the subsector was a comparatively small $1.5 billion in 2022. Compare that to the ~$40 billion in revenue pulled in by U.S. sports franchises during the same year — eSports nears or exceeds U.S. franchises in viewership, but gets blown out for revenue.

https://vitalik.eth.limo/general/2019/04/03/collusion.html

In the case of governance and content curation (both of which are really just special cases of the general problem of identifying public goods and public bads) a major class of mechanism that works well is futarchy - typically portrayed as "governance by prediction market", though I would also argue that the use of security deposits is fundamentally in the same class of technique. The way futarchy mechanisms, in their most general form, work is that they make "voting" not just an expression of opinion, but also a prediction, with a reward for making predictions that are true and a penalty for making predictions that are false. For example, my proposal for "prediction markets for content curation DAOs".

In the case of the content curation example above, we're not really solving governance, we're just scaling the functionality of a governance gadget that is already assumed to be trusted. One could try to replace the moderation panel with a prediction market on the price of a token representing the right to purchase advertising space, but in practice prices are too noisy an indicator to make this viable for anything but a very small number of very large decisions. Some kinds of games, particularly prediction market or security deposit based games can be made collusion-safe and identity-free.

https://www.astralcodexten.com/p/prediction-market-faq?#§whats-the-current-status-of-prediction-markets (2022-12-20)

Polymarket doesn't let people create and resolve their own markets; it relies on the Polymarket central authority, which can be censored, has limited throughput, and has limited trust. Prediction markets beat the average person, various experts, and various other methods like election polling. They are somewhere between equal-to and slightly-worse-than complicated aggregation algorithms

Prediction markets are our way out of the “crisis of trust” that threatens modern democracy. Lots of people doubt the experts, the government, and the media. Sometimes these doubts are justified; other times they’re loony. Most proposed solutions to this problem are authoritarian (eg ban all sources of information that the speaker doesn’t trust), and throw the baby (a free press capable of challenging authority when necessary) out with the bathwater (real disinformation). But because of a deal with US gambling regulators,

PredictIt won’t let anyone bet more than $850 on their site. Polymarket and Kalshi - where you can easily make $10,000+ by correcting mispricings. I recently had to read many articles on Elon Musk’s takeover of Twitter, which all repeated that “rumors said” Twitter was about to go down because of his mass firing. Meanwhile, there were several prediction markets on whether this would happen, and they were all around 40%.

https://www.nytimes.com/2021/02/13/technology/slate-star-codex-rationalists.html

Re: Astral Codex Ten, Mr. Siskind hinted that Substack paid him $250,000 for a year on the platform. Sam Altman was effusive in his praise of the blog as essential reading among “the people inventing the future”.

Slate Star Codex carried an endorsement from Paul Graham, founder of Y Combinator. It was read by Patrick Collison, chief executive of Stripe, the billion-dollar start-up that emerged from the accelerator. Venture capitalists like Marc Andreessen and Ben Horowitz followed the blog on Twitter.

https://rationalwiki.org/wiki/Scott_Alexander#In_popular_culture

Iranian secularist Kaveh Mousavi, while agreeing with Alexander that the intellectually bankrupt sections of the social justice community should be heavily critiqued, has nonetheless criticized Alexander himself for having an Americentric view of social issues and of creating a false equivalence between social justice advocates and social conservatives, as well as of downplaying discrimination against women and minorities in Western countries.

http://www.eecs.harvard.edu/cs286r/courses/fall10/papers/GooglePredictionMarketPaper.pdf

The most interesting of these was an optimism bias, which was more pronounced for subjects under the control of Google employees, such as whether a project would be completed on time or whether a particular office would be opened. Optimism was more present in the trading of newly hired employees, and was significantly more pronounced on and immediately following days with Google stock price appreciation.

Our optimism results are interesting given the role that optimism is often thought to play in motivation and the success of entrepreneurial firms. They raise the possibility of a “stock price‐optimism‐ performance‐stock price” feedback that may be worthy of further investigation.

https://www.astralcodexten.com/p/mantic-monday-let-me-google-that

The problem is, the things that we really wanted to get a probability assessment on were things that were so sensitive that we thought we would violate the SEC rules on insider knowledge because, if a small group of people knows about some acquisition or something like that, there is a secret among this small group.

To combine regular trading and options trading into a single price, so that we could get the advantages of options trading, but traders would still be betting on the regular market and increasing our predictive accuracy?

https://www.maximumtruth.org/p/deep-dive-on-predicting-elections

Nate Silver’s site is worse than bettors at predicting Republican wins, and better at predicting Democratic wins. ElectionBettingOdds.com, has now tracked 805 different candidate chances on prediction markets. Over $400 million was bet on the 2020 election.

Princeton Election Consortium, which gave Trump a “less than 1%” chance of winning the 2016 election on election morning. By contrast, ElectionBettingOdds.com gave Trump a more reasonable 20.2% chance on election morning, higher than the odds given by any statistical model — except for Nate Silver’s FiveThirtyEight.com, which gave Trump a 28% chance. (See here and a paper by Dhruv Madeka for all the models’ predictions on election morning.)

https://thezvi.wordpress.com/2018/07/26/prediction-markets-when-do-they-work/

Robin Hanson, Eliezer Yudkowsky and Scott Sumner are big advocates of prediction markets. There are markets at PredictIt and BetFair and Pinnacle Sports, and there used to be relatively deep markets at InTrade.

https://comments.cftc.gov/Handlers/PdfHandler.ashx?id=34702 (Academic Group Letter)

Polling error has increased in recent years, polarization is at an all time high, fake news is rampant: a market-based mechanism for forecasting the outcome of the midterms would be a vastly superior alternative to polling and punditry, and would thus foster a healthier and more reasonable debate around the electoral process. Combating fake news and providing a better mechanism for truth makes the proposed contracts very much so in the public interest.

https://www.lesswrong.com/tag/prediction-markets

Robin Hanson was the first to run a corporate prediction market - at Project Xanadu – and has made several contributions to the field such as: conditional predictions, accuracy issues and market and media manipulation.

https://manifoldmarkets.notion.site/Maniswap-ce406e1e897d417cbd491071ea8a0c39

The solution is to modify the Uniswap constraint to make it parametrized in terms of the initial probability. Suppose you want to want to initialize the probability at p. Instead of the simple constant-product formula, use.. With the corresponding market probability of… This will allow you to allocate all 100 YES and 100 NO shares of your original $100 subsidy at any probability you choose!

More importantly, the farther the initial probability is in the extremes (0.1% or 99.9%), the better the liquidity and the lower the price-jumpiness you will observe versus Uniswap. This system—known as as Maniswap—can be thought of as a generalization of Uniswap at p = 50%.

Even for the candidates with a shot of being chosen, the incentives in a conditional market are weaker than those in a non-conditional market because the fees are lost when the market resolves N/A. (Nate Silver wrote a good analysis of why it would be implausible for e.g. Shapiro vs Walz to affect Harris' odds by 13 percentage points.) So the sharps would have no reason to get involved if even one of the contenders has numbers that are off by a couple points from a sane prior.

https://vitalik.eth.limo/general/2022/12/05/excited.html

Prediction markets: these have been a niche but stable pillar of decentralized finance since the launch of Augur in 2015. Since then, they have quietly been growing in adoption. Prediction markets showed their value and their limitations in the 2020 US election, and this year in 2022, both crypto prediction markets like Polymarket and play-money markets like Metaculus are becoming more and more widely used.

Prediction markets are valuable as an epistemic tool, and there is a genuine benefit from using cryptocurrency in making these markets more trustworthy and more globally accessible. I expect prediction markets to not make extreme multibillion-dollar splashes, but continue to steadily grow and become more useful over time.

https://benjamincongdon.me/blog/2022/05/09/Manifold-Markets/ (2022-05-09)

One of the highest traded markets on Manifold for the first couple months was “Will Midnight the stray cat allow humans to pet her by April 1st, 2022?” There are also more serious markets, like “Will Ethereum merge to Proof-of-Stake by July?”, and “Will the US make daylight savings time permanent in 2023?”

https://docs.gnosis.io/conditionaltokens/docs/introduction3/

Prediction markets—also referred to as information markets, idea futures, event derivatives, decision markets, or virtual stock markets—are exchange-traded markets where individuals stake on the outcome of an event. In blockchain-based prediction markets, participants stake on the market in the form of event contracts.

Unlike financial markets such as stock or commodities futures, which traders use to hedge against risk (i.e., farmers use futures markets to hedge against low crop prices, airlines use futures markets to hedge against high fuel prices), prediction markets primarily seek to aggregate information on particular topics of interest. The principal informational value of a prediction market lies in the price of the futures themselves, which not only represent the average assessment of market participants concerning the likelihood of an event’s outcome, but also the confidence level different participants have in their predictions.

https://vitalik.eth.limo/general/2021/09/26/limits.html (On Nathan Schneider on the limits of cryptoeconomics)

Prediction markets to scale up content moderation. Instead of doing content moderation by running a low-quality AI algorithm on all content, with lots of false positives, there could be an open mini prediction market on each post, and if the volume got high enough a high-quality committee could step in an adjudicate, and the prediction market participants would be penalized or rewarded based on whether or not they had correctly predicted the outcome – like Slashdot meta moderation

Prediction markets avoid the plutocracy issues inherent in coin voting because they introduce individual accountability: users who acted in favor of what ultimately turns out to be a bad decision suffer more than users who acted against it. However, a prediction market requires some statistic that it is measuring, and measurement oracles cannot be made secure through cryptoeconomics alone: at the very least, community forking as a backstop against attacks is required.

https://blog.1inch.io/1inch-revolutionizes-automated-market-maker-amm-segment-with-mooniswap/ (2020-08-10)

Bancor launched the first-ever AMM in 2017. Alan Lu from Gnosis in 2017 first used the constant-product invariant formula for prediction markets. Hayden Adams then used the beautiful formula for his AMM Uniswap. Vitalik Buterin called to “run on-chain decentralized exchanges the way we run prediction markets” and reflected upon the front-running problem. Indeed, the AMM mechanism imposes risks of losses on traders.

https://members.delphidigital.io/reports/whats-next-for-gnosis (2020-10-16)

Gnosis called itself a prediction market but has since developed to include three distinct verticals: Conditional Tokens – Prediction market offering. This allows users to place bets on future events. Also known as event derivatives or decision markets. Gnosis’s prediction platform served as a progenitor to DXdao’s Omen prediction platform.

Despite their stated objectives, it’s hard to give merit to the claim that Gnosis is either a prediction market or a DEX. The prediction market has failed to gain traction writ large as competitors such as Augur have similarly failed to gain meaningful volumes.

https://members.delphidigital.io/reports/not-one-two-bull-markets-incoming-for-crypto (2020-08-06)

Decentralized Finance (“DeFi”) in its current form looks completely different than even a few months ago. This time last year, there were only 4 DeFi projects in the top 100 – (Maker, 0x, Augur, and Ren). Today, there are 11 with the addition of Aave, Synthetix, Compound, Kyber, Kava, Bancor, and Loopring. This time next year, I predict there will be at least 25 in the top 100.

https://thecontrol.co/long-augur-405a9a58d886 (2019-01-14)

Augur was one of the first Ethereum-based projects to launch in mid 2015. These people don’t recognize the fact that building a truly robust cryptoeconomic protocol that maintains a high level of decentralization (development, nodes, token holders, users, etc) is a different process than building a centralized product… with Augur v2 in the works and services like Veil and many others launching this year.

The object of trading in the Polymarket protocol are conditional tokens. Conditional tokens represent outcomes of real-life events and can be arbitrarily complex. Exchange utilizes these tokens to create binary markets for specific events: For each event, a pair of tokens representing a mutually exclusive condition such as YES and NO answers to a question is created. They depend on an external oracle for the settlement of their value.

Polymarket implements a hybrid non-custodial exchange for the trading of conditional tokens representing bets in prediction markets. It consists of a centralized marketplace where trading orders are submitted by the users in the form of EIP712 signed messages, and of a smart contract running on the Polygon network handling the filling of matched orders in an open and verifiable way. The centralized exchange keeps a pool of not filled or partially filled open orders.

https://github.com/Polymarket/contract-security/blob/main/audit-reports/cs_conditional_tokens.pdf

ConditionalTokens is an ERC-1155 contract that allows users to create tokens tied to questions with up to 256 outcomes (conditions). Each position a user can hold is identified by a unique positionId that corresponds to an ERC-1155 token id. A position is tied to a collateral token and a collectionId. A collection is a condition tied to a subset of all possible outcomes.

https://vitalik.eth.limo/general/2024/04/01/dc.html (Degen communism: the only correct political ideology)

A 90% price drop erases billions of dollars of value, but the average dollar lost is only lost in mark-to-market book-value terms: it's people to held on the way up, and kept holding on the way down. The average coin lost from a $100 million defi hack is a coin that was worth ten times less two years earlier.

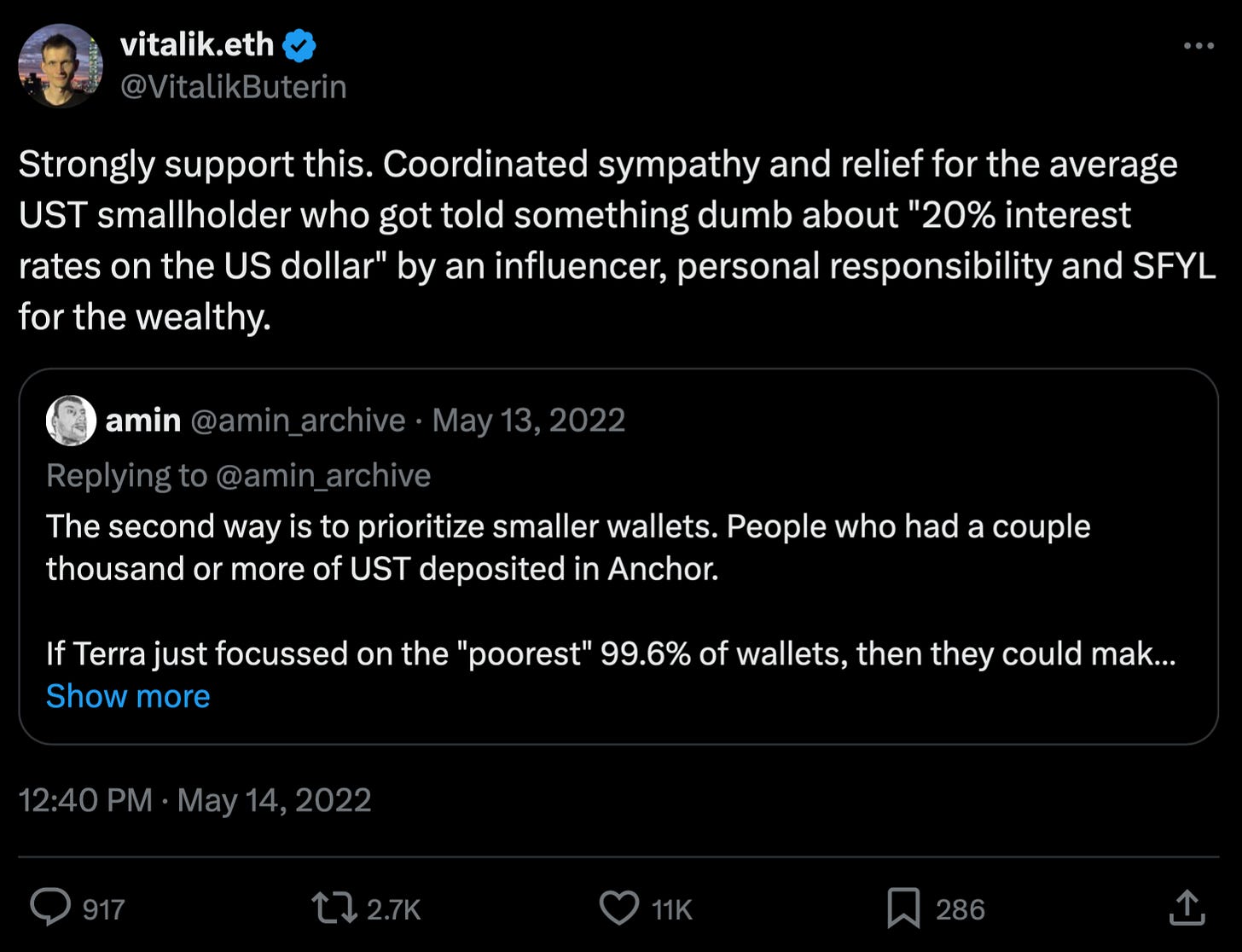

When projects collapse or get hacked, and only partial refunds are possible, don't make the refunds proportional. Instead, make smaller users whole first, up to some threshold (eg. $50k). Two years ago, when I proposed this idea, many treated it with scorn, misrepresenting the idea as asking for government bailouts.

Public discussion and consensus-finding platforms, which can allow large groups of people to rapidly participate but include mechanisms to identify points of consensus. This includes tools such as pol.is and Community Notes, which focus on cross-tribal bridging. It also includes prediction markets (eg. Polymarket).

http://mason.gmu.edu/~rhanson/ideafutures.html

Real money political markets, such as Iowa Electronic Markets and WahlStreet, predict election outcomes better than opinion polls. Derivatives are usually required to have prices predictable from the underlying instruments they derive from.

https://videolectures.net/uai08_hanson_cpm/ (Combinatorial Prediction Markets, by Robin Hanson)

Several hundred organizations are now using prediction markets to forecast sales, project completion dates, and more. This number has been doubling annually for several years. Most, however, are simple prediction markets, with one market per number forecast, and several traders per market. In contrast, a single combinatorial prediction market lets a few traders manage an entire combinatorial space of forecasts. For millions of numbers or less, implementation is easy, and lab experiments have confirmed feasibility and accuracy.

https://docs.polymarket.com/#resolution

Polymarket uses Gnosis conditional tokens to represent positions in prediction markets with binary outcomes. The most critical subjects covered in our audit are functional correctness and the resilience of elliptic curve calculations used in ID computation.

https://docs.polymarket.com/#introduction

Polymarket leverages UMA's Optimistic Oracle (OO) to resolve arbitrary questions, permissionlessly. From UMA's docs: "UMA's Optimistic Oracle allows contracts to quickly request and receive data information. The Optimistic Oracle acts as a generalized escalation game between contracts that initiate a price request and UMA's dispute resolution system known as the Data Verification Mechanism (DVM).

Polymarket's Order Book, also referred to as the "CLOB" (Central Limit Order Book) or "BLOB" (Binary Limit Order Book), is hybrid-decentralized wherein there is an operator that provides off-chain matching/ordering services while settlement/execution happens on-chain, non-custodially according to instructions provided by users in the form of signed order messages.

https://docs.polymarket.com/#proxy-wallets

When a user first uses Polymarket.com to trade they are prompted to create a wallet. When they do this, a 1 of 1 multisig is deployed to Polygon which is controlled/owned by the accessing EOA (either MetaMask wallet or MagicLink wallet). This proxy wallet is where all the user's positions (ERC1155) and USDC (ERC20) are held. Using proxy wallets allows Polymarket to provide an improved UX where multi-step transactions can be executed atomically and transactions can be relayed by relayers on the gas station network.

https://www.astralcodexten.com/p/why-im-less-than-infinitely-hostile

Vietnam uses crypto because it’s terrible at banks. 69% of Vietnamese have no bank access, the second highest in the world. There’s a history of the government forcing banks to make terrible loans, and then those banks collapsing; maybe this destroyed public trust? In any case, between banklessness and remittances (eg from Vietnamese-Americans), Vietnam leads the world in crypto use.

Ukraine has always been among the top crypto countries: in 2021, NYT called it “the crypto capital of the world”. Again, this owes a lot to its terrible banking system. This guy says that if you deposit more than $100,000 in a Ukrainian bank, “the chance that you get it back is very slim”. When Russia invaded.. to donate to the war effort - $70 million as of March. It proved so helpful that during the first month of the war… pass a law legalizing crypto.

https://www.astralcodexten.com/p/why-does-ozempic-cure-all-diseases

GLP-1 receptor agonist medications like Ozempic are already FDA-approved to treat diabetes and obesity. But an increasing body of research finds they’re also effective against stroke, heart disease, kidney disease, Parkinson’s, Alzheimer’s, alcoholism, and drug addiction.

Diabetes involves excessive blood sugar, so this is the profile you want for an antidiabetic drug. But natural GLP-1 decays within a minute or two, so there’s no way to use it as a medication. In 1992, scientists discovered a chemical in Gila monster venom which looked like GLP-1, activated GLP-1 receptors, but lasted a whole two hours. This became exenatide, the first GLP-1 receptor agonist (one of my favorite paper names is Exenatide: From The Gila Monster To The Pharmacy). By playing around with its structure, Big Pharma was eventually able to create liraglutide (twelve hours), semaglutide (one week), and cafraglutide (one month).

The results were unequivocal: Ozempic and its relatives work in the brain. There are two plausible places GLP-1 drugs could lower weight: the body or the brain. In the body, they could change stomach contraction rate, hormone production, etc. In the brain, they could control the mental sensation of hunger.

So we have 9 Foods And Supplements That Increase GLP-1 Naturally, 6 Foods That Increase GLP-1 Levels, and Foods That Naturally Mimic GLP-1. I regret to tell you these are mostly the ones you already knew were healthy - fish, eggs, vegetables, whole grains. There’s also some discussion of supplements including psyllium (plausible) and curcumin (all results related to curcumin are false until proven otherwise). Needless to say, people have already written up arguments for why the GLP-1 evidence supports the paleo diet, the Mediterranean diet, the Ayurvedic diet, the carnivore diet, and the plant-based diet.

How about exercise? Sure, see for example Effects of Exercise On Glucagon-Like Peptide 1, Does Exercise Potentiate The Effect Of [GLP-1] Treatment?, and Endurance Training Improves GLP-1 Sensitivity and Glucose Tolerance in Overweight Women. Mostly this seems to happen by making tissues more sensitive to the effect of GLP-1. Why? Exercise creates very high demand for glucose, so it kind of makes sense that it’s a signal for the body to focus on keeping its glucose system well-tuned.

But Ozempic and other GLP-1 drugs appear to be a promising treatment for alcoholism, smoking, stimulant addition, opioid addiction, and maybe even behavioral addictions like shopping. It made rats eat less. But second, when presented with very tasty food vs. normal food, it made the rats stop preferring the very tasty food; see Recursive Adaptation blog.

Runners-up for the Science Breakthrough of The Year include advancements in antibody therapies that may slow neurodegeneration in the brains of people with Alzheimer's disease; the discovery of natural hydrogen sources below the Earth's surface; the push for systemic changes in how early-career scientists are treated at institutions worldwide; strong evidence that humans arrived in the Americas thousands of years earlier than most archaeologists had thought; findings that show Earth's crucial carbon pump is slowing down; interstellar signals from massive black hole mergers; the development of AI-assisted weather forecasting; new malaria vaccines; and the deployment of exascale computing, which promises to bring unprecedented computational power to many fields of science.

https://paulgraham.com/foundermode.html

Steve Jobs used to run an annual retreat for what he considered the 100 most important people at Apple, and these were not the 100 people highest on the org chart. Can you imagine the force of will it would take to do this at the average company? And yet imagine how useful such a thing could be. It could make a big company feel like a startup. Steve presumably wouldn't have kept having these retreats if they didn't work. But I've never heard of another company doing this. So is it a good idea, or a bad one? We still don't know. That's how little we know about founder mode.

https://www.theinformation.com/articles/the-superintelligence-of-ai-investor-daniel-gross

Y Combinator accepted Gross, then 18, into a 2010 cohort of startup founders. At the time he was the youngest entrepreneur the accelerator had ever accepted. He did a marathon in Antarctica with Kyle Vogt, founder and former CEO of Cruise.

Their investing entity, NFDG, has more than $2 billion in total assets under management… setting up a cluster of thousands of graphics processing units. He’s actively involved in recruiting talent for the company and often asks people he’s interviewing to complete challenges and puzzles or play videogames.

https://www.alumni.hbs.edu/stories/Pages/story-impact.aspx?num=9483

I would be a turnaround CEO. I got very specific that what I wanted to do was take something that seemed impossible and make it possible,” she says. Xbox recently surpassed Windows to become the third-largest revenue earner of the company

In a recent survey of Gen Z teens, around 30 percent list video games as their preferred entertainment, ahead of social media, television, and movies. And the vast majority of Gen Z and Gen Alpha gamers cite the social aspect of gaming as the most appealing part. In other words, games are often how younger generations interact with their peers.

https://www.notboring.co/p/vertical-integrators

Thiel says, “There probably are only two broad categories in the entire history of the last 250 years where people have actually come up with new things and made money doing so.” One is software. The other is the sort of vertically-integrated, complex monopolies which people did build in the Second Industrial Revolution at the end of the 19th and start of the 20th century. And so this is like Ford, this is the vertically integrated oil companies like Standard Oil.”

The DOGS token is yet to launch officially on the spot market. However, you can buy and sell DOGS on KuCoin pre-market trading platform.

https://www.wsj.com/world/russia/russia-military-telegram-founder-arrest-b080dd8d

Russian regulators removed the restrictions in 2020, while the Russian state bank VTB helped Telegram raise $1 billion in bonds, some of them purchased by Russian investors. Durov said that the lifting of the ban would have a “positive impact” on Russia’s national security, and he added that Telegram had developed ways of removing “extremist propaganda” without sacrificing users’ privacy.

Russian soldiers and spies depend on Telegram for battlefield communications, including the guidance of artillery, the coordination of movements and intelligence gathering. Russian volunteers who supply drones, night-vision scopes, vehicles and other aid to military units operate almost exclusively through Telegram. The service also has offered a lucrative social-media platform to Russian war propagandists, with millions of subscribers, who work in close cooperation with the Russian Ministry of Defense.

https://www.theinformation.com/articles/sand-hill-road-dodges-telegram-crisis

To support burgeoning cloud server costs, it has raised over $2 billion in debt. Backers include Emirati sovereign wealth fund Mubadala Investment Co., which invested $75 million in pre-initial public offering convertible bonds in 2021. Earlier this year, Telegram raised another $330 million through bond sales. The bonds will convert to equity at a discount to the IPO if one happens by 2026, the FT says.

https://www.wsj.com/world/europe/telegram-ceo-pavel-durov-charged-french-authorities-43a125a2

Russia in 2018 attempted to block Telegram, saying the platform didn’t cooperate in terrorism investigations. But Telegram continued to thrive there even as authorities prevented thousands of IP addresses a day from accessing the app, the company said.

Moscow in 2020 abandoned the blockade, saying Telegram had promised to fight terrorist content on its platform. A Telegram spokesman denied there was any deal with Russia and said the company had a “zero compromise” policy for bans in authoritarian countries.

https://www.katseye.world/charms/

STELLAR TIARA 👸. In every interaction, your grace and warmth are like a sparkling tiara, casting a gentle glow on those around you. With a quiet dignity, you navigate life’s challenges, your tiara gleaming with the steadfastness of your values and integrity. Your strength, akin to the resilience of a precious gem, allows you to weather any storm that comes your way. Your quiet confidence, adorned like a jewel in your tiara, serves as a beacon of inspiration to others, providing unwavering support in times of need. Together, these qualities define you as someone who gracefully moves through life, radiating warmth and dignity like a regal tiara adorning a queen.

https://www.capcut.com/resource/how-to-make-funny-tiktok-videos (2023-01-24)

CapCut gives users access to exclusive funny filters and effects that are sure to impress their TikTok audience. For example, you can apply the “Big Head” on someone in the video to instantly enlarge the size of their head or the “Shy” to make them appear as though they are blushing.

CapCut helps you trim, split, merge, crop, and resize the raw footage of your funny TikTok video into an eye-catching masterpiece. Special effects can do wonders for enhancing your funny TikTok video. In addition to making it more visually enticing and ramping up the “wow” factor, they can actually help to amplify humor and punchlines.