🌳 Perps: Invincible Summer of 💪 1000x Leverage + 🕐 1-second Orderbook

Why perpetuals? Are 1000x leverages and 1-second orderbooks profitable?

Let’s make Harmony’s Shard 1 the future DeFi platform – with fast transaction finality, cross-chain liquidity, and generative agents. We are building 1. power perpetuals that unify stablecoins and margined futures; 2. cross margins that minimize portfolio liquidations due to volatility; and, 3. pull oracles that support long-tail assets and avoid price manipulations.

Join our development! I am at t.me/stephentse or s@harmony.one.

🌞 Invincible (DeFi) Summer

The future is fully onchain with smart contracts – including asset custody (wallets), order matching (books), trade clearing (settlements).

Avoid dependencies against attacks or extracted values – including price oracles (volatility), maker bots (arbitrage), token incentives (governance).

Minimal product with no charts or sliders or steps – just long or short ETH-USDT at 1000x leverage, seamlessly bridged via LayerZero.

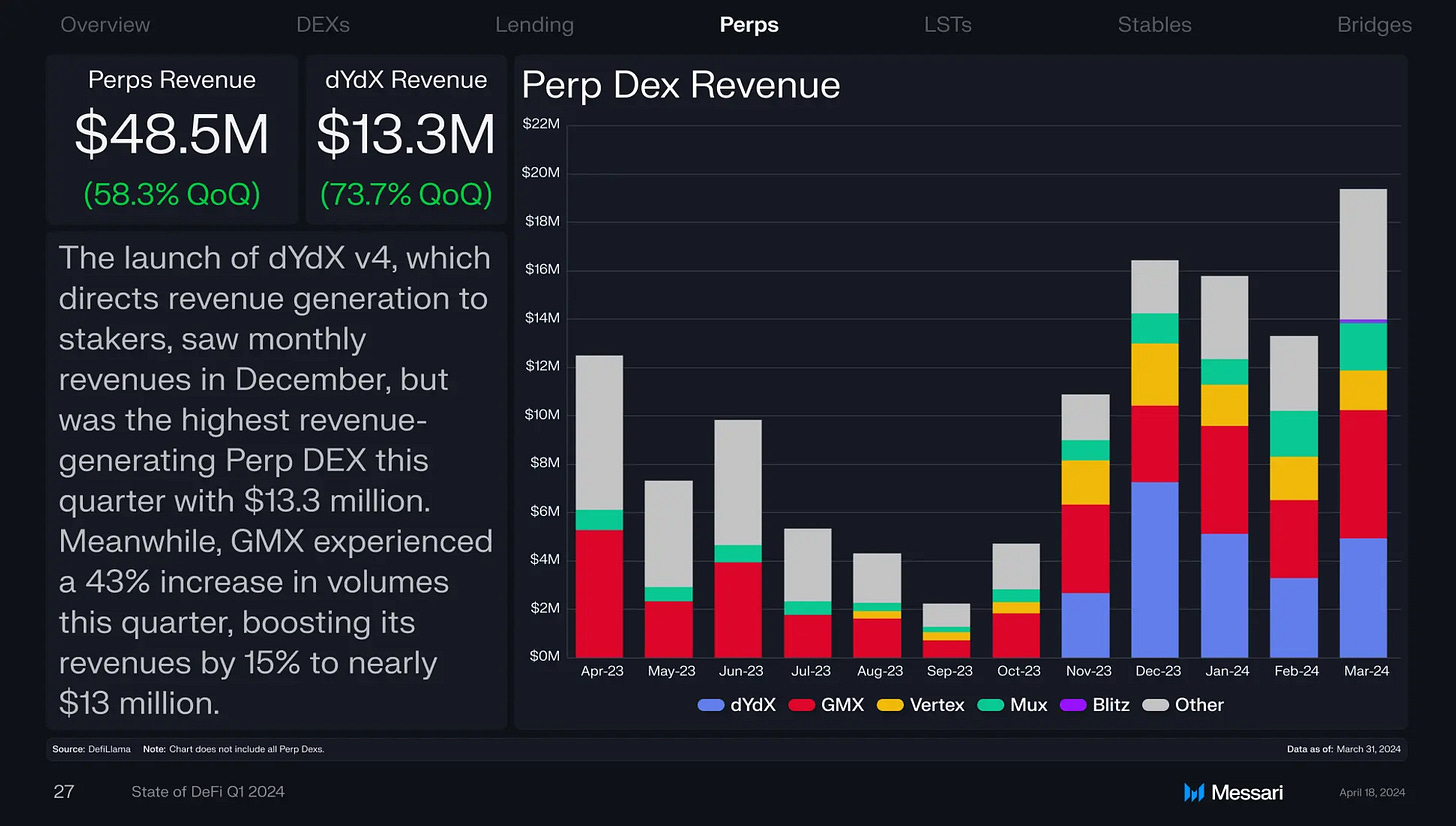

The area in which DeFi made the most progress is decentralized perpetuals. Rollups and appchains have allowed for a greater variety of orderbook protocols. dYdX v4 is transitioning to Cosmos appchain, Aevo is pioneering the OP rollup stack with a unique offering of pre launch markets, Vertex has pushed DEX UX to new heights, and RabbitX has come out of nowhere to bootstrap usage on Starkware. The peer-to-pool model transformed as well. Synthetix and GMX have implemented risk management measures establishing peer-to-pool as a truly viable perps model for the first time.

Derivatives DEXes need to process a massive load of orders every block; be cheap for users to place orders, cancel orders, rebalance positions; would benefit from having their own execution environment [vs sequencers, provers, validators, gas token].

– Delphi Digital: The Year Ahead for DeFi 2024 (and for 2023)

Here are protocols supporting Central Limit Order Book (CLOB): Drift on Solana, Orderly Network on Near, DeepBook on Sui.

Jupiter’s second biggest product is perps, which is also its newest. With over $80M in AUM, $47M in open interest, and 11,000 traders, it’s already one of the top perp platforms on Solana.

Aevo: a rollapp with off-chain matching and on-chain settlement; building up to volume via viral asset listing strategy (pre launch futures).

Lyra: a rollapp promising less centralized matching process vs Aevo and Vertex; focus on perpetuals, options, and spot trading.

Avantis (invested by Pantera): a perpetual futures protocol on the Optimism Superchain. Liquidity providers can customize their risk-reward structure, and traders have seamless access to leverage across several asset classes.

dYdX, which already outpaces BitMEX and Kraken in certain markets (ETH and SOL), to continue to win market share vs. its centralized perps competition. dYdX’s outperformance [and] migration to a Cosmos app chain should speed up performance... perpetuals as a product still dominate more than 75% of the global crypto futures open interest (OI) and more than 90% of volumes... primarily a perps-driven business [given their] the high leverage rates.

DeFi: Super cheap fees, fast finality, and protocols like fully onchain order books create a DeFi UX... and upcoming airdrops from Pyth, Jito, Jupiter. Synthetix [will introduce] cross-margin functionality, support multiple new collateral types, and a range of other trading improvements (access controls, liquidation improvements).

– Messari’s Crypto Theses for 2024 (Chapter 6.7: CME vs. Perps vs. dYdX; Chapter 8.4: On-Chain Perps)

Messari: “Perpetual futures are arguably crypto’s stickiest innovation. Perp DEXs are the most capital-efficient instruments in crypto and generate the most revenue by market cap… Perpetual swaps (perps) in crypto have shown strong indications of product-market fit, both from a product perspective and business model perspective.”

Here are the project founders: Kain Warwick (Synthetix), Julia Koh (Aevo / Ribbon), Darius Tabatabai (Vertex), Michael Spain (Lyra), Guillaume Lambert (Panoptic), Barney Mannerings (Vega).

Study dYdX’s code, GMX v2’s code. Follow analysts Jordan Yeakley (Head of DeFi), Joo, and Ashwath Balakrishnan at Delphi Digital. Also, Toe Bautista at Messari Crypto, and Nate 0xperp at Adjacent Research.

The most important financial innovation of the last decade was popularized in 2016 by BitMEX: the perpetual swap contract, aka “perps.” There are many financial constructions that facilitate the trading of synthetic assets, but in our view, the perpetual contract is the first-order correct construction. This is clear empirically. Crypto perps trade 3-10x more than spot every day, while other synthetic constructions trade a fraction of spot. The market is clear: perps are the optimal financial construction for synthetic trading. We expect the perpetual swap contract to become wildly popular across every asset class in the coming decade. – Multicoin Capital: The Perpetual Protocol

💪 1000x Leverages & Margins

The leading projects for high (infinite!) leverages are Infinity Pools and Panoptic.

The History of dYdX by Antonio Juliano (founder): “the increase in throughput of Starkware vs Ethereum allowed us to switch to cross margining (multiple positions could be collateralized by one margin account). This allowed us to build much better liquidity, and launch many more markets. We now have around 30 markets, up from 3.” Its 2024 Product Roadmap: “The end state of “Permissionless Markets” should result in dYdX software having: Cross-margin and isolated-margin at the protocol layer for enhanced risk controls.”

Rollbit’s provision of exceptionally high leverage — reaching up to 1000x for cryptocurrency futures trading — [with] protective measures:

Profit and Loss (PnL) Fee: This fee serves as a partial hedge for users’ positions, providing some balance against potential losses by Rollbit.

Open Interest Limit: Users initially have a default open interest limit set at $1M on highly liquid large assets, which can be increased upon request. Limits then scale down with liquidity, going down to $30k for less liquid assets, helping manage exposure and risk.

Moreover, with access to user trading data, Rollbit has the capability to hedge against the positions of consistently successful traders by taking offsetting positions on other CEXs, thereby dispersing risk. Since you can use up to 1000x leverage on Rollbit I think many of the high-leverage traders will not be using the flat 4bps fee and instead opt for the house edge model.

– Delphi Digital’s Rolling the Dice on Rollbit Fundamentals (2023 Dec) and How Has Rollbit Done Over $72B In Futures Volume Last Month (2023 Jun).

Solcasino: crypto futures trading with up to 1000x leverage [and] a provably-fair trading experience using a randomly drawn seed that is revealed at the end of each trading round.

Aark Digital (raised $6M): a perpetual DEX that allows single-sided and delta-neutral liquidity provider (LP), while providing 1000x leverage powered by liquid staking tokens (LSTs) and liquid restaking tokens (LRTs).

HMX: a perpetual DEX that provides multi-asset and cross-margin collateral, leveraged market making, and 1000x leverage.

SuperCharged: a gamified prediction and perpetual market that allows leverage trading with 1000x.

Everything Is A Perp by Paradigm’s Dan Robinson: “So stablecoins (and collateralized loans more broadly), margined perpetual futures, and AMMs are all a type of power perpetual. What’s missing? Higher order power perpetuals — starting with quadratic power perpetuals. Squeeth, the first quadratic power perpetual, provides pure exposure to the quadratic component of price risk. We can get a good approximation of many payoffs by combining higher order power perpetuals and 1-perps (futures) with 0-perps as collateral.”

⛽ Orderbook & Oracle Infrastructure

Messari reports on Infinity Pool with 💪 1000x leverage: No Oracles: Since prices are implicit to the borrowed LP positions and with the underlying AMM usage, there is no dependence on external oracles (which are an attack vector and thus a limitation for adding long-tail assets to other leveraged products). No Liquidations – Without the cash loan dependency, there is no need for traditional liquidations where leveraged assets are sold on the market (leveraged assets are paid back in kind).

Vertex Edge introduces an innovative synchronous orderbook design. This design packages Vertex’s powerful DEX into a shared liquidity layer spanning multiple blockchains with: A Cross-Chain Orderbook that integrates liquidity across different blockchains, enhancing market depth and reducing slippage.

Primary to Vertex Edge is the emphasis on alignment between EVM chains and the app layer which is embedded in its design. Since trades from Vertex Edge’s cross-chain trading engine settle on-chain, all on-chain activity remains on the host chain. Each Vertex instance displays the combined orderbook liquidity of all connected chains on the app’s trading interface (e.g., the orderbook), but activity and value accrue to the host chain, rather than an alternative settlement or execution layer (a problem with many cross-chain solutions).

– Introducing Vertex Edge: The Future of Liquidity is Synchronous

“Hyperliquid makes a fundamental adjustment to the onchain order book: Cancels and post-only orders are prioritized above Good 'Til Canceled (GTC) and Immediate-Or-Cancel (IOC) orders. This ordering is enforced onchain by the L1 itself. The only correct way for a node to execute a block on the Hyperliquid L1 is to sort cancels and post-only orders first. Hyperliquid has the fastest L1 in production, so human users barely notice this ordering. Most users happily wait half a second to save hundreds of dollars on a trade.”

What is a little wild is it actually took Pyth codeveloping a novel pull oracle solution with a few rogue Synthetix engineers to finally shift us away from push oracles. Yet even today, the legacy implementation still relies on push oracles. Thankfully, we are about to detach from this legacy tech once and for all; Synthetix Andromeda, which will be launched on Base in a few weeks, has no reliance on legacy oracles and is completely redesigned to only require pull oracles.

Andromeda, at launch, will be solely powered by Pyth. That said, the pull oracle interface is generic and can accommodate any new pull oracle solution that eventually comes to market. This will ensure, as block times get lower and latency is reduced, oracle responsiveness continues to improve and trade execution latency approaches that of centralised exchanges.

– Synthetix 2024, by Kain Warwick (founder)

To support 1000x leverage, “Panoptic’s options are built on top of LP tokens, the pricing is path dependent, and there is no need for Black–Scholes models. Another inefficiency with protocols that utilize Black–Scholes pricing is their reliance on oracles. Oracles are prone to price manipulation and are not suited for low-liquidity, long-tail tokens. Panoptic’s design enables it to accurately price options on any tokens with Uniswap v3 liquidity, completely circumventing the need for oracles…

“Neither of automated market makers (AMMs), and DeFi option vaults (DOVs) facilitates an efficient options market. AMMs are seldom able to buy back options; buyers are locked into their positions until expiry, while options sold by DOVs cannot be accessed by regular traders. Market participants have started pushing implied volatility (IV) lower in anticipation of DOVs’ weekly auctions, forcing DOVs to sell underpriced options. Panoptic circumvents these issues, by building options on top of Uniswap v3 liquidity pools, enabling users to mint perpetual options that never expire.”

Gauntlet will (as well as Chaoas Labs) conduct a risk evaluation of Jupiter’s perpetual trading platform and develop bespoke risk models:

Trader Open & Close Position Fees: Opening & closing perpetuals position fees

Jupiter Liquidity Provider token (JLP) Deposit & Withdrawal Fees: Fees related to depositing and withdrawing LP

JLP Spot Swap Fees: Swap fees for trading spot assets in the JLP

Borrowing Rate Fees: Fees paid by perpetual traders during the life of the position

Asset Target Index Weight: Target weight of the asset in the JLP

Max Leverage: The maximum leverage of a market

Global JLP Asset Under Management (AUM) Limit: The maximum size of a pool

Global Market Open Interest Limits: The maximum Open Interest (OI) for long and short positions

Max Position Size: The maximum size of an account position

“DeFi protocols that rely on oracles are mainly lending and derivatives protocols. Lending protocols rely on oracles to feed accurate price data to value collateral put up by users, give out loans, trigger liquidations, and determine interest rates. Similarly, derivatives protocols also rely on oracles for valuing the underlying collateral, triggering based on market events, and calculating funding rates for perpetuals.”

Aevo: An L2 appchain for perps and options built on the Optimism stack, Aevo listed an index based off of the ETH liquidity in the Friend.Tech (FT) shares contract on Base. Essentially, it tracks overall liquidity going into/out of FT instead of specific creator share prices. It is illiquid at the moment with ~$50k Open Interests (OI).

Hyperliquid: A different construction than Aevo, Hyperliquid is an index constructed on the median price of a static group of the top 20 accounts, a change from their original model (similar to Aevo’s) which they deemed to be exploitable (someone could create a new account, buy a bunch of shares to inflate TVL, and then liquidate shorts). OI is a bit higher at ~$200k, but still low.

– Delphi Digital: Came for the Tech, Stayed for the Friends

Messari’s Welcome to the Real World (2024 Apr): “Ethena, a prominent cash and carry protocol, generates yield by executing a delta-neutral carry trade. It takes users' stETH deposits and splits them into a spot stETH position and a short ETH position on a centralized exchange. The yield generated by this strategy comes from two sources: the native yield from stETH and the negative funding rate from the short perpetuals position.”

🌳 Perps > Perpetual Markets

Delphi Digital: dYdX, Aevo, GMX

Delphi Digital: Synthetix, Vega, Voltz

Delphi Digital: Overview, Oracles, Modular

[Anja Finance] How “Oracle-less Primitives” Are Rearchitecting DeFi (2024 Mar)

Serum: Return of the Order Book (2021 Dec)

Paradigm Research

Multicoin Captial

[Pyth] Oracles and Application-Owned Orderflow Auctions (2023 Dec)

”A better route to capturing emergent miner extractable value (MEV) is to outsource the auction via a global orderflow auction (GOFA). Pyth is structurally positioned to run orderflow auctions (OFA) directly in aggregate for all the applications it powers since those applications already rely on Pyth’s oracle updates to keep their systems functional. In addition to pioneering the first-party data contributor model in crypto, Pyth also pioneered a pull-based price publishing model. Instead of constantly pushing data on chain at some defined interval (e.g., every time there is a 50bps price deviation, or every hour for oracles like Chainlink), Pyth allows smart contracts to pull precise data at the exact moment they need it. This is a fundamentally new design that results in fresher, more accurate prices than oracles that only update on arbitrary, epochal basises. It also structurally reduces costs for user-protocols and applications because they don't need to constantly pay gas for unnecessary updates.“The Perpetual Protocol (2021 Jan)

Exploring the Opportunity for DeFi Interest Rate Markets (2021 Oct)

Solving the Stablecoin Trilemma (2021 Sep)

On Forking DeFi Protocols (2020 Apr)

”First, all of these protocols are subject to the constraints of the underlying blockchain which ultimately settles trades, these limitations include non-deterministic order execution, high latency, and miner front running.Second, these decentralized exchanges generally do not support cross-margining and position netting.”

Messari Crypo

InfinityPools: New Leverage Mechanics (2023 Feb)

Messari Crypo: Synthetix, dYdX, SOL

Synthetix Q1 2024 Report (also Q4 2023)

SynFutures Q1 2024 Report (also Q4 2023)

Analyzing DYDX Tokenomics (2023 Feb)

dYdX - Perpetual Maxima (2021 Nov)

The Perpetual SOL Rise (2021 Nov)

Rethinking Concentrated Liquidity with Trader Joe’s Liquidity Book (2023 Apr)

“Throughout 2022, GMX traders were known for their poor performance racking up $52 million in cumulative net losses across the protocol’s Arbitrum and Avalanche deployments. Since then, GMX traders have significantly improved and closed the gap to only $12 million in cumulative losses. Despite this turnaround, GMX traders are still struggling to time their short trades. Since the start of 2023, GMX traders have shown a tendency to flip bearish on any small market dip. The quick change in positioning has resulted in these traders being wrong three of the four times there was a significant decrease in long positions. This is likely due to the negative conditioning many learned during the bear market that was 2022.”

Academic Publication

Decentralized Finance (DeFi): A Survey (2023 Nov)

SoK: Decentralized Finance (DeFi) – Fundamentals, Taxonomy and Risks (2024 Apr)

⤵️ Put 📞 Call 🤸🏽♂️ Straddle 🦖 Big lizard 🦇 BATS 🦓 ZEBRA 🦓🦓🦓 ZEEHBS

🥌🦋 Iron butterfly 💎🦎 Jade lizard 🙅♀️😵 Strangle

🦸♂️🐂 Super bull 🦸♂️🐻 Super bear 🥌🦅 Iron condor

📞🧈 Call spread ⤵️🧈 Put spread 📅🧈 Calendar spread

↗️🧈 Diagonal spread ⚖️🧈 Ratio spread

As of 2024/5/20, the top derivative decentralized exchanges (DEX) and their total locked values (TVL) are Drift ($370.76m), Jupiter Perpetual Exchange ($363.91m), GMX V2 ($358.08m), Hyperliquid Perp ($339.7m), dYdX V3 ($314.09m), GMX V1 ($170.83m), Vertex ($96.31m), ApeX Protocol ($91.17m), Aevo ($71.68m), 01 ($57.89m).